- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If you are itemizing and have listed your charitable contributions as follows, you should not have anything entered or be given the option to enter anything for Charitable Contributions under the Cares act.

Your entries should have been made in the Federal interview section of the program.

- Select Deductions & Credits

- Scroll down to All Tax Breaks and select Charitable Donations

If the total of all of your deductions allows you to itemize your deductions, you will not have the option to answer the Cares section where you would enter the $300.

I recommend doing the following to ensure any input is cleared out.

- On the Deductions & Credits screen, go ahead and scroll down to the bottom and select Wrap up Tax Breaks.

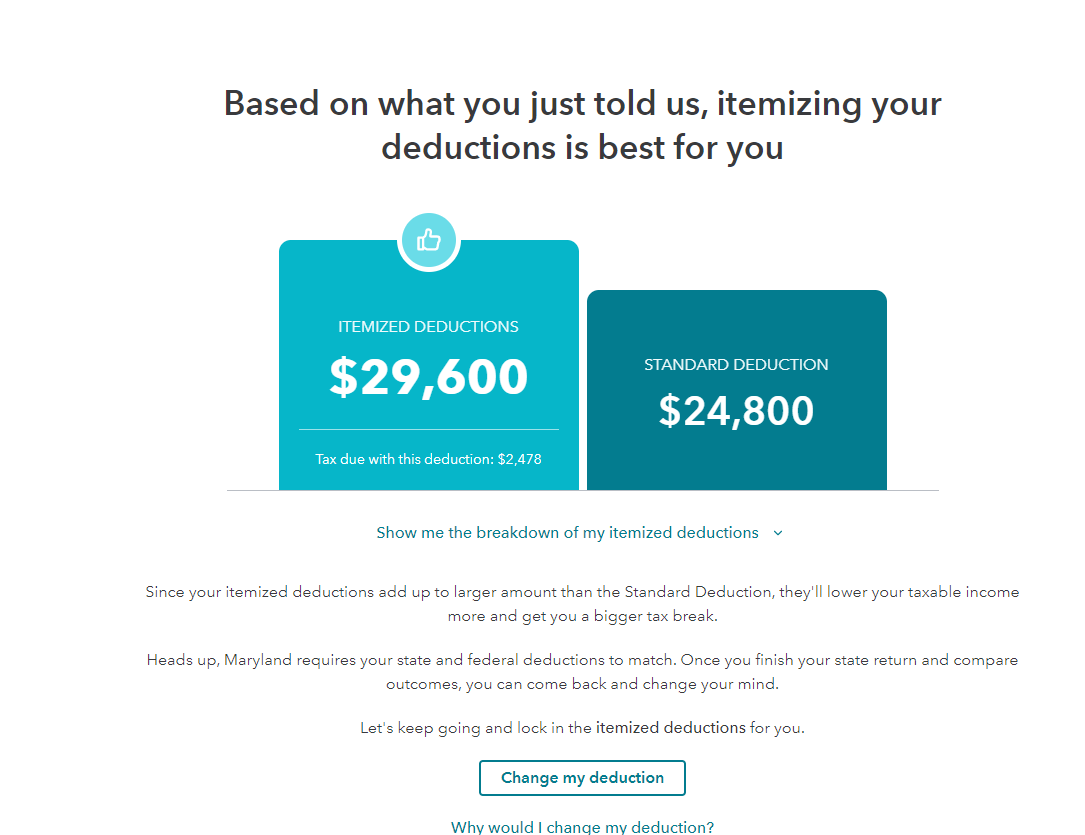

- Proceed through the screens until you see the following screen titled Based on what you just told us,...your deduction is best for you:

Continue through this screen and you should not be given the option to enter any other cash charitable contributions.

If you are still receiving any error messages, please comment with the message so we can assist you.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 10, 2021

9:22 AM