- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Complicated Investment property question - loan closed in TY prior to taking possession

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Complicated Investment property question - loan closed in TY prior to taking possession

I took out a loan for an investment property that closed on 12/31/2020. I didn't take possession of the home until 1/4/21. I incurred a number of up front closing costs, but I can't figure out where I enter these in TT, since I had no income on the property itself (because I didn't take possession of it until 2021). On top of the closing costs, I also paid for an inspection. Where do I enter these costs so I get the deduction (or automatically carry over the deductions for next year)?

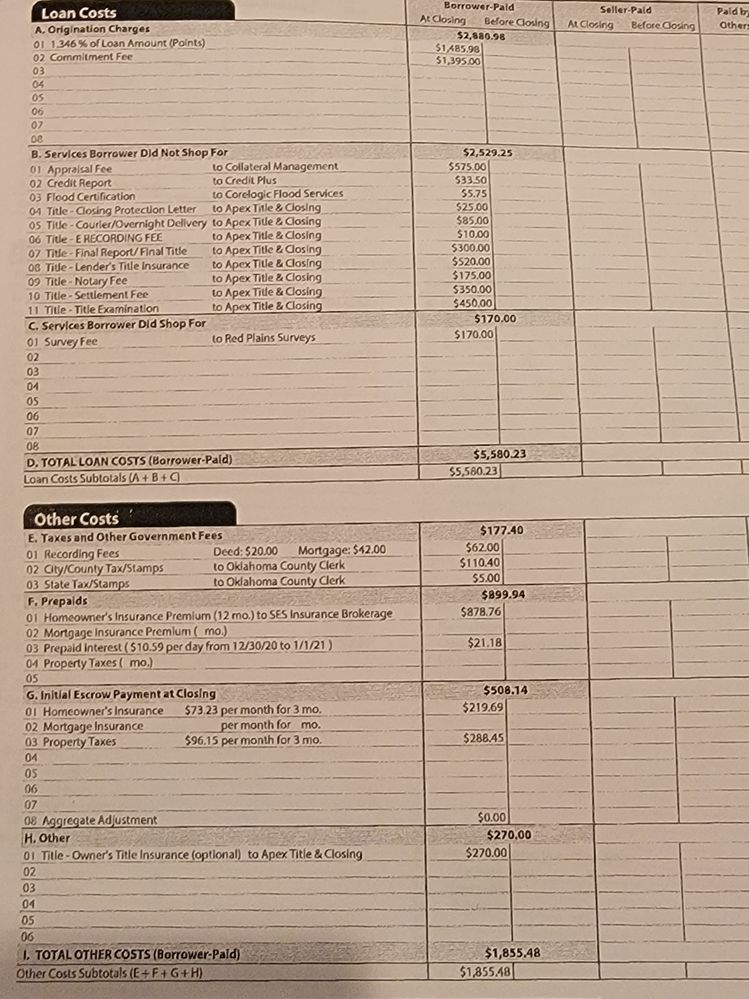

Below, please find a photo of my closing costs document. There are so many different fees on here, including two different line items for home insurance and property taxes, which I also don't understand. I also received a 1098 for the $21.18 listed as "prepaid interest" - do I have to enter that somewhere on my TY2020 taxes?

If someone could provide me some advice, I'd be so grateful.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Complicated Investment property question - loan closed in TY prior to taking possession

Generally, deductible closing costs are those for interest, certain mortgage points and deductible real estate taxes.

Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including:

- Abstract fees

- Charges for installing utility services

- Legal fees

- Recording fees

- Surveys

- Transfer taxes

- Title insurance

- Any amounts the seller owes that you agree to pay (such as back taxes or interest, recording or mortgage fees, sales commissions and charges for improvements or repairs).

[Source: IRS FAQs Rental Expenses]

For more information, please see:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

statusquo

Level 3

sfvaziri3913

Returning Member

johntheretiree

Level 2

hero123

Level 2

da2024

Level 1