- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2 questions when amending foreign house mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 questions when amending foreign house mortgage

I bought a house in my home country and pay mortgage every month. Since it's a foreign bank, they don't provide 1098 form. I get 2 questions when amending my 2021 tax.

1. I think I should use the 2021 average currency exchange rate to convert the foreign money amount to dollars for Box1. But since I got the mortgage in 2018, should I use 2018 or 2021 average currency exchange rate to calculate Box 2?

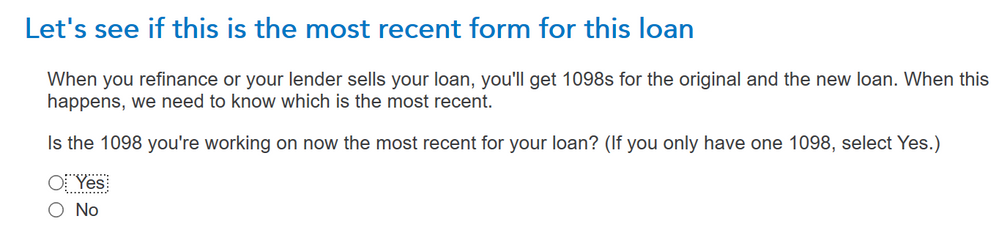

2. I don't have 1098 so I don't know if I should select yes or no here:

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 questions when amending foreign house mortgage

@xnervwang , I understand your questions but do not understand the situation fully:

(a) I am assuming here that you are US person ( citizen / GreenCard / Resident for tax purposes ) --- when did you arrive here, with what visa and are you still and Alien ( Green Card or Visa) ?

( b) that you have a main residence in the USA ( Rental or own)

(c) you house in China is a second residence and that this was bought before arriving in the USA

(d) this property in China is personal property and is not income property ( yes ? )

(e) you took out a mortgage on the property in 2018 for US$ XXXX ( converted from RMB to US$ at average / actual exchange rate )

1. Thus the remaining mortgage principle should be actual balance converted to US$ using Dec. 2021 exchange rate ( RMB to US$) or the annual average published by the US treasury/IRS not that of 2018

2. even though you are telling the software that you do not have a 1098, just say "yes" to satisfy the software -- it should not be asking that question but "yes" is valid since you are working with the equivalent to 1098 --a bank / lender statement.

Please can you clarify the situation more ( answer my questions above and also why you are having to amend your 2021 return in addition to how are you using the property ? I know in many countries, you take a mortgage and pay while the construction is going one and do not have possession or beneficial possession till after the whole mortgage is paid-off or replaced by a different mortgage ( like the construction mortgage replaced by a regular mortgage in the US ).

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 questions when amending foreign house mortgage

@pk Thanks for your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 questions when amending foreign house mortgage

@xnervwang , thank you very much for clarifying the situation -- now I understand what and why of the situation. Thank you

pk

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fellynbal

Level 3

matto1

Level 2

user17523314011

Returning Member

owlnal063

Level 1

matto1

Level 2