- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Did 2023 turbo tax premier change how E*Trade ESPP entries are done? Suspiciously much simpler than last year, for real?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did 2023 turbo tax premier change how E*Trade ESPP entries are done? Suspiciously much simpler than last year, for real?

Strange that it is suspiciously so simplified this year. Am I missing something? E*Trade ESPP sales - in past years with turbo tax premier, I had to laboriously dig out old 3922 forms, answer many interview questions about the lot of ESPP, what % discount, pricing info etc etc. Did turbo tax really change it this year for 2023 premier that you ONLY need to enter the adjusted cost basis now after importing your E*Trade 1099???? It all seems way too simple to be true. Or did E*trade finally clean up their act when Morgan Stanley took over? Did turbo tax finally fix something? Can someone please confirm we're not missing a step here? thank you!

@TomYoung

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did 2023 turbo tax premier change how E*Trade ESPP entries are done? Suspiciously much simpler than last year, for real?

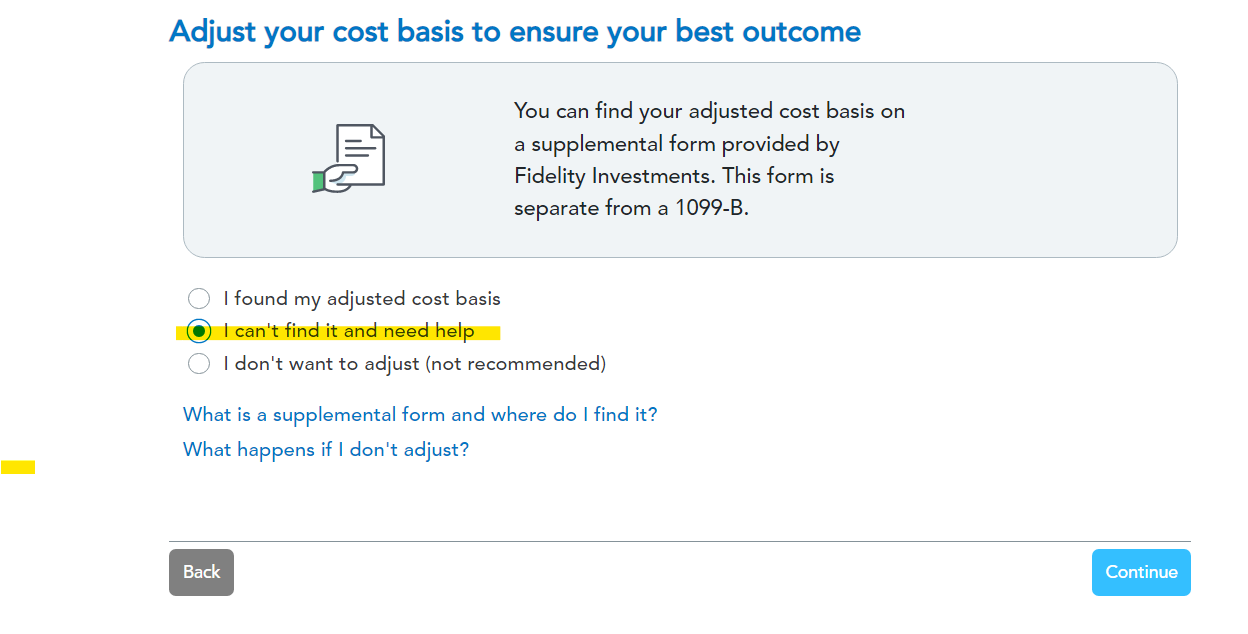

Yes and no. Yes, it is much easier to enter and no you should not trust what came in. When you sell stock, you always need to be sure the basis entered is correct. You should dig out the old 3922 forms to verify the amounts using your discount percentage to get the correct basis. The program will ask if you need to adjust the basis, need help or not adjust. I recommend selecting, I can't find it and need help. That will walk you through all those steps you remember.

Reference: How do I enter Employee Stock Purchase Plan (ESPP) sales in TurboTax?(1:08)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bamangan

Level 1

GNE

Returning Member

GNE

Returning Member

GNE

Returning Member

silverso

Returning Member