- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2 state part-time resident....which state gives tax credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

When filing Part-year resident state returns you allocate the income between the 2 state. You will assign income to the state you were living in when you earned it. You don't claim credit for taxes paid to another state.

How do I file a part-year state return?

How do I allocate (split) income for a part-year state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

But NY taxed the income for the entire year. OR taxed for the portion of the

year that he was there. There is 5/12 of the year that was double taxes.

kaot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

*double taxed in NY.

kaot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

Oregon law says it will give credit if the other state doesn't. But NY does offer the credit.

So now I have it as taking the credit in New York for the income

earned in Oregon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

For part year and nonresidents, New York calculates tax liability based on total income for the year. Then, the state applies an "income ratio" to the tax liability to prorate the income so that you're only paying tax on the percentage of income you earned within the state.

For example:

Assume your total income for the year is $120,000. You earned $50,000 in Oregon and $70,000 in New York.

New York calculates tax on the entire $120,000. That would give us about a $6,300 tax liability on the full amount of income.

Then the state calculates an income percentage based on the income that was earned within the state: $70,000/$120,000 = 58% approx

Using the 58% income percentage, the tax liability is reduced to about $3,600.

Through this process, you'll see that New York actually doesn't tax the full year's worth of income. However, for this calculation to work properly it's important to allocate the income properly within TurboTax.

When working through your New York tax return, you'll come to a screen that asks about income allocation.

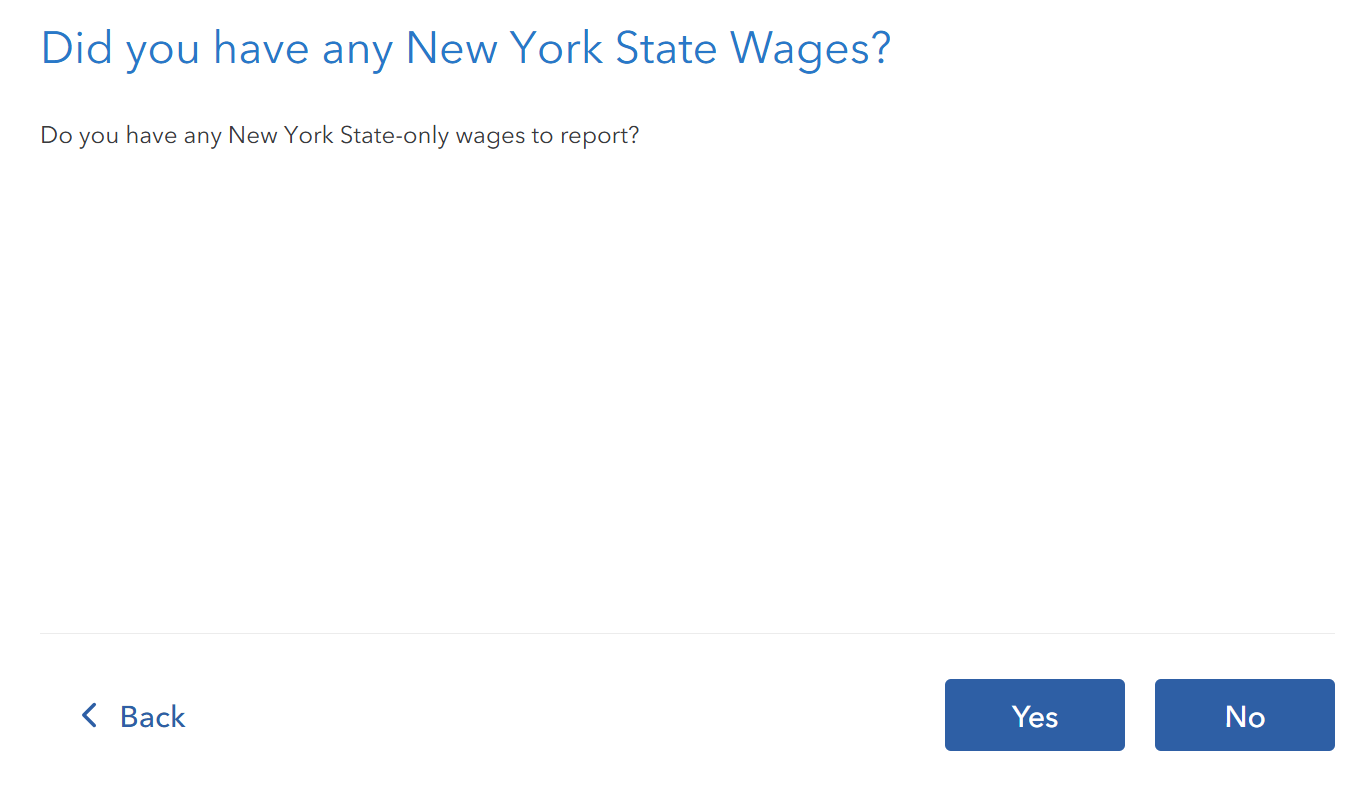

Next you'll be asked if you have any New York only wages. If you worked for the same company in both states, choose No here. If you worked for a different employer in New York than you did in Oregon, and all the income earned from that employer were only earned in New York, choose Yes.

If you chose No on the previous screen, you'll see a screen asking how much of your income was earned while living in New York. Enter the New York portion of income in the box.

The next screen will ask if you had earned income in New York while living outside of New York. Enter the appropriate amount.

Follow the prompts on the remaining screens to complete your return.

Once you get to the New York tax summary screen, you should see the income allocation factor that prorates your tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

But New York factor ended up being .9987. I still can't claim tax

credit for taxes paid to another state?

So Sad, kaot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 state part-time resident....which state gives tax credit?

You can get a credit in Oregon for the tax that was paid to New York if you were required to pay tax to New York while a resident of Oregon. You'd need to calculate how much of the New York income was earned while a resident of Oregon. If you don't have the exact breakdown of this amount, you can estimate based on number of days in each state.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elliottulik

New Member

bawbfree

New Member

jrmcateer305

New Member

jigga27

New Member

anonymouse1

Level 5

in Education