- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

I am a disabled person in a Medicaid program. My budget allows me to bring in a housekeeper twice per month. I pay the housekeeper out of pocket, then the Managed Care Organization (MCO) running the program reimburses me when I send in the documentation. The MCO just sent me a 1099-NEC for the amount of those reimbursements. When I enter it, the Turbotax wants me to open a Schedule C, but clearly this is not income. How should I enter this 1099-NEC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

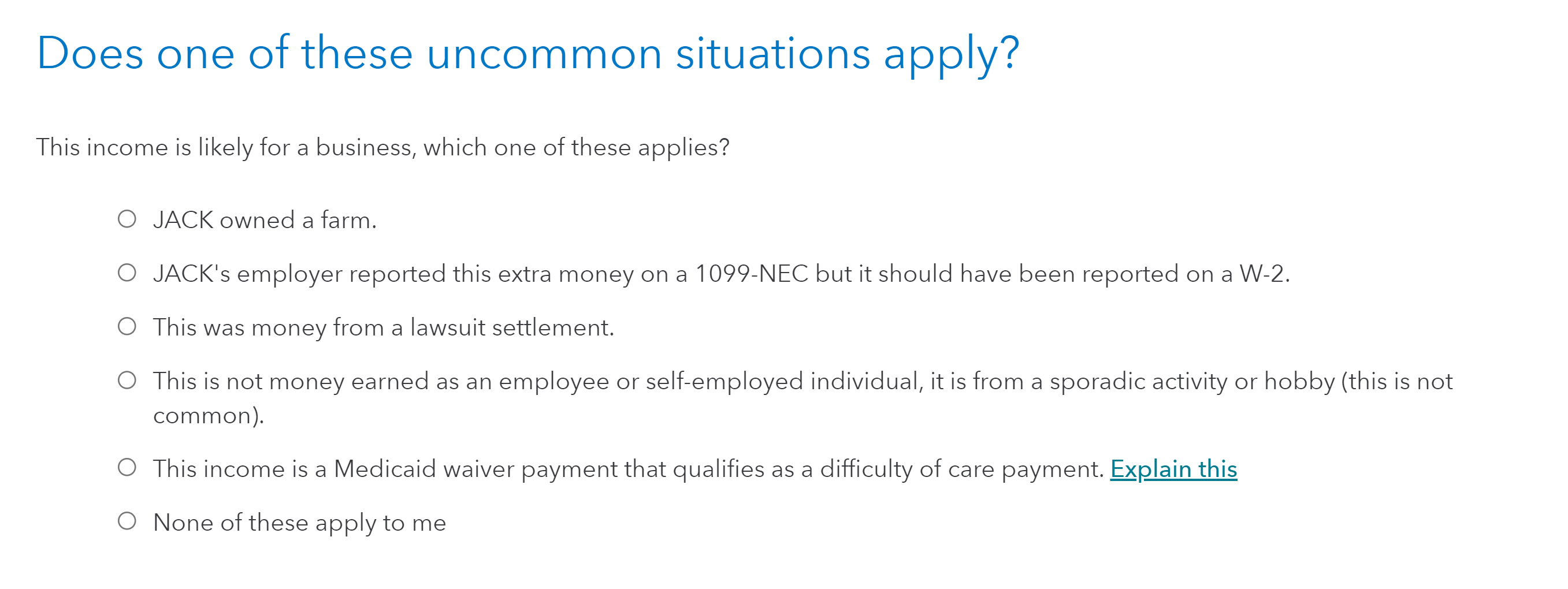

After you enter the 1099-MISC, you will want to indicate that "This income is a Medicaid waiver payment that qualifies as a difficulty of care payment." This will not include it as taxable income. NOTE: TurboTax indicates that the income may be used to qualify for the Earned Income Tax Credit- if it does, make sure you DO NOT use this as income for the Earned Income Tax Credit because this is a reimbursement, not payment for services.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

Where do these answers go?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

After you enter the 1099-MISC, you will want to indicate that "This income is a Medicaid waiver payment that qualifies as a difficulty of care payment." This will not include it as taxable income. NOTE: TurboTax indicates that the income may be used to qualify for the Earned Income Tax Credit- if it does, make sure you DO NOT use this as income for the Earned Income Tax Credit because this is a reimbursement, not payment for services.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DeboraWood148

New Member

lauriebrady

New Member

3000NAR

New Member

user17693062481

Returning Member

angelarsanders04

New Member