- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can you get credit for foreign tax paid for capital gains from mutual fund sales?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

I'm going through the interview for foreign tax credit, and it does ask about income from but not foreign tax paid on capital gains from foreign mutual fund sales. (The passive income category only mentions interest, dividend, royalty and annuity income) Is the tax on fund/stock sales not eligible for credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

@karenkailua , just to clarify, are you talking about a scenario where you owned shares of a Mutual Fund in a foreign country ( i.e. the fund is not traded in the US ) and that the gain on disposition was taxed at source ? Which country? Are you US citizen / Resident ( Green Card )/ Resident for tax purposes ( what work visa ) ?

Generally, if you are being taxed on your world income then any income taxed by both the USA and a foreign country ( with a Tax agreement ), you should be able to get credit for the taxes paid to a foreign tax administration. However, I need the info asked for above before I can say anything specific to your situation. Please ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

I'm using TT Premier , download version.

I'm a US cit, husband is Green card/permanent resident. We file MFJ. We are retired.

He has mutual funds in Sweden. (I assume they are not traded in the US -- can I look that up somehow?) He sold his shares in a few funds and overall he has capital gains from the sales. Sweden taxes this automatically. So Yes, the gain on disposition was taxed at source.

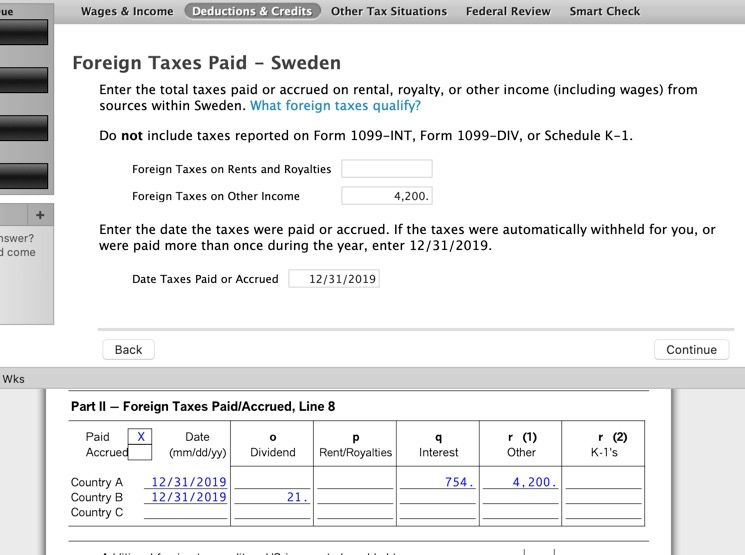

In the income section, I've entered his pension income (as Other Income) and bank interest (as if I had 1099-INTs) and that info goes onto the 1116 with no problem. In the income section I also reported his cap gains (as Investment Income) and during the foreign tax credit interview I also reported the capital gains BUT I don't see where to report the tax. There is a box for Foreign Taxes on Rents and Royalties and one for Foreign Taxes on Other Income (and I put his pension tax in this box.) Am I supposed to put the taxes paid on cap gains in that box as well? In forms mode, I see this info in Part II, box r(1). I hope you can see the attached photo --

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

@karenkailua . from your attachments, I tried out the scenario and I agree generally with what you are seeing. It appears to be correctly handing the data. However:

1. what are two countries ? Know one is Sweden ( for mutual funds ) .

2. His pension is from where ( which country ? ); Is is also taxed at source?

3. Are you living in the USA or abroad ( Sweden ? or ? ); How long have you been there ?

One thing to make sure is that the form 1116 is correctly filled out and for that the forms mode is essential-- so I am glad that you have desktop version.

One thing that I do not believe is correct is your reporting the pension ( foreign? ) as other income ---- you will need to create a substitute 1099-R --- recently I have answered this for another poster whom had a 1042-s for his/her 1099-R -- of course that was from USA and he was living abroad. But you have to do the same .

Do you need help on this ? You will need his basis in the pension fund and the type of pension I.e. private or govt. or equivalent to Social Security or what ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

Since this is my personal situation (and likely not helpful to the rest of the world) I'm going to PM you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

@karenkailua -- sure . I am a retired tax professional ( second career just because I enjoy it ) and fully believe in the tenets / rules laid out in Circular 230

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

Thanks, look forward to your reply there. I've never done private message here so I assume (hope) I will see some sort of notification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

@karenkailua it works-- you will get a notification ONLY when I respond I.e. you have a PM. Let me read through the material and a little research -- will be back by tomorrow sometime.

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

I also am a US citizen, long time resident of a foreign country (Mexico), and have tax paid to Mexico on Cap Gains for sale of US ETFs. Can I claim Foreign tax credit for the amount paid?

How do I do this on Form 1116?

How do I do this thru TurboTax?

(I can do this for dividends and interest in TurboTax using Form 1116 for Foreign Tax credit, but cannot do this for Cap Gains.)

I think a lot of US citizens living abroad need this answer so please answer in this email string so others can also take advantage of this information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

@Dennis8 , essentially you exclude the taxes paid from the foreign income on form 1116 . Thus and from the IRS: https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit-compliance-tips

"Foreign Source Qualified Dividends and Gains

If you have received foreign sourced qualified dividends and/or capital gains (including long-term capital gains, unrecaptured section 1250 gain, and/or section 1231 gains) that are taxed in the U.S. at a reduced tax rate, you must adjust the foreign source income that you report on Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), line 1a.

How do I make the adjustment?

- Form 1116 Instructions - See the detailed instructions for “Foreign Qualified Dividends and Capital Gains (Losses)”.

- Generally, if the foreign source income was taxed at the 0% rate, then you must exclude the income from your foreign source income (Form 1116, line 1a).

- Generally, if the foreign sourced income was taxed at the 15% rate, then you must multiply that foreign sourced income by 0.4054 and include only that amount in your foreign source income on Form 1116, line 1a.

-

Generally, if the foreign source income was taxed at the 20% rate, then you must multiply that foreign source income by 0.5405 and include only that amount in your foreign source income on Form 1116, line 1a.

-

Generally, if the foreign source income was taxed at the 25% rate, then you must multiply that foreign source income by 0.6757 and include only that amount in your foreign source income on Form 1116, line 1a.

-

Generally, if the foreign source income was taxed at the 28% rate, then you must multiply that foreign source income by 0.7568 and include only that amount in your foreign source income on Form 1116, line 1a.

- See Publication 514, Foreign Tax Credit for Individuals, for more information on the rate differential adjustment for the applicable year. "

Does this help ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

Yes, it did help to have the sections of the law and IRS instructions available. There are at least 2 worksheets that I would need to fill out.

Now, How do I do this thru TurboTax?

Will TurboTax walk me thru this like it does with the credit for Foreign tax paid on interest and dividends?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

Making my question more specific:

Will TurboTax walk me thru getting this foreign tax credit for Cap Gains just like it does with the credit for Foreign tax paid on interest and dividends?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

@Dennis8 , I have downloaded / CD version of TurboTax Home & Business --- thus I can create your scenario of US stocks sold in the USA for capital gain ( long-term ) and taxed in Mexico at 15%. It works but you have to be careful because it does not ask for the foreign tax percentage etc --- you kind of have to work out the gross income ( Capital Gain ) from the Mexico Tax filings ( or your own records ), multiply by the factors called out by IRS and then enter this as your gross subject to foreign taxation for this category --- then tell TurboTax the actual taxes paid and go on from there. In my case because of the software on my machine , I could go back to forms mode and confirm that the form 1116 was properly filled out.

Hope this helps

If you need more help on this -- let me know.

Note : here we are actually resourcing the US capital gains to MX so that the foreign tax credit could be applied to avoid/mitigate double taxation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you get credit for foreign tax paid for capital gains from mutual fund sales?

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RicN

Level 2

Blue Storm

Returning Member

garys_lucyl

Level 2

fcp3

Level 3

Moonlight

Level 2