- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- $1 Buyout Lease Information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$1 Buyout Lease Information

Doing my business taxes has gone well, until I added a new piece of equipment.

My company did a capital lease for a printer with a $1 buyout at the end of a 5 year term. From what I've read, we basically own it & can deduct the entire cost for the 2020 tax year.

The ticket price on the printer was $8,500. Our final fixed cost has us at $10,500 for a $8,500 piece of equipment.

Since we're in a contract to pay off the printer, I'd like to deduct the entire cost for the 2020 tax year.

I need to know how to handle the payments each on the LLCs taxes & balance that against the one-time deduction.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$1 Buyout Lease Information

This appears to be a capital lease and qualifies for Sec 179 deduction.

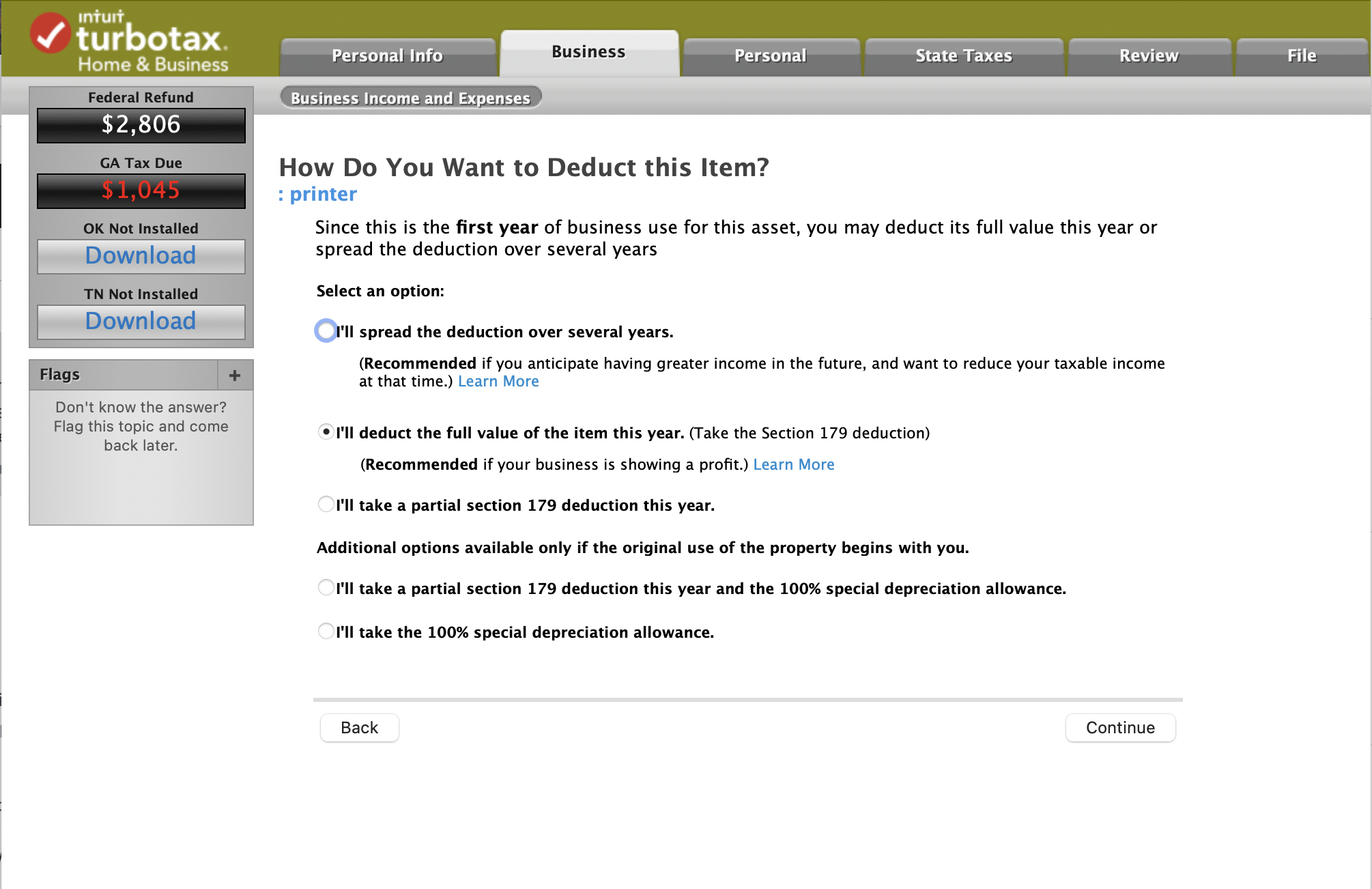

Enter the printer in the Business assets interview of TurboTax using the ticket price of $8500 as the purchase price, and making the appropriate Sec 179 or special depreciation allowance election (see sample screen shot, below).

Record the liability (Equipment Loan) on your LLC books with a principal balance of $8500.

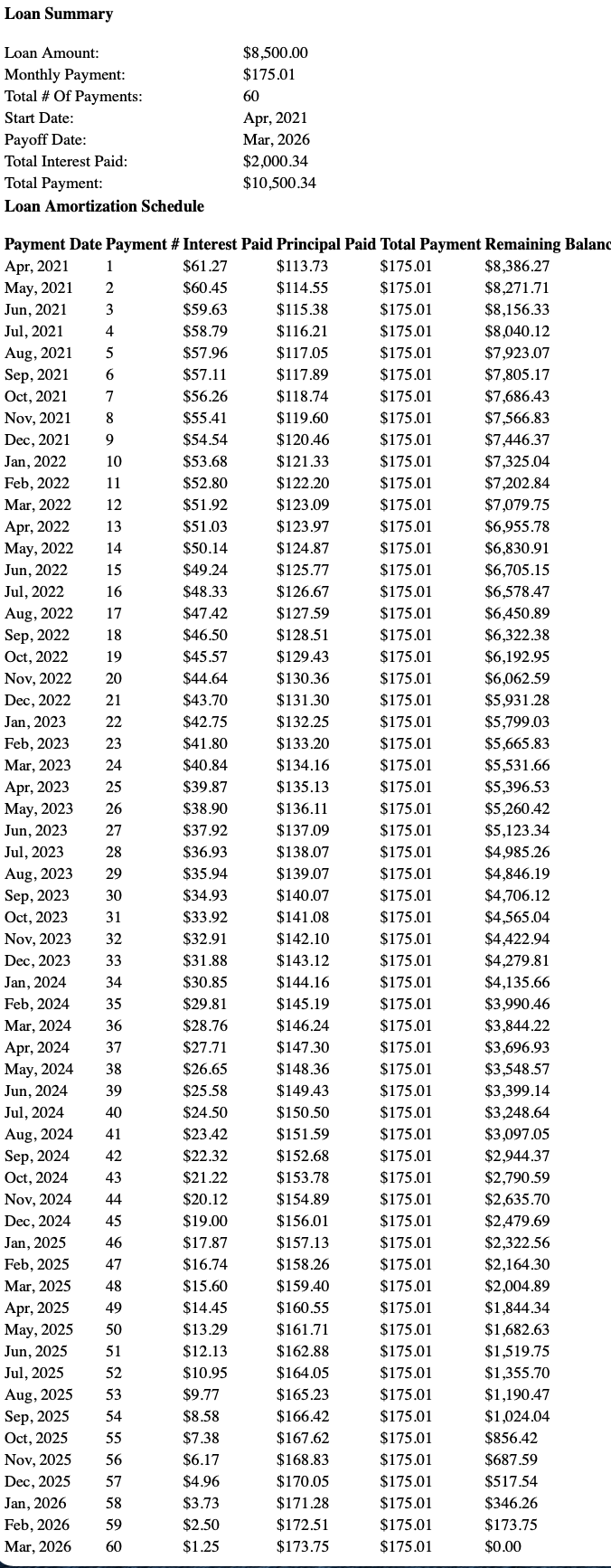

With a 5-year amortization (60 payments of $175) at 8.65%, your total cost will be $10,500 (sample amortization schedule attached). You can make manual entries each month to record the interest expense, or a year-end adjusting entry.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mehradz

New Member

corinneL

Level 2

john_sramek

Level 1

john_sramek

Level 1

jds24

Level 2