- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can someone here tell me where is FORM 8915 B at for 2020????????

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone here tell me where is FORM 8915 B at for 2020????????

@reycar69 wrote:

So how do I include it so I can pay the last part of taxes for it?

The answer was posted on this thread by @DianeW777 yesterday. Scroll up this page.

This form is supported in TurboTax and is populated based on your answers to the questions about the distribution for Form 1099-R.

For more information about this form use this link: Qualified 2020 Retirement Distributions due to COVID

Steps to review in your tax return for this entry:

- Login to your TurboTax Account

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R” you should see the “Your 1099-R Entries” screen and will click "edit"

- Continue until "Tell us if any of these uncommon situations apply" screen

- Select "I took out this money because of a qualified disaster (includes COVID-19)"

- Answer the any question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone here tell me where is FORM 8915 B at for 2020????????

Take your taxes to H&R Block, took me 20 minutes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone here tell me where is FORM 8915 B at for 2020????????

Form 8915-B, Qualified 2017 Disaster Retirement Plan Distribution & Repayments is available in all versions of TurboTax. If you are using the desktop software, make sure you have updated your software. The form cannot be e-filed, see this chart. The first column is for print and the second column is for e-file.

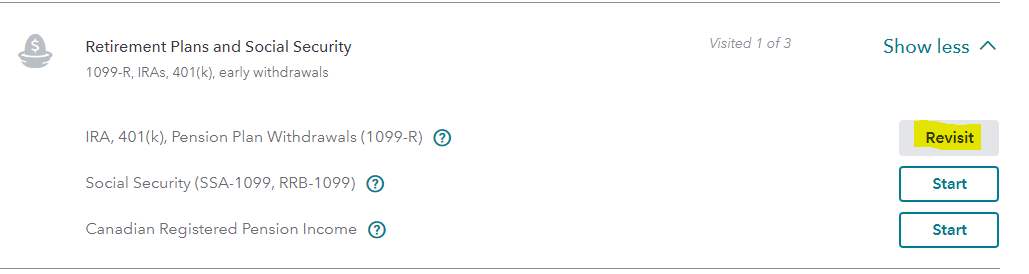

If you need to include the form, you will need to file by mail. Go through the retirement income section to have TurboTax generate the form for you. Click START next to 1099-R income, answer NO if you did not receive a 1099-R in 2020 and the next question will be about prior year disaster distributions. @reycar69

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone here tell me where is FORM 8915 B at for 2020????????

Got it. Thanks.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thisblows

New Member

SB2013

Level 2

20tprtax

New Member

JB_Tax

Returning Member

zena-moore

New Member