- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

With some more playing around, I was finally able to get my transactions imported. It seems that TT does not recognize the category type of "other" despite that being listed on the accepted transaction type list.

Back to the Voyager/bankruptcy reporting issue. Voyager liquidated all of my holdings. They basically only gave me about 30% of my holdings back. How do I report the 70% that they liquidated as a true loss? This is where I am confused.

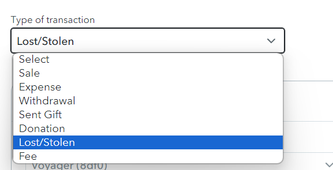

@JamesG1 A problem seems to be that the choices of transaction types in TT do not match the types TT says can be imported here . This is the screenshot of what the program actually accepts, which doesn't match. "Buy" isn't even a choice. And when choosing "lost/stolen" the transaction shows as "not taxed" rather than as "loss" in the "taxable" column on the transactions in the program. So how can I count my losses properly here?

On the Voyager platform, there are 2 tables in my account.

- Table 1 shows 100% of my holdings and what they valued them at as of July 2022.

- Table 2 shows The "June 2023 In kind distribution" - which is about 30% of my holdings and all I was able to withdrawal/sell.

So how do you report the 70% that was lost? I see that TT has a drop down for "lost/stolen" in the transaction view but when I choose that and enter 70% of the coin that was liquidated, its not showing up as a loss. In fact, its not being counted at all. Should I instead choose "expense" as the type category in the drop down instead of "lost/stolen"?

I know I invested $1500 in crypto and I got $86 back. So I lost over $1400 as my time in market and transactions were minimal. But I can't understand how to report the loss as a tax event so that I get credit for the $1400+ lost.

Thanks @unre for your Voyager specific help