- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Virginia VA TurboTax Bug Form OSC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia VA TurboTax Bug Form OSC

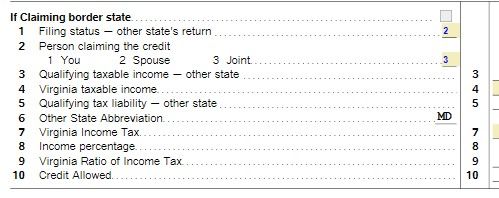

Schedule OSC (Credit for Tax paid to another state)

Summary: TurboTax does not seem to calculate the allowed CREDIT correctly in some cases.

Narrative:

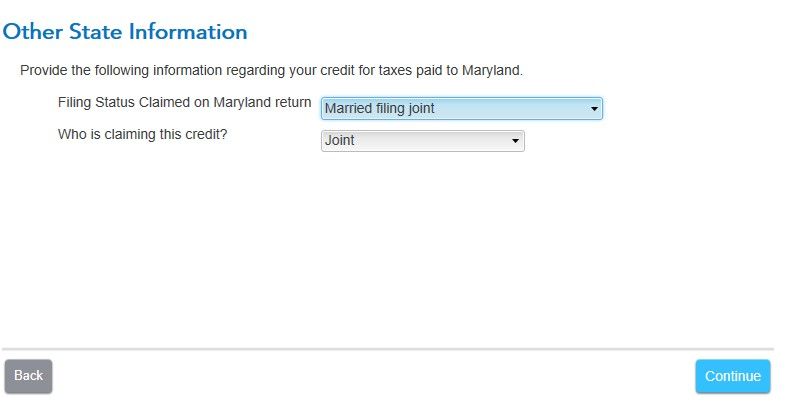

I completed my filing for VA with income from MD using the guided method and select "Who is filing credit?" as Jointly. TT passed it's review and filed e-filed. The State of VA notified me of an error and provided me an updated calculation.

After some investigation, I discovered by cycling the "Who is filing credit?" from Joint to BLANK and back to Joint. TT would recalculate the credit (which was in agreement with the State of VA).

I have uploaded my return as Token 1214097 and screen shot attached.

Note: This error is also reproducible in the Forms mode.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia VA TurboTax Bug Form OSC

When you change between blank, each spouse, joint, it moves the ratio of tax and changes the liability. I am not having this issue of changing from joint to blank to joint.

Since you did, TurboTax has a special phone number for help with IRS/state tax letters, which will be easier than going through regular Customer Support. Follow these steps:

- Click on this link,

- then click on the blue button that says "Get Help from TurboTax Support".

- Answer the question regarding what tax year is your letter.

- Then it will ask you what the letter concerns.

- Then it will show you the phone number during posted business hours.

See How to submit documentation for accuracy guarantee claims

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Psyblade

Level 3

NETOLICKY71

Level 2

NETOLICKY71

Level 2

scsiguru

Level 2

7t9r743V

Returning Member