- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2021 Home and Business error "Charitable Contributions has an unacceptable value"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Here are some possible solutions so the your tax return reflects the $600 charitable contribution:

- Make sure you compete the entire interview,

- Do a final review,

- Make sure you enter that the contribution was money, and

- Make sure you are claiming the standard deduction.

To reap tax benefits for making charitable donations, you must generally itemize your deductions rather than taking the standard deduction.

- For 2020 you can deduct up to $300 per tax return of qualified cash contributions if you take the standard deduction.

- For 2021, this amount is up to $600 per tax return for those filing married filing jointly and $300 for other filing statuses.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

For the TurboTax online editions -

The problem appears to be that a charitable donation was entered in the Deductions and Credits section of the program when you are only eligible for the Standard Deduction.

Click on Tax Tools on the left side of the online program screen

Click on Tools

Click on Delete a form

Scroll through the all the forms, schedules and worksheets listed and delete all the Charitable Organization forms listed.

When completed with removing forms click on Continue With My Return at the bottom of the list.

Click on Federal on the left side of the screen

Click on Deductions & Credits at the top of the screen

Scroll down to the bottom of the page and click on Wrap up tax breaks

Continue through the screens. After the screen showing that you are getting the Standard Deduction the following screen is Charitable Cash Contributions under Cares Act. Enter $600 if filing Jointly or $300 for all other filing status'. The federal review and the Final Review should no longer show an error for the charitable donation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Sorry but your response does not address the problem I'm having. I have been doing my taxes on TurboTax for over 10 years i.e. I know what I'm doing. The issue is that I have "money" contributions of $3972 and my filing status is "Married Filing Jointly", my personal deductions do not exceed the standard deduction so the system should and it did last year assign the proper deduction of $600 (last year it gave me properly the $300). The "Smart Check" does not find a problem, however, when I go through the "Analysis" it comes back with an error "Charitable Contributions has an unacceptable value" and it shows the value of $300 in the entry box. Once I change it to $600 the error clears, however, if I go back to review any of my entries I get the same error with the $300 showing up again. Where it is getting the $300 I can't determine because the "Data Source" is greyed out. This is not a user problem, there is some sort of bug in the program. I need to enter "money" contributions so I can have the carryover.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Additionally, I'm using the Home and Business 2021 Desktop version, not the online version. BTW, I found another problem. The 1040SR PDF generated when the error is corrected and before I go back and get the error again does not fill in the 12C amount, it is left blank when it should have the sum of 12a $ 26,450 and 12b $600 for a total in 12c $27,050 a little buggy I would say.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Going back through the program and entering $600 on the screen Charitable Cash Contributions under Cares Act then completing both the federal review and Final Review shows the correct amounts in 12a, 12b and 12c.

In Forms mode review Form 1040 - Line 12a has the amount for the Standard Deduction, Line 12b has the $600 amount and Line 12c has the sum of Line 12a and Line 12b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Ok, so you are saying don’t enter my actual Charitable contributions of $3,970 but rather $600?? So what happens to the charitable contributions carryover, forget about it?? I don’t think so!! In addition, the form that is not completing properly is the finished 1040SR PDF after it has been reviewed and can be saved, not the form review of the 1040 within the form mode which is completely different and you can’t preview a 1040SR!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

@A276845X wrote:

Ok, so you are saying don’t enter my actual Charitable contributions of $3,970 but rather $600?? So what happens to the charitable contributions carryover, forget about it?? I don’t think so!! In addition, the form that is not completing properly is the finished 1040SR PDF after it has been reviewed and can be saved, not the form review of the 1040 within the form mode which is completely different and you can’t preview a 1040SR!!!!

If you are not eligible for the Itemized Deduction and only the Standard Deduction there is no carryover of the charitable donation. The maximum deduction that can be entered when filing jointly and only eligible for the Standard Deduction is $600.

The total of all your itemized deductions on Schedule A must be greater than the standard deduction for your filing status to have any tax benefit.

Standard deductions for 2021

- Single - $12,550 add $1,700 if age 65 or older

- Married Filing Separately - $12,550 add $1,350 if age 65 or older

- Married Filing Jointly - $25,100 add $1,350 for each spouse age 65 or older

- Head of Household - $18,800 add $1,700 if age 65 or older

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Surprise! When I delete my $3970 deduction and enter $600, I get the same error when the analysis is done, the Desktop Home and Business 2021 TurboTax enters $300 and I get the error "Charitable Contributions has an unacceptable value" again and I have to change it manually to $600, same identical scenario as before.

BTW, what if in 2022 I have enough deductions by adding/using my charitable contributions carryover and I do not have to use the standard deduction? I can't retroactively use my previous year's charitable contributions if I did not declare them in the corresponding year!!

So you are saying I should ignore this: "If your charitable donations equal more than the amount you’re allowed to deduct in a given tax year, you may be able to carry excess contributions forward to a future tax year. For most types of contributions, you’re allowed to carry forward the deduction for up to five years."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

FYI....it's a known problem and a case has been open for the software developers to fix this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

How long does it usually take them to fix a problem. If I look at 1040 form mode it adds the $300 but on the summary at the end, it does not show. I will calculate the tax and see which number it has been using to calculate the tax. What good is a program that doesn't work and doesn't get fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Please return to the Deductions & Credits section, scroll down to "Charitable Donations" and DELETE any cash entries you made there.

(NOTE: Some states allow you to Itemize Deductions when taking the Standard Deduction on the Federal Return. To include charitable donations as an Itemized Deduction on your STATE return, you can enter the donations as "Items" select "I'll value them, select "Other intangible property" enter the description as cash if it was and the amount as the value.)

Go back through the review. The program will ask you for your charity donation again although it may not be until after the state return is finished, at the END of the FINAL REVIEW. (After the "Tax Summary for 2021" screen)

Enter the amount up to 600 Married Filing Joint.

The Tax law allows a Taxpayer to claim Charity Donations on their Schedule A or, if using the Standard Deduction, on their 1040 line 12b as an addition to their Standard Deduction amount.

This amount can be up to 600 for Married Filing Joint, or 300 for all others

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Your workaround does not fix two issues I have identified:

1) Charitable Contribution Carryover i.e. I donated $3,970 to an approved charitable organization and this year I'm using the standard deduction, however, next year I might have enough deductions not to use the standard deduction in which case the carryover can be utilized. Deleting the entry and overwriting the error by entering $300/$600 excludes/does away with the carryover.

2) In my case I print a PDF of the 1040SR form and it also has an error, line 12C is left blank, it does not sum the 12A amount of the standard deduction and 12B amount of the $300/$600 manually entered.

In addition, if you have to go back to review/add additional items to your taxes such as other 1099's, etc. the same Charitable Contribution error shows up again even though it was corrected previously.

This is a programming error that TurboTax needs to fix, not a workaround!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

Turbotax has assigned investigation number 16696 to this problem. However, I identified this problem on January 14th and still, nothing has happened!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Home and Business error "Charitable Contributions has an unacceptable value"

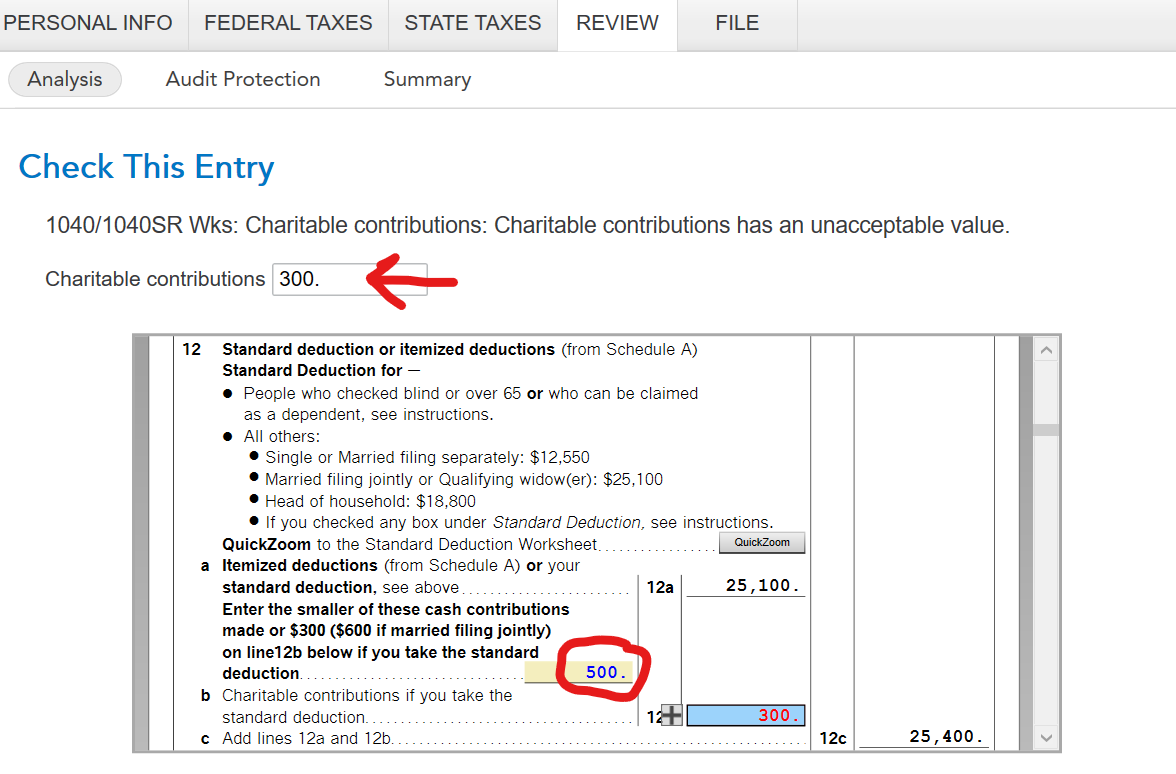

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TMM322

New Member

happysue19

New Member

toddrub46

Level 4

binarysolo358

New Member

user17549435158

New Member