- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

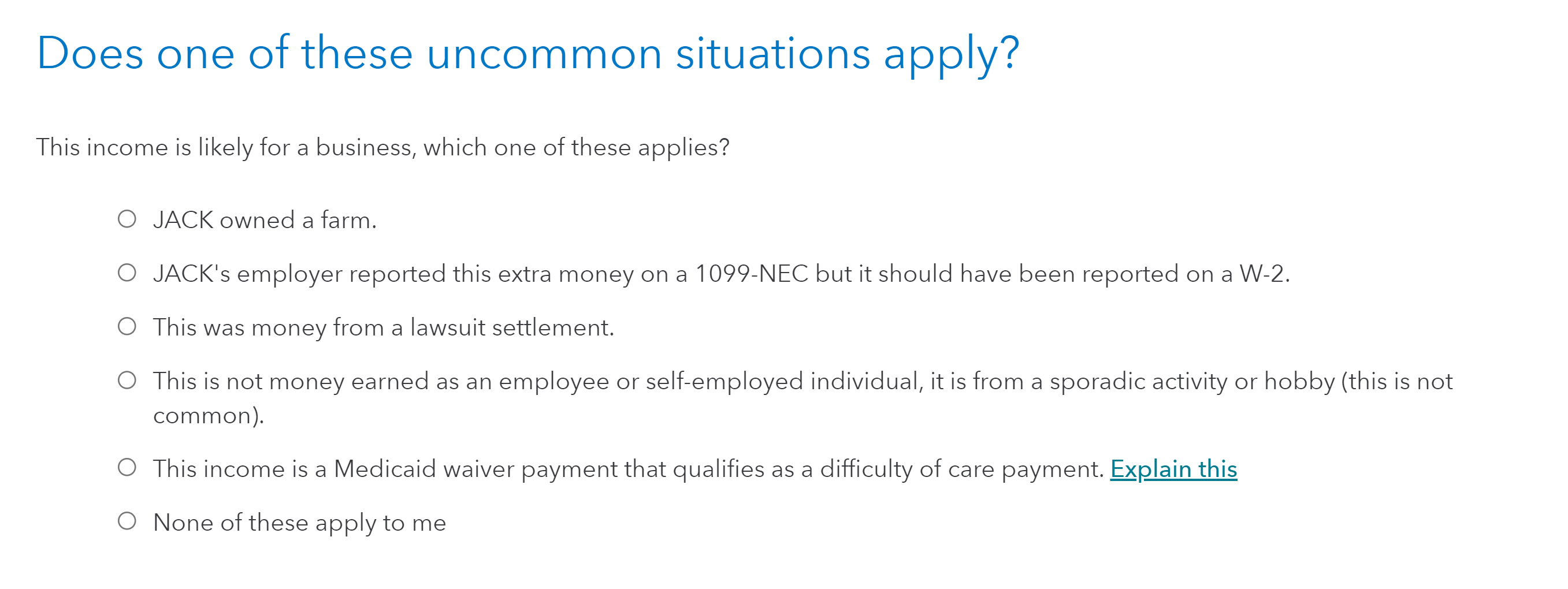

After you enter the 1099-MISC, you will want to indicate that "This income is a Medicaid waiver payment that qualifies as a difficulty of care payment." This will not include it as taxable income. NOTE: TurboTax indicates that the income may be used to qualify for the Earned Income Tax Credit- if it does, make sure you DO NOT use this as income for the Earned Income Tax Credit because this is a reimbursement, not payment for services.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 12, 2023

11:51 AM