- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

Hi

Based on my preliminary data entry. Turbotax should allow me to choose between itemized deductions or standard deductions but this is not the case.

How can I accomplish this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

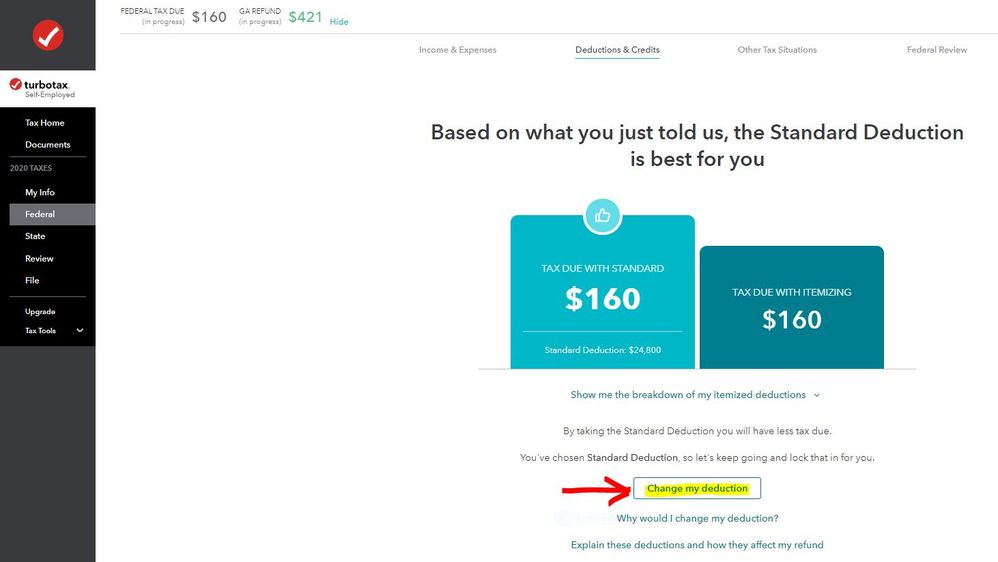

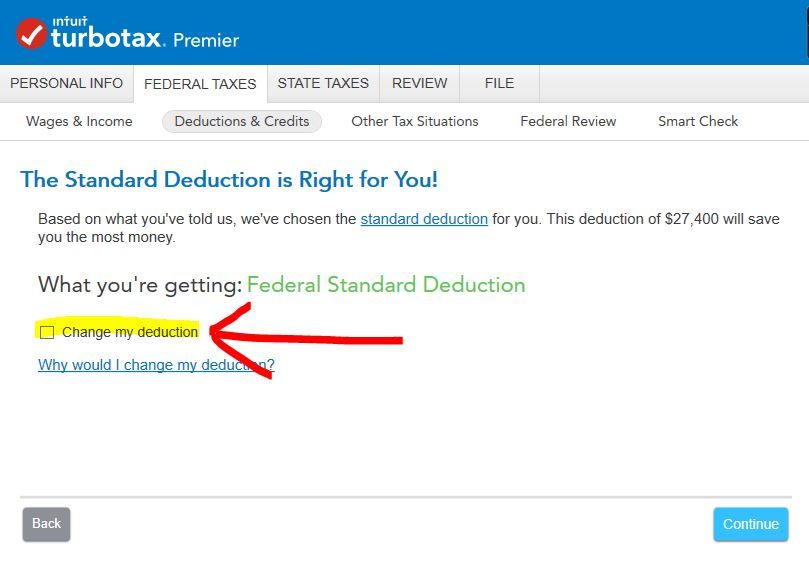

Complete the Deductions & Credits section. On the following screens you will land on the screen that indicates which deduction you are eligible to receive, Standard or Itemized. Click on the box Change my deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

Unfortunately, It only shows that I am getting the standard deduction. No option to change it.

Is there another way to change this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

@jptalledo wrote:

Unfortunately, It only shows that I am getting the standard deduction. No option to change it.

Is there another way to change this?

You do not see this screen?

If not, then enter itemized deductions, choosing in the Search box located in the upper right of the program screen. Click on Jump to itemized deductions, choosing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

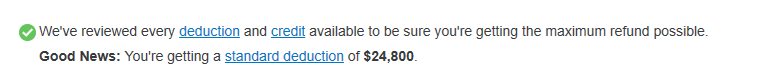

I am getting this:

Then it shows the comparison between 2019 and 2020. On the bottom, it shows the Continue/Back button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

@jptalledo Are using a Windows or a Mac for the TurboTax 2020 desktop edition?

Have you tried entering itemized deductions, choosing in the Search box located in the upper right of the program screen. Click on Jump to itemized deductions, choosing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

Has anyone been able to solve this? I keep getting the same message that jptalledo gets and there is no way for me to change from itemized to standard. I've done just about every tutorial out there but none of them seem to be accurate for my version of turbo tax: Home & Business (self employed). Please help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

There is a preliminary screen showing a deductions and credits summary, but this is not the final conclusion of the Deductions & Credits section. Click Continue to proceed.

Here are screenshots of what it will look like in TurboTax Online and TurboTax CD/Download:

TurboTax Online:

TurboTax CD/Download Home & Business for Windows:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

home and business wont take all my itemized deductions.

i refinanced my mortage in 2021 and have 30,000 of interest and taxes .

When i change the to itemized vs standard it doesnt use all the legit deductions..

I am very frustrated--call me

Frank V

[phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Change to Itemized Deductions from standard deductions for TurboTax Home & Business 2020

Mortgage interest rules have changed, see Publication 936 (2021), Home Mortgage Interest Deduction - IRS. You are welcome to Contact Us .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

q1williams

New Member

Viking99

Level 2

cj5

Level 2

jgilmer78

Returning Member

wilsonbrokl

New Member