- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1040/1040SR Wks: Charitable Donations: Unacceptable amount

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

People are saying they tried this and it hasn't worked. I tried it and it didn't work.

If this is a known issue it should be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

I spoke with a TurboTax representative yesterday (2 actually).

I deleted all my charitable contributions (6 of them) and replaced all of them with a $300 cash donation to a charity called "charity". That's what they advised me and it worked.

<dunno emoji>

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

The CARES ACT link helped me - Line 10b on the 1040 or 1040SR worksheets wanted either $150 for single filers or $300 for joint filers for the CARES Act cash contribution deduction even for those who could not itemize charitable deductions for the federal return due to the standard federal deduction level

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Just in case you still need guidance, or if someone else reads this thread, here's how to get past the charitable contributions error:

First, delete the $300 in the error check. Then go back to Deductions & Credits and enter the contribution there, in the Donations to Charity topic. Then click Done with Donations and proceed through the screens until you get to the screen that tells you that TurboTax has added in the contribution.

The contribution will be back on Form 1040 line 10b, but it should not be flagged as an error if you enter it in Donations to Charity.

Here is a TurboTax article about charitable donations.

Here's an IRS article explaining how the CARES act changes charitable deductions in 2020.

@jameswagner_sb

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Does this work if I am itemizing and claiming $5,000 in charitable contributions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

If you are itemizing and have listed your charitable contributions as follows, you should not have anything entered or be given the option to enter anything for Charitable Contributions under the Cares act.

Your entries should have been made in the Federal interview section of the program.

- Select Deductions & Credits

- Scroll down to All Tax Breaks and select Charitable Donations

If the total of all of your deductions allows you to itemize your deductions, you will not have the option to answer the Cares section where you would enter the $300.

I recommend doing the following to ensure any input is cleared out.

- On the Deductions & Credits screen, go ahead and scroll down to the bottom and select Wrap up Tax Breaks.

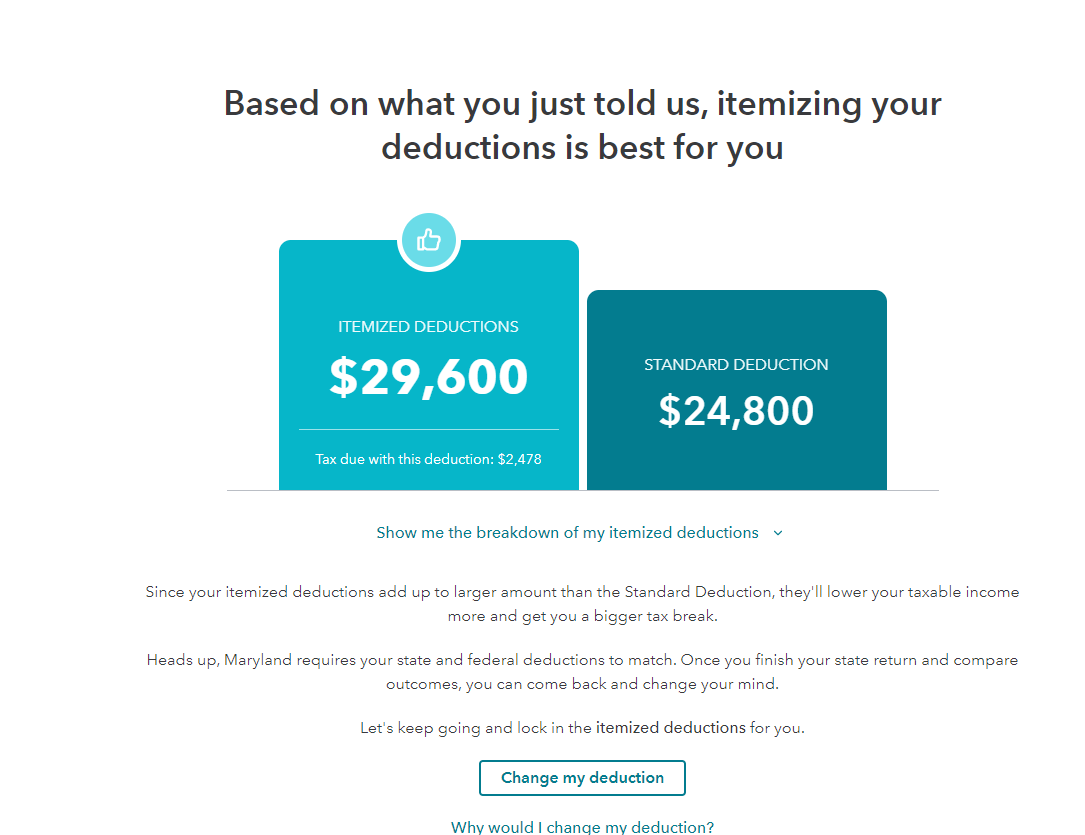

- Proceed through the screens until you see the following screen titled Based on what you just told us,...your deduction is best for you:

Continue through this screen and you should not be given the option to enter any other cash charitable contributions.

If you are still receiving any error messages, please comment with the message so we can assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

I've tried to do the solutions presented in several of the replies in this chain - NONE of them worked - I tired many variations of my own, and still could not get the error message to go away which PREVENTS e-filing of the federal return. I went through the entries several times and could not find where the error message would have come from.

The only ways I could make it work was 1) delete all contributions and loose some of my federal refund OR 2) just print (with whatever error exists) and mail the return - which is the solution I used.

Not happy with this aspect of Turbotax since even Turbotax has no solution that worked for me and I wasted much time trying to fix this issue with no result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Suggestions haven't worked. Can't get past this msg. Not good!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Thank you for preventing me from wasting more time. I'll just forgo the deduction and move on from TurboTax next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

I've spent 2 days and many phone calls to get past this glitch. If I have to mail in for my refund I will never use Turbo Tax again.

Lee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Here's what TurboTax is working on instead of fixing their software. The makers of TurboTax and other online systems spent millions lobbying last year, much of it direct...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Yes. There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. TurboTax cannot just program our software without having final forms issued by the IRS. What TurboTax does in the way of updating software for tax forms is completely dependent on the IRS. I suggest you wait until there is a fix. We do not have a date because we are waiting, as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

worked !!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

What did you do that worked? I’d sure like to know as would many others. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks: Charitable Donations: Unacceptable amount

Hi, I deleted the page, opened a new one & wrote the names of 2 charities & the amount given. For some reason it worked for me.

Good luck, Lee

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

organdan

Level 1

intuit

New Member

pv

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

IY

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

TRIBBIE

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill