- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

The Utah tax form (TC-40) starts with federal income because of the way Utah calculates tax on part-year residents. However you are not being tax on federal income; only the UT percentage.

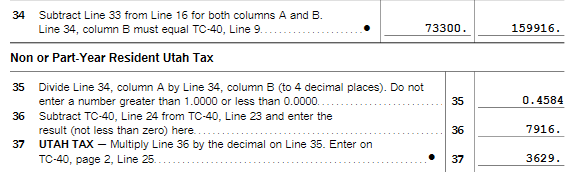

Utah first calculates a base tax rate as if all your income were earned in Utah. Your actual tax is the Utah income percentage of the base tax. For example, if you earned $159,915 total and $73,300 in UT, your Utah tax would be the UT tax on $159,915 x ($73,300/$159,915),

The tax computation is shown on Form TC-40B.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 5, 2021

11:50 AM