- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

If you always took the standard mileage deduction, then there was no depreciation deducted. Therefore, there is no depreciation to recapture. The standard mileage deduction simplifies recordkeeping.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

Even if I deducted the allowable auto loan interest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

Yes. Auto loan interest is a separate deduction from vehicle depreciation. You can't depreciate if you use the standard mileage rate, therefore, there is no deprecation to recapture.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

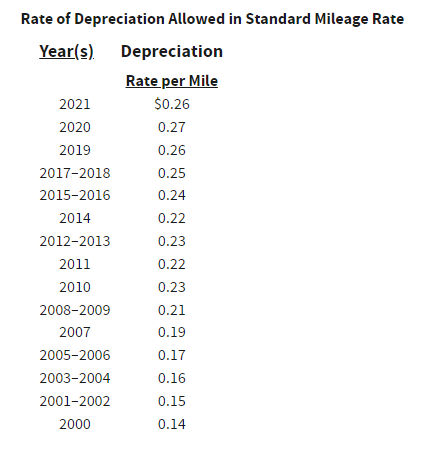

TurboTax is telling me, in the Calculate Depreciation Equivalent part, to "Enter the depreciation equivalent of your standard mileage deduction for the years before 2021 (we'll compute the 2021 amount for you.) When I click Learn More, it says, "To determine the amount to enter for depreciation, multiply your business mileage for each year that you used the standard mileage rate by the amounts below." And it gives me a table to use to calculate that depreciation.

Isn't this saying that part of the standard mileage deduction was depreciation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i need to recapture depreciation for a car that i took standard mileage deduction in the past when driving for uber but am no longer using the car for uber?

A portion of the standard mileage rate includes depreciation. To determine the amount of depreciation to enter you multiply the mileage for the year by the depreciation amount for the year. You will do this for each year and add the total as the Depreciation equivalent.

For example, if you had 1,000 miles in 2020 your depreciation would be $260. (.26 x 1000 = 260)

Ref: IRS Pub 463 https://Disposition of a Car

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

realestatedude

Returning Member

alvin4

New Member

AndrewA87

Level 4

HSTX

Level 1

Dee98

New Member