- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1099 Misc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 Misc

I have tried to enter the information from this form and keep being rerouted to the same questions over and over again. What should I do? I received this form because I receive money from my former employer (IBM0 to help pay the Long Term Care premiums. Please get me out of this never ending circle.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 Misc

There are many kinds of 1099-Misc forms given for many different reasons.

When entering your 1099-Misc, don't say YES to 'is this work for a former employer'.

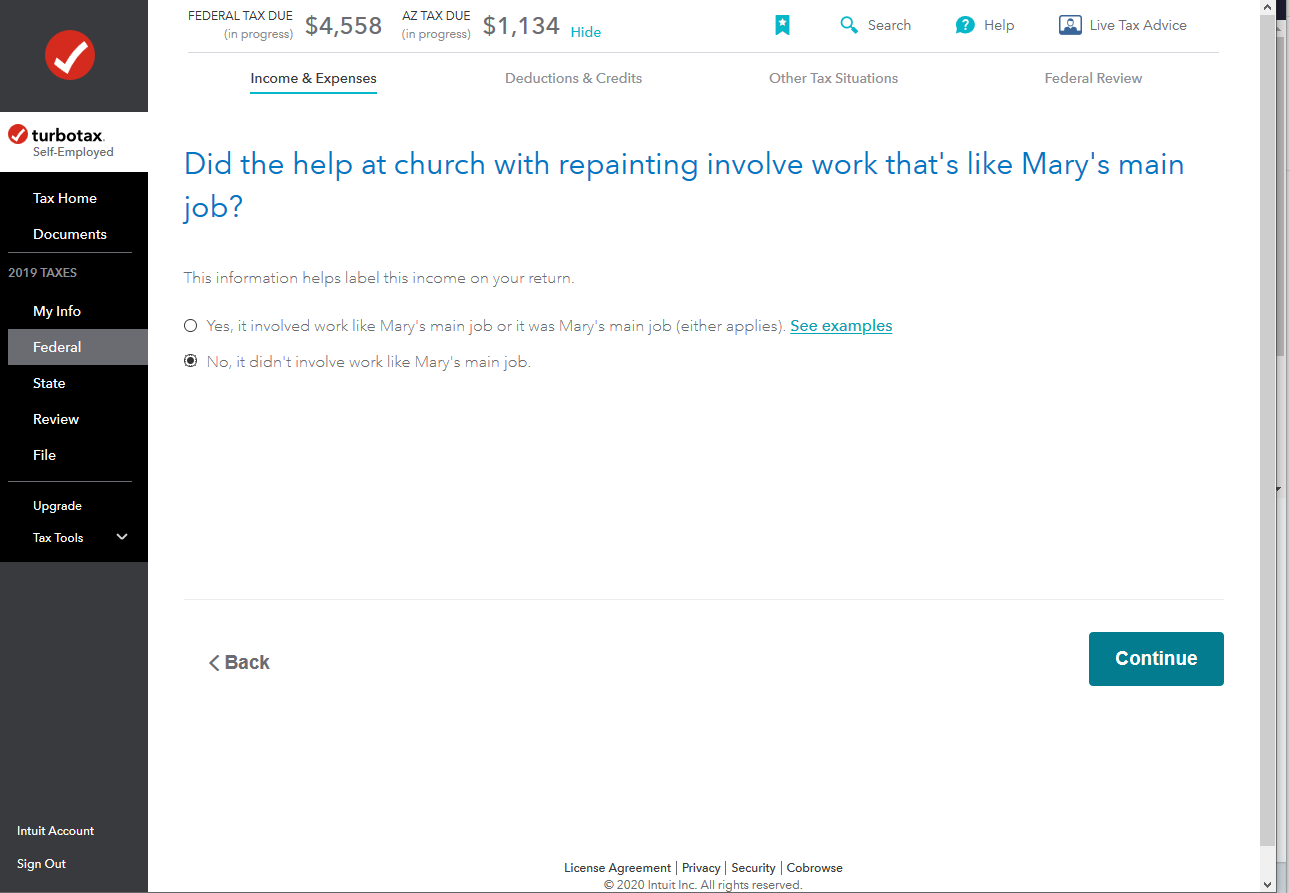

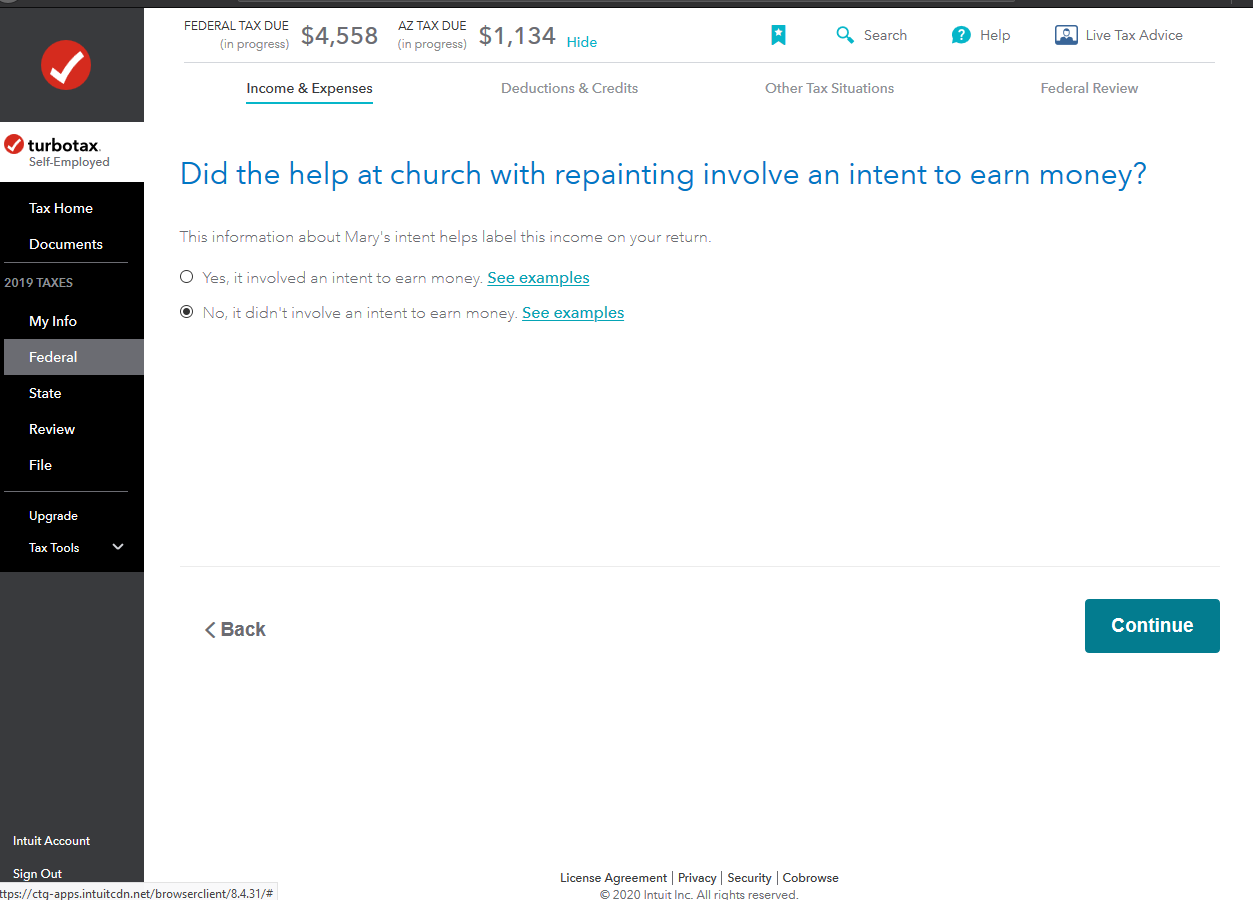

Indicate that this 'is not my main job' and you had 'no intent to earn money' (screenshots).

The income will be reported as Other Income, and you can enter your own description.

Be sure to claim the corresponding Long Term Care Insurance Premiums you paid as Medical Expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 Misc

Can I deduct LTC Insur payments even if I'm using the Standard deduction? Also what deductions can I take if II'm using the standard deduction, does Turbo have a link that will answer that question for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 Misc

Here is a link to Schedule 1. Part II of this form is adjustments to income, a list of deductions, before itemizing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ttax2

Level 2

mc257

New Member

jerryandevescrab

Level 1

jay3

Returning Member

Don-TT

Level 3