- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

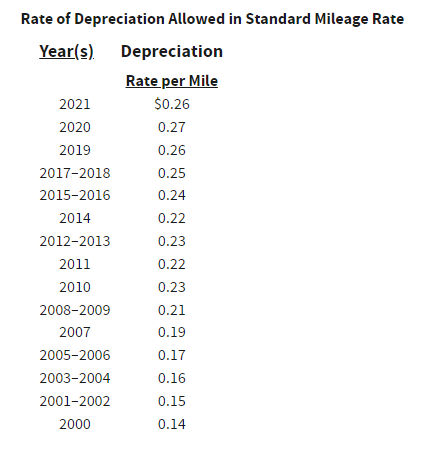

A portion of the standard mileage rate includes depreciation. To determine the amount of depreciation to enter you multiply the mileage for the year by the depreciation amount for the year. You will do this for each year and add the total as the Depreciation equivalent.

For example, if you had 1,000 miles in 2020 your depreciation would be $260. (.26 x 1000 = 260)

Ref: IRS Pub 463 https://Disposition of a Car

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 18, 2022

7:52 PM