- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- where to indicate it is MA bank interest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where to indicate it is MA bank interest?

Form 1-NR/PY line 7a ask for "MA bank interest". It is taking from Schedule B "MA Interest Income Worksheet". column "regular Interest" is automatically filled with the interest from the 1099INT. How do I remove this number and put it in the column for "MA Bank Interest"? That entry seems read-only, I can not change.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where to indicate it is MA bank interest?

The Massachusetts bank interest question is part of the interest section in Federal.

Here’s how to tell TurboTax you have MA bank interest:

- Type interest in Search in the upper right

- Select Jump to interest

- Say YES to Did you have investment income in 2022?

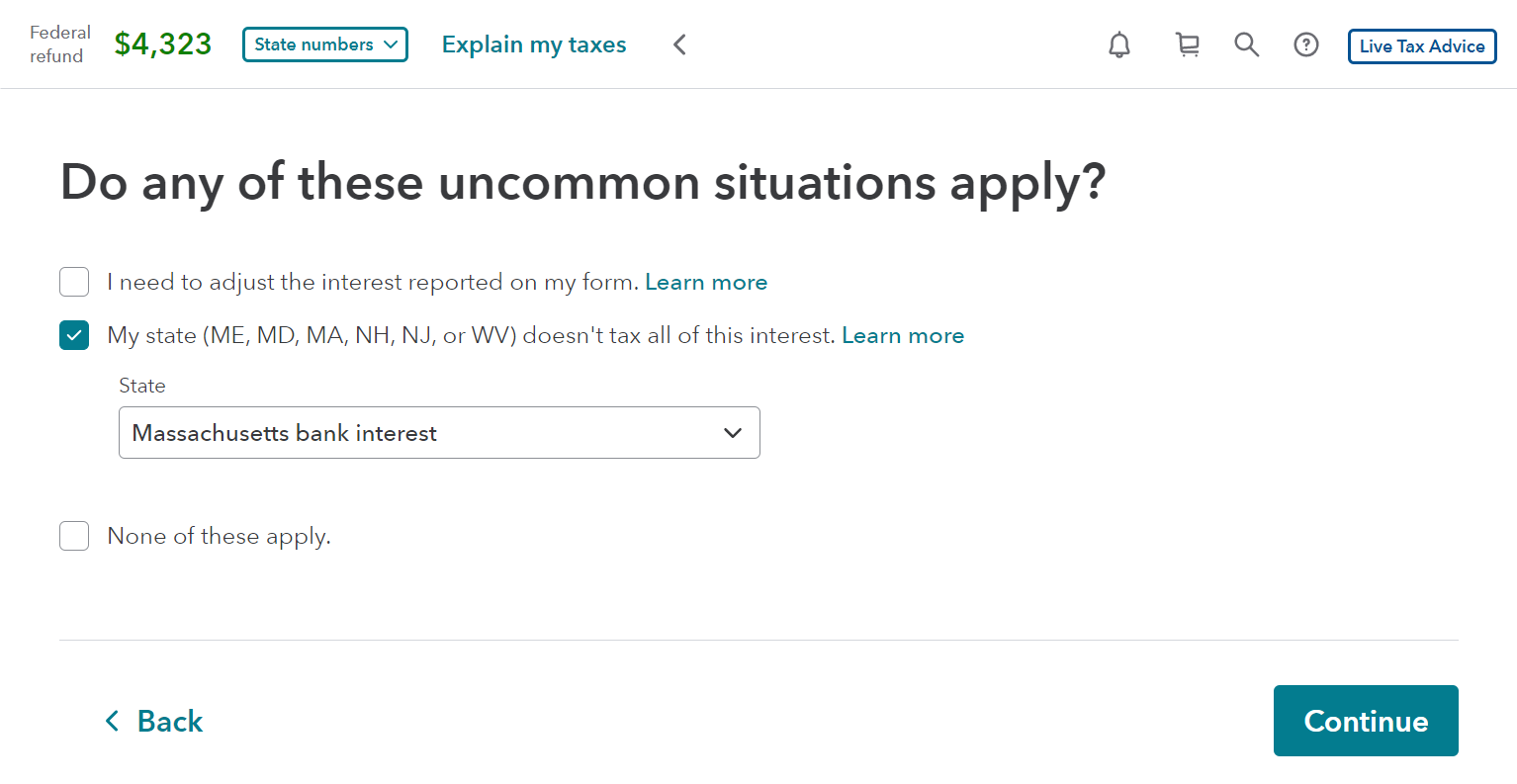

- After you’ve entered your interest, you will see a screen “Do any of these uncommon situations apply?”

- Select My state (ME, MD, MA, NH, NJ, or WV) doesn’t tax all of this interest.

- In the dropdown select Massachusetts bank interest

For Massachusetts income tax purposes, interest on money market deposit accounts in banking institutions located in Massachusetts will be includible in Massachusetts gross income as Part B income, taxable at the rate of 5% plus surtax, and will be eligible for the $100 deduction ($200 for a husband and wife filing a joint return) provided by General Laws Chapter 62, Section 3(B)(6).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Newby1116

New Member

claire-hamilton-aufhammer

New Member

Kh52

Level 2

ilenearg

Level 2

realestatedude

Returning Member