- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Virginia VA TurboTax Bug Form OSC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia VA TurboTax Bug Form OSC

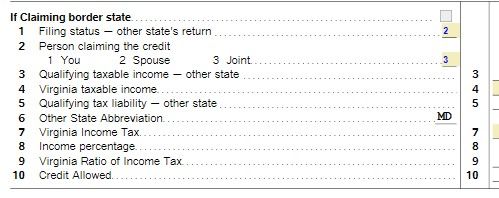

Schedule OSC (Credit for Tax paid to another state)

Summary: TurboTax does not seem to calculate the allowed CREDIT correctly in some cases.

Narrative:

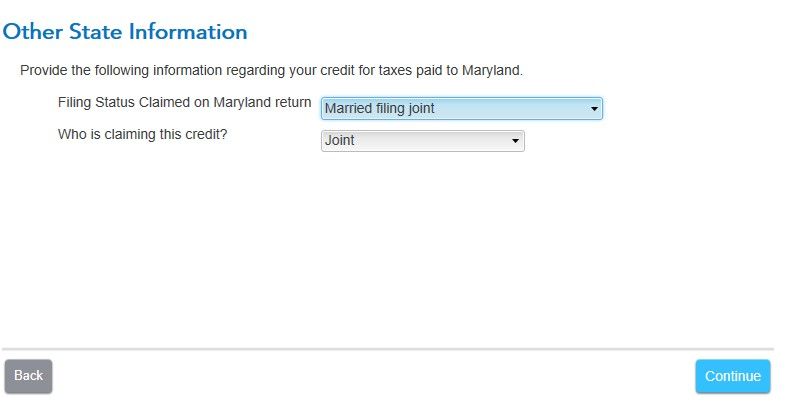

I completed my filing for VA with income from MD using the guided method and select "Who is filing credit?" as Jointly. TT passed it's review and filed e-filed. The State of VA notified me of an error and provided me an updated calculation.

After some investigation, I discovered by cycling the "Who is filing credit?" from Joint to BLANK and back to Joint. TT would recalculate the credit (which was in agreement with the State of VA).

I have uploaded my return as Token 1214097 and screen shot attached.

Note: This error is also reproducible in the Forms mode.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia VA TurboTax Bug Form OSC

When you change between blank, each spouse, joint, it moves the ratio of tax and changes the liability. I am not having this issue of changing from joint to blank to joint.

Since you did, TurboTax has a special phone number for help with IRS/state tax letters, which will be easier than going through regular Customer Support. Follow these steps:

- Click on this link,

- then click on the blue button that says "Get Help from TurboTax Support".

- Answer the question regarding what tax year is your letter.

- Then it will ask you what the letter concerns.

- Then it will show you the phone number during posted business hours.

See How to submit documentation for accuracy guarantee claims

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sososupa

New Member

hirohyoto

New Member

MegND05

New Member

ddaday

Level 2

mbuntyn

Returning Member