- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Why is my adjusted gross income in Utah the same as my federal adjusted income when income earned in Utah was $73,300 and my income for California was $71,961 and my adjusted gross income on federal i...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my adjusted gross income in Utah the same as my federal adjusted income when income earned in Utah was $73,300 and my income for California was $71,961 and my adjusted gross income on federal income tax return is $159,915?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my adjusted gross income in Utah the same as my federal adjusted income when income earned in Utah was $73,300 and my income for California was $71,961 and my adjusted gross income on federal income tax return is $159,915?

Did (1) you move from one state to the other during 2020, or (2) are you filing a Nonresident ("NR") return in one state, and a Resident ("R") one in the other? If so, which is NR and which is R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my adjusted gross income in Utah the same as my federal adjusted income when income earned in Utah was $73,300 and my income for California was $71,961 and my adjusted gross income on federal income tax return is $159,915?

NR California, full time resident UT. We move to UT in 2012 and have not lived in CA since then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my adjusted gross income in Utah the same as my federal adjusted income when income earned in Utah was $73,300 and my income for California was $71,961 and my adjusted gross income on federal income tax return is $159,915?

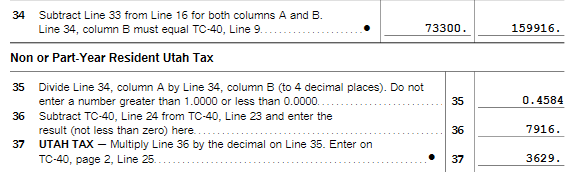

The Utah tax form (TC-40) starts with federal income because of the way Utah calculates tax on part-year residents. However you are not being tax on federal income; only the UT percentage.

Utah first calculates a base tax rate as if all your income were earned in Utah. Your actual tax is the Utah income percentage of the base tax. For example, if you earned $159,915 total and $73,300 in UT, your Utah tax would be the UT tax on $159,915 x ($73,300/$159,915),

The tax computation is shown on Form TC-40B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josht777

New Member

user17539892623

Returning Member

bees_knees254

New Member

barbaramays333

New Member

barbaramays333

New Member