- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@unre thanks, I'll look into this.

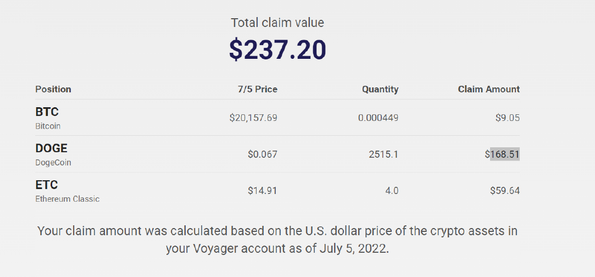

I'm still confused. Here's what I got from Voyager. I invested $1500. Image 1 is what they valued the claim at in 2022 (I couldn't touch it then).

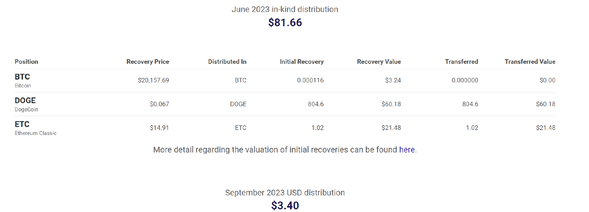

Now Image 2 from 2023 when I was finally able to access whatever was left. They sent me a $3.40 check for the BTC as they sold that off. I transferred the DOGE coins to Coinbase and sold it there (have that report). I was able to transfer the DOGE to Coinbase and sell it. I was unable to get the ETC to transfer into any exchange so I consider that one totally lost. I am new to all of this and not technically savvy at how to do this.

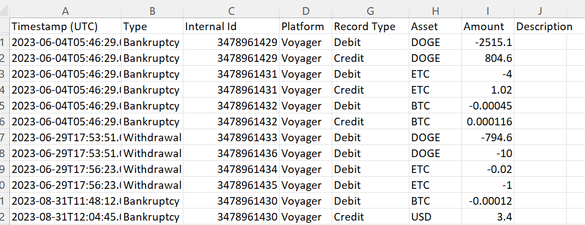

Image 3 below is the above activity as it came out in the raw data export from Coinledger. I then have to transpose that with the earlier data (buys & interests) into the Turbo Tax Universal Template to upload that to TT. That template does not read the types listed herein - Bankruptcy & withdrawal.

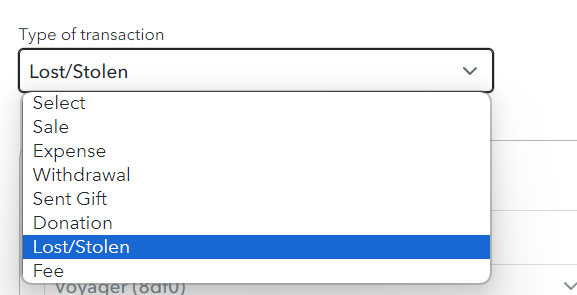

I am very lost on what type to list these as for this series of events. I put a different type name (like sold) just to get the transaction into TT so I could then edit them. When I look at the individual transaction, these are the drop down menu options in TT for type

If I choose "Lost/stolen" for the for any of the bankruptcy related transactions (lines 1-6 in the above spreadsheet), TT then doesn't count them as a dollar value loss in the full list of cyrpto transactions. Instead it says "non taxable" Will those go in another part of my tax form?

Basically, I know I put in $1500, and only got about $45 back. I need to claim that full $1455 loss. I'm so confused about how to categorize all of these transactions post-settlement (the activity related to the first 2 images from Voyager). in order to get the full $1455 counted as a loss.

Thank you!!