- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I'm using TT Premier , download version.

I'm a US cit, husband is Green card/permanent resident. We file MFJ. We are retired.

He has mutual funds in Sweden. (I assume they are not traded in the US -- can I look that up somehow?) He sold his shares in a few funds and overall he has capital gains from the sales. Sweden taxes this automatically. So Yes, the gain on disposition was taxed at source.

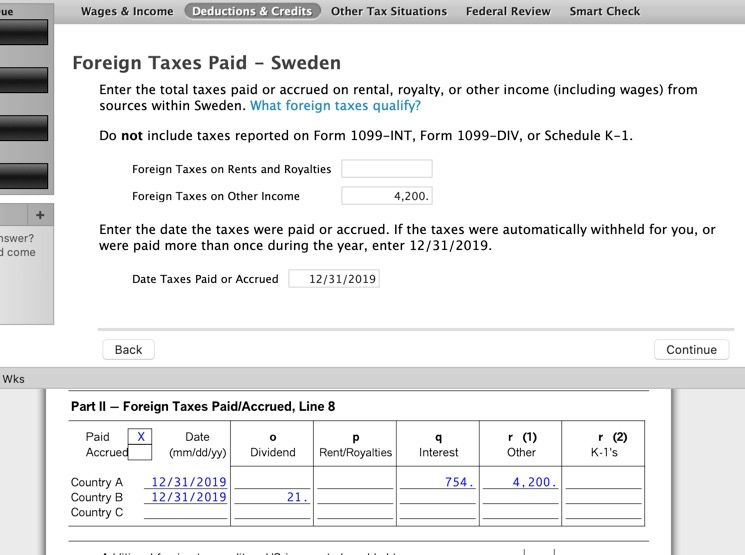

In the income section, I've entered his pension income (as Other Income) and bank interest (as if I had 1099-INTs) and that info goes onto the 1116 with no problem. In the income section I also reported his cap gains (as Investment Income) and during the foreign tax credit interview I also reported the capital gains BUT I don't see where to report the tax. There is a box for Foreign Taxes on Rents and Royalties and one for Foreign Taxes on Other Income (and I put his pension tax in this box.) Am I supposed to put the taxes paid on cap gains in that box as well? In forms mode, I see this info in Part II, box r(1). I hope you can see the attached photo --