- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Complicated Investment property question - loan closed in TY prior to taking possession

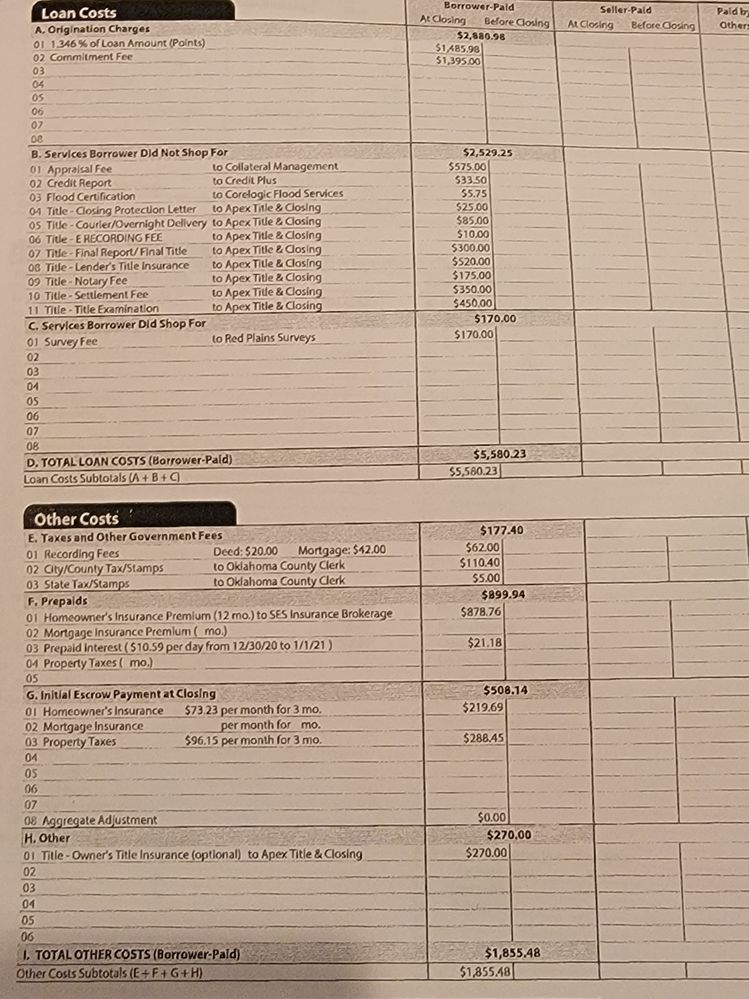

I took out a loan for an investment property that closed on 12/31/2020. I didn't take possession of the home until 1/4/21. I incurred a number of up front closing costs, but I can't figure out where I enter these in TT, since I had no income on the property itself (because I didn't take possession of it until 2021). On top of the closing costs, I also paid for an inspection. Where do I enter these costs so I get the deduction (or automatically carry over the deductions for next year)?

Below, please find a photo of my closing costs document. There are so many different fees on here, including two different line items for home insurance and property taxes, which I also don't understand. I also received a 1098 for the $21.18 listed as "prepaid interest" - do I have to enter that somewhere on my TY2020 taxes?

If someone could provide me some advice, I'd be so grateful.