- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Crypto CSV & TurboTax Universal Template - Upload Problems

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

I've wasted 9 hours with TT phone reps on a program glitch. They keep closing my case - no resolution. I NEED to talk to a true backend tech person who can review the matter and get it put in for coding resolution. Can't file until this is fixed!! Does anyone have any suggestions? I would really like to get on the phone with someone who actually understands the backend of the program so I can screenshare the problem. I've already done this with 5 reps over 9+ hours. It's infuriating.

Here's what's happening. There are multiple issues so hard to show in 1 screenshot. This is all related to the section for uploading a CSV or raw data for Crypto transactions. I used the "TurboTax universal template" to input my raw data into. I cannot do manual entries as the crypto exchange went bankrupt and I have no sales, only their liquidations (losses). The manual entry doesn't have the right field to accept that sort of information.

When I go to upload my CSV file (based on the TT template format), I get this error that there are "duplicate Transactions Ids" (whereas "transaction IDs" is a column heading/data field in the file). However, my file has no duplicates in this column. I even tried to upload a version where that column was both erased entirely, or the data below the header was removed. Got the same message. Why would it identify an error in a column that wasn't even in the CSV?

So then I took the original "TurboTax universal template" CSV file, which comes with populated sample transactions in it. I didn't alter it, and then I uploaded that as is to see if that would upload the sample transactions into my form. That gave me this error message: "Malformed CSV file uploaded. Please upload the file in proper CSV format." Mind you, this is the error given for the TURBOTAX FORMATTED FILE with your sample data.

This leads me to believe there is a backend error with this upload/import component. Yet I cannot get any real help on this and customer support keeps sending me the same useless articles, and trying to sell me on the Live tax help option for more $$ where you get CPA assistance. A CPA cannot fix a programming glitch in TT! I've talked to numerous escalation supervisors only to be told that my escalation is being denied!! This wholly unacceptable. I've rebuilt my file countless times, cleared cookies/cache, and tried different browsers (Chrome, FF, Edge). In fact, when using Firefox & Edge to try to upload a file here, it doesn't even get to the error message stage, it just hangs/spins on the upload.

HELP!!! I cannot file my taxes until this is resolved! If I can get a real technical support person on the phone who can create an actionable, trackable issue to get this investigated and fixed, I would be willing to walk them through the problems via screenshare. But calling the phone number is useless. I have a case number,w which they keep closing.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

Can anyone at TurboTax please address this? I really need help. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

Have you investigated the Investor Center here?

- Then click TurboTax Investor Center in the center of the screen.

- Click Get started.

The Investor Center can download data from wallets / exchanges using an API Key and Passphrase.

Would this method allow you access to the data you are referring to?

The information can be reviewed and edited similar to the processes you see in TurboTax Online Premium.

Investor Center generates a CSV file which can be uploaded into TurboTax Desktop or TurboTax Online.

Let me know whether this is helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

No this won't work because the platform (Voyager) is closed/inactive because they filed for bankruptcy. Nothing can be pulled from that service via any API. This is not a user error/issue. This is a programming glitch in the TT software. The TT tool won't even upload the unaltered TT universal template properly, which is supposed to be in the proper format that the program requires. I NEED to connect with a true product support person who can enact this as a real trouble ticket that will get remediated on the backend coding/tech troubleshooting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

I still REALLY need help here!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

HELP!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

Hey!

After several hours of troubleshooting I FINALLY found a solution for this.

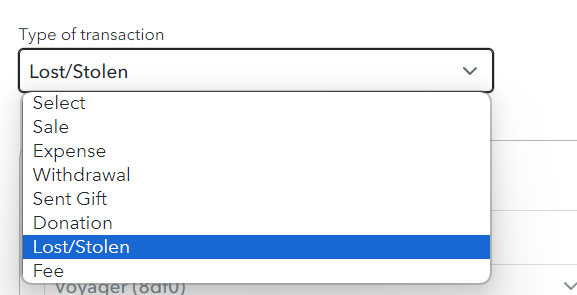

Check your "Type" column. If there is a transaction that is labeled as "Fee", change it to "Expense" (without the quotation marks of course).

This obviously doesn't change the backend error on TurboTax' end of this, but it allowed me to upload my transactions.

TurboTax reps, if you're reading this: please report this error to the appropriate department responsible for this!

GOD BLESS! 😁

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

I uploaded a CSV file into TurboTax Online Premier version. All transactions are available for review.

When I view the CSV file in Excel, the information is in this format.

I deleted all other columns and lines other than these headings and the five columns of data.

Purchase Date

Date Sold

Proceeds

Cost Basis

Currency Name

All transactions imported and are available for review.

The steps that I used to import are as follows:

At the screen Let’s import you tax info, select Enter a different way.

At the screen OK, let’s start with one investment type, select Cryptocurrency. Click Continue.

At the screen Select your crypto experience, select Upload it from my computer. Click Continue.

At the screen What’s the name of the crypto service you used, at the down arrow select Other.

Under Name, enter ‘Voyager’. Select Gain/Loss Report. Click Continue.

At the screen Go ahead and upload your crypto CSV file, select Browse and upload.

Review and Continue to clear review.

Hope that this helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

@JamesG1 Thanks but that does not work for this situation. You used a gain/loss csv which won't work for me.

Voyager gave us raw transaction data only (via Coinledger) because they liquidated about 70% of our holdings in the bankruptcy. So I put that data into the provided TurboTax Universal Template file provided via link in the program. I have followed the instructions for how to build that file to the letter, read and followed all the troubleshooting but it's still not uploading.

Please re-read the original post with images. The fact that the TT universal template with its contained sample data won't upload properly tells me that there is an issue beyond my file here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

Just in case the steps below may be of use for Voyager liquidation reporting:

Regarding the remaining portion not yet liquidated and what to do with it on the 2023 tax return-my opinion is that until it is deemed worthless, it is not reported. So, I only dealt with the part that was liquidated in 2023.

- From investvoyager.com/claim, from VIEW MY CLAIM, scrolling to the bottom, clicking the purple button "Visit CoinLedger" opens CoinLedger

- Note: I had to purchase CoinLedger to see the tax forms

- From the now open CoinLedger, on the right side, at the top, there is a a blue button "Connect API"

- A "Link Your Voyager Account" then appears for specific details to be entered to connect

- Use this help article for upload tips specifically for TurboTax (online and desktop):

- There is a subsequent screen asking if the stock is worthless--in my case, I decided to report my forced liquidation as not worthless since a value was assigned to it in liquidation. In my case, I decided to wait on anything else not yet liquidated because it is not yet completely worthless.

- The Fed ID of Voyager Digital (three entities per their liquidation procedures link dated in May, 2023, do not appear to be essential to enter for Form 8949/Schedule D in 2023.

- Regarding small errors, while I'm getting "Needs Review" on the step by step side, the returns are passing review and on the forms side for the TurboTax download, there are no errors. In my specific case, I was still able to submit via e-file (meaning still in process, but so far, so good.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

With some more playing around, I was finally able to get my transactions imported. It seems that TT does not recognize the category type of "other" despite that being listed on the accepted transaction type list.

Back to the Voyager/bankruptcy reporting issue. Voyager liquidated all of my holdings. They basically only gave me about 30% of my holdings back. How do I report the 70% that they liquidated as a true loss? This is where I am confused.

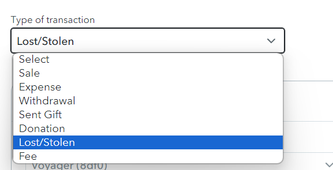

@JamesG1 A problem seems to be that the choices of transaction types in TT do not match the types TT says can be imported here . This is the screenshot of what the program actually accepts, which doesn't match. "Buy" isn't even a choice. And when choosing "lost/stolen" the transaction shows as "not taxed" rather than as "loss" in the "taxable" column on the transactions in the program. So how can I count my losses properly here?

On the Voyager platform, there are 2 tables in my account.

- Table 1 shows 100% of my holdings and what they valued them at as of July 2022.

- Table 2 shows The "June 2023 In kind distribution" - which is about 30% of my holdings and all I was able to withdrawal/sell.

So how do you report the 70% that was lost? I see that TT has a drop down for "lost/stolen" in the transaction view but when I choose that and enter 70% of the coin that was liquidated, its not showing up as a loss. In fact, its not being counted at all. Should I instead choose "expense" as the type category in the drop down instead of "lost/stolen"?

I know I invested $1500 in crypto and I got $86 back. So I lost over $1400 as my time in market and transactions were minimal. But I can't understand how to report the loss as a tax event so that I get credit for the $1400+ lost.

Thanks @unre for your Voyager specific help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

It seems that my suggestion below is similar to one post above, which did not work for you. Sorry about that - for some reason I saw only your question and not the entire thread with replies. Anyway, here is a potential solution for importing Crypto transactions using Gain/Loss reporting with a CSV file structured with just a few columns.

If you need only to report your Gain/Lost transactions, this will get your transactions into TurboTax with the bare essentials for Capital Gains reporting (similar to Stock transactions).

I suggest using a sample test file with 1 transaction. If it works, you can structure an import file with all of your transactions the same way, or, if you prefer, divide your transactions by Wallet.

To prepare the Import File, Create a CSV (spreadsheet) with these columns in Row 1

Date Sold

Purchase Date

Currency Name

Cost Basis

Proceeds

Example:

| Date Sold | Purchase Date | Currency Name | Cost Basis | Proceeds |

| 10/1/23 15:21 | 10/1/22 15:21 | BTC | 4000 | 4498.5 |

Be sure to name the columns exactly as shown above, and be sure to structure the Date fields exactly as they are shown above . There is a single space between the words in the first 4 columns. This is very important.

Once you have the file structure, I suggest creating a dummy transaction file with one of your "Trades", Saving the file as a CSV and performing a test import.

Steps for the Import

1. Go to Wages and Income

2. Click Investments and Savings

3. Click Add Investments

4. Select Cryptocurrency and Click Continue

5. Select Upload it from my Computer (Use a CSV file) and Click Continue

When you see "What's the name of the crypto service you used?"

1. Select Other as the Crypto "service"

2. Give the Import a name (for the test, something like Test 5 col Gain Loss format)

3. Select the first option for CSV type (Gain/Loss Report or CSV) . This specifies the csv file structure, and is important.

4. Click Continue and you will see"Go ahead and upload your crypto CSV file"

5. Use the Browse or Drag and Drop to import the CSV file with your transactions.

If your test file matches the example I provided above, the results should show the Capital Gain as $499.

One final note - this is not a solution for importing everything that occurs in a Crypto account, and should only be used for simple Gain/Loss reporting of "trades".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

You're welcome, @klhrabosky in reply to your earlier post!

In answer to your question, you'd need to adjust the cost basis to reflect the full investment.

I've reached out to Voyager and it would appear that the liquidation payout received represents the full investment--while previously, I thought there was still some value remaining.

To capture your full investment, there are two options.

*adjust the cost basis to be in accordance with your records

* follow guidelines at Coin Ledger here, specifically under the title How do you report a nonbusiness bad debt deduction?: https://www.cointracker.io/blog/what-are-your-options-for-reporting-losses-related-to-bankrupt-excha...

The portion that is not included in the Coin Ledger upload would be the portion to declare as worthless. Note that this guidance would classify the worthless portion as short term.

See https://www.irs.gov/taxtopics/tc453

"Nonbusiness bad debts - All other bad debts are nonbusiness bad debts. Nonbusiness bad debts must be totally worthless to be deductible. You can't deduct a partially worthless nonbusiness bad debt.

Report a totally worthless nonbusiness bad debt as a short-term capital loss on Form 8949, Sales and Other Dispositions of Capital Assets, Part 1, line 1. Enter the name of the debtor and "bad debt statement attached" in column (a). Enter your basis in the bad debt in column (e) and enter zero in column (d). Use a separate line for each bad debt. It's subject to the capital loss limitations. A deduction for a nonbusiness bad debt requires a separate detailed statement attached to your return. The statement must contain: a description of the debt, including the amount and the date it became due; the name of the debtor, and any business or family relationship between you and the debtor; the efforts you made to collect the debt; and why you decided the debt was worthless. For more information on nonbusiness bad debts, refer to Publication 550."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

@unre thanks, I'll look into this.

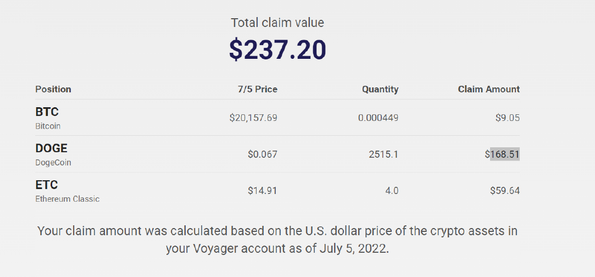

I'm still confused. Here's what I got from Voyager. I invested $1500. Image 1 is what they valued the claim at in 2022 (I couldn't touch it then).

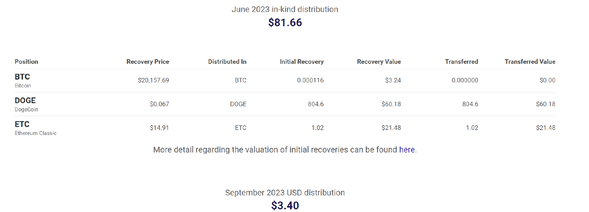

Now Image 2 from 2023 when I was finally able to access whatever was left. They sent me a $3.40 check for the BTC as they sold that off. I transferred the DOGE coins to Coinbase and sold it there (have that report). I was able to transfer the DOGE to Coinbase and sell it. I was unable to get the ETC to transfer into any exchange so I consider that one totally lost. I am new to all of this and not technically savvy at how to do this.

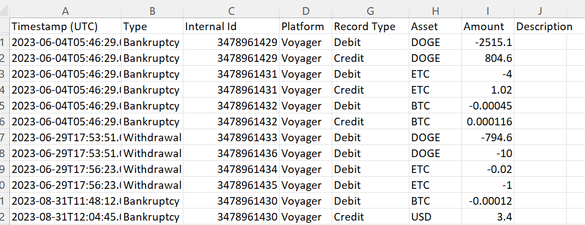

Image 3 below is the above activity as it came out in the raw data export from Coinledger. I then have to transpose that with the earlier data (buys & interests) into the Turbo Tax Universal Template to upload that to TT. That template does not read the types listed herein - Bankruptcy & withdrawal.

I am very lost on what type to list these as for this series of events. I put a different type name (like sold) just to get the transaction into TT so I could then edit them. When I look at the individual transaction, these are the drop down menu options in TT for type

If I choose "Lost/stolen" for the for any of the bankruptcy related transactions (lines 1-6 in the above spreadsheet), TT then doesn't count them as a dollar value loss in the full list of cyrpto transactions. Instead it says "non taxable" Will those go in another part of my tax form?

Basically, I know I put in $1500, and only got about $45 back. I need to claim that full $1455 loss. I'm so confused about how to categorize all of these transactions post-settlement (the activity related to the first 2 images from Voyager). in order to get the full $1455 counted as a loss.

Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

I hear what you're saying-it is confusing. I'm a novice digital asset investor, too.

But, it seems to me that the 2022 value can be disregarded unless there was a payout of any kind in 2022. It is an unrealized value and does not appear to be applicable to 2023.

For the portion that was received, my personal opinion is to treat it the same as a sale. The IRS information states they view digital assets as property. For my entry level purposes, no mining, no income received--strictly investment...I think of bankruptcy/liquidation as thr same as selling an investment.

For the portion of my holdings that were not reflected in Voyager's download to Coin Ledger, it appears that portion should be reported as a short term capital transaction.

Here is a hypothetical example:

*The person bought $1,000 of various digital assets through Voyager in 2021. (Any income received was reported in 2021 and 2022 as needed so that the person has basis.)

*Voyager went into Chapter 11 and sent checks to the investor in 2023 for $50 considering the investor paid out in full.

*Let's say Coin Ledger reflects that the cost basis for the $50 was $560, which will generate a hypothetical $510 long term capital loss (since it was held longer than 1 year) reported on Schedule D/Form 8949.

This leaves $440 deemed worthless. (It is not technically lost/stolen in the sense someone broke in and took it or it was otherwise lost.)(a different category to the IRS than capital gains/losses)

*The IRS guidance appears to me to direct the investor to claim the remaining hypothetical $440 originally spent by reporting $0 sales with $440 cost as a short term loss on Schedule D/Form 8949.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

swati surana

New Member

klhrabosky

Level 2

tnl001

New Member

KatValek

Level 3

Anonymous

Not applicable