- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Don't know where a REIT dividend came from.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

I am preparing my fathers return. His income comes from Social Security, an IRA Distribution, and some interest and dividends. He shares a condo with my sister and has some mortgage interest deductions for that. Other then medical expenses, that's all that his return consists of. This year line 10 of 1040 shows a qualified business deduction of $86. I don't know where it came from. Last year it was blank. The Qualified Business Income Deduction Summary shows Total REIT dividends of $428. I don't know where that comes from, he has no business. Line 7a, other income is blank. Business income in easy Step is $0.

The $86 and $428 are calculated, and double clicking on them only opens windows with likewise calculated values.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

The Qualified Business Income Deduction comes from the REIT dividends and information on the Form 1099-DIV, and is calculated automatically. It may look odd to you, but it sounds like everything is working the way it should. I don't think you have anything to be concerned about here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

- By any chance did your father get a K-1? This would be a possible location that a REIT could sneak in.

- On the 1099-DIVs that he got was there additional information beyond Box 2(a)? Box 5 would represent a REIT Dividend.

- Do you see the number $428 associated with any dividend income or anywhere else on the entry screen?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

The Qualified Business Income Deduction comes from the REIT dividends and information on the Form 1099-DIV, and is calculated automatically. It may look odd to you, but it sounds like everything is working the way it should. I don't think you have anything to be concerned about here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

But TURBO said I can't E-File

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

- By any chance did your father get a K-1? This would be a possible location that a REIT could sneak in.

- On the 1099-DIVs that he got was there additional information beyond Box 2(a)? Box 5 would represent a REIT Dividend.

- Do you see the number $428 associated with any dividend income or anywhere else on the entry screen?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

Thanks for that. There are "Box 5 - Section 199A dividends" on his 1099-DIV. Didn't know what 199A dividends were.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

Same here! The form 8995 as filled out by TurboTax Deluxe DOES NOT provide any source for the figure shown on Line 6 Qualified REIT divs etc, a major omission! There's no indication anywhere that these are the 199A dividends shown on 1099-MISC forms. Since I had no such deduction last year, and my income sources were about the same, neither do I believe that TTax provided this deduction in 2018. I appreciate that the tax law changes of 2017 were byzantine, but come on! -- that's why we buy TTax!

I'm glad I found this discussion, but it shouldn't have been necessary to search. A simple "Source" link at Line 6, Form 8995 would have made it unncessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

This also happened to me - this thread saved me a lot of trouble. Thanks for posting this!

Regarding "slowreader" comment about showing the source, my QBI Deduction Summary (which feeds Form 8995) does indeed show a source of this 199A dividend. Unfortunately, it erroneously pointed at a K1 that I'd entered, instead of the 1099-DIV where the number actually came from.

I tried everything experimenting -- I deleted my K1, Form 8995, and the QBI Ded Summary - TTAX still showed the source being a K1 (unnamed) that didn't exist. This one wasted a lot of my time...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

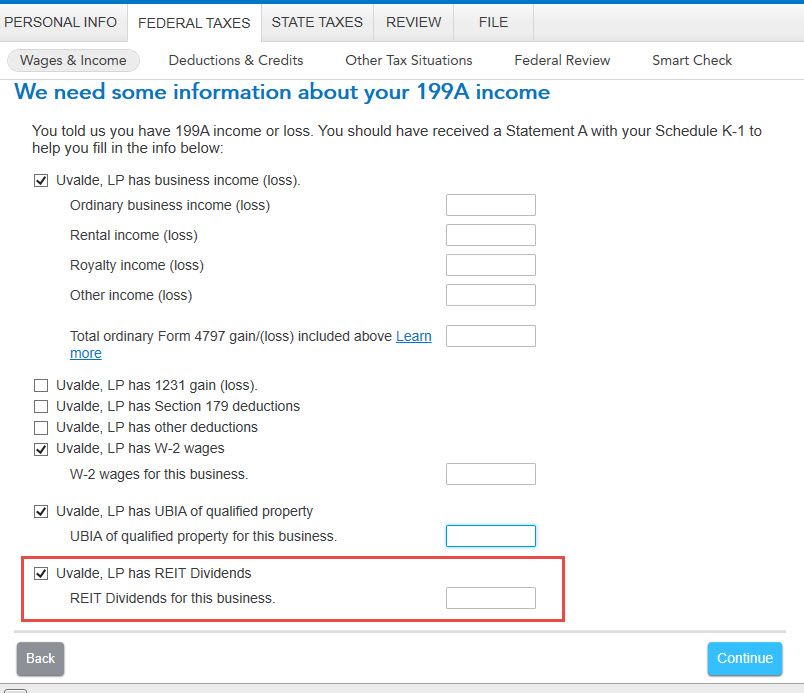

If you have K-1, and enter Z in box 20, that means you have section 199A income. TurboTax will allow you to capture many types of income including REIT dividend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

Form 8995 showed up on my 2021 return with a qualified REIT dividend of $203 on Line 8 (Have no idea where that came from). I have no business. On the bottom line 17, it shows I have 0 qualified REIT dividends. Can I remove Form 8995. It is useless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't know where a REIT dividend came from.

No, you can't delete Form 8995.

That computes your Qualified Business Income Deduction (QBI) which you do not have the option of opting out of.

QBI also includes REIT income.

Form 8995 Line 17 reports "Total qualified REIT loss" so you don't have a loss.

The income from REIT dividends must have been reported on one of your investments. You must have a mutual fund or some other asset that invests in Real Estate Investment Trusts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user08181992

Level 1

jillwoodcpa

New Member

gir0106

New Member

taxman_us

Level 3

taxdean

Level 4