- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

This appears to be a capital lease and qualifies for Sec 179 deduction.

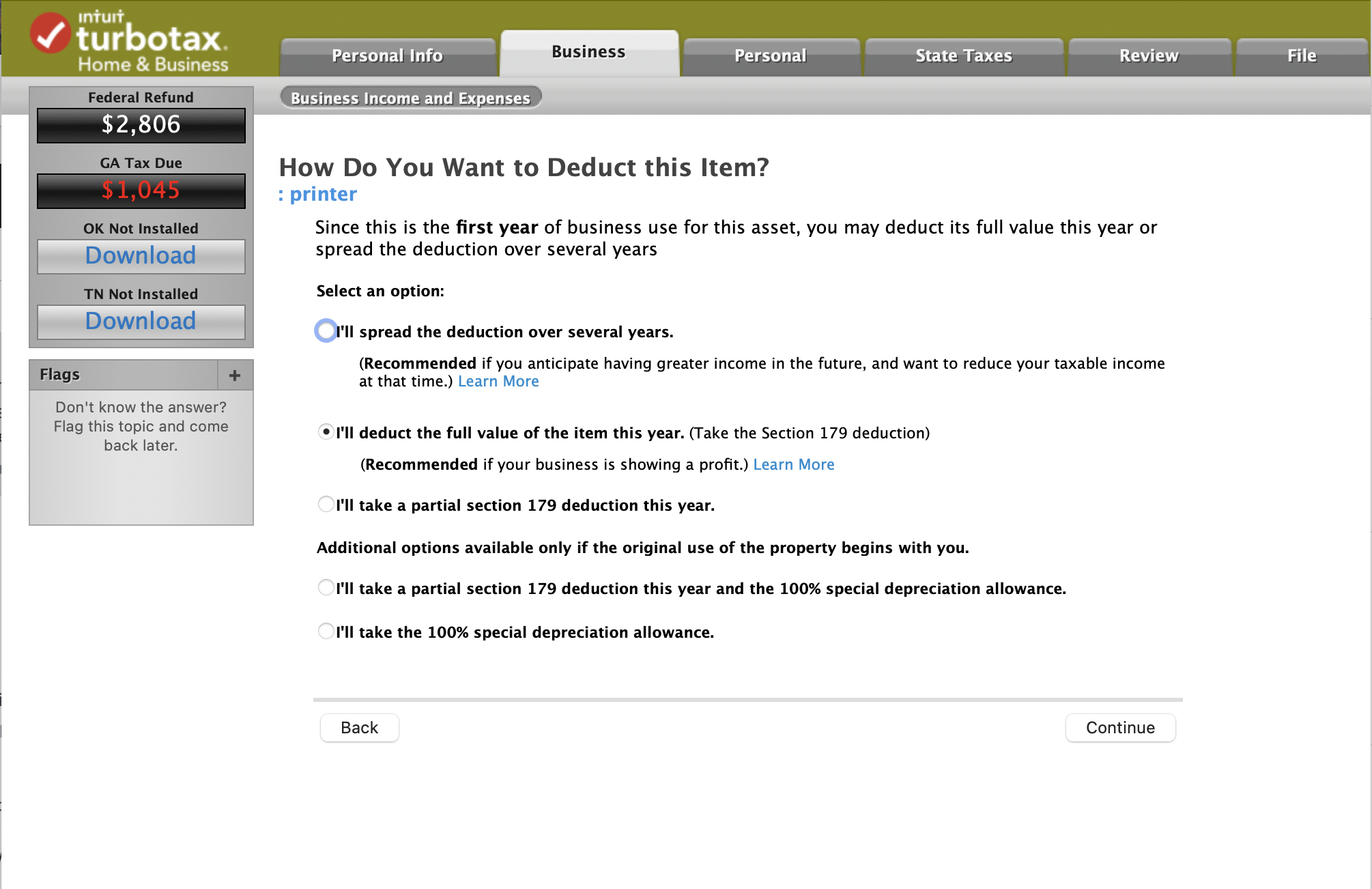

Enter the printer in the Business assets interview of TurboTax using the ticket price of $8500 as the purchase price, and making the appropriate Sec 179 or special depreciation allowance election (see sample screen shot, below).

Record the liability (Equipment Loan) on your LLC books with a principal balance of $8500.

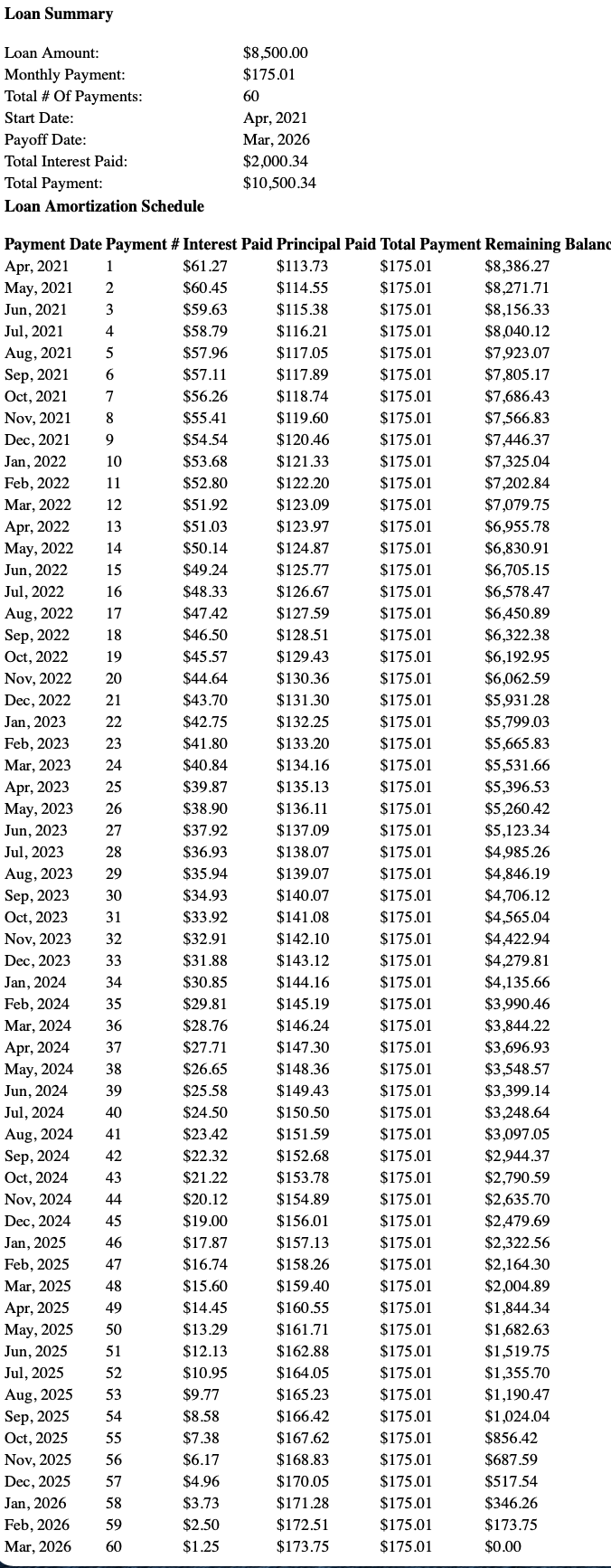

With a 5-year amortization (60 payments of $175) at 8.65%, your total cost will be $10,500 (sample amortization schedule attached). You can make manual entries each month to record the interest expense, or a year-end adjusting entry.

April 25, 2021

2:34 PM