- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Us government obligations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

When doing my federal taxes, I entered the amount of my dividends that were from US Government obligations. When I go to the state portion of my taxes, how do I know that it took? They have a section in the state (Michigan) about Capital Gains, but that isn't part of the US Gov't Obligation calculation. If I entered the amount of my dividends that was from US Gov't Obligations in the federal section, do I need to enter it again in the state section?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

No, you do not need to enter it again. In most states, mutual fund dividends from interest on direct U.S. government securities are exempt from state and local taxes.

The following U.S. Obligations are exempt from Michigan Individual Income Tax:

U.S. Government Bonds U.S. Savings Bonds – Series E, F, G and H U.S. Government Certificates U.S. Treasury Bills and Notes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

No, you do not need to enter it again. In most states, mutual fund dividends from interest on direct U.S. government securities are exempt from state and local taxes.

The following U.S. Obligations are exempt from Michigan Individual Income Tax:

U.S. Government Bonds U.S. Savings Bonds – Series E, F, G and H U.S. Government Certificates U.S. Treasury Bills and Notes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Hello- I have Turbo Tax Premier, and it imported my 1099-DIV from Fidelity. However, when I was in the state filing section, it shows "this is what we've reported so far" and it was only the capital gain from a mutual fund sale- NO dividends at all! The percentage of the reduction for US govt based obligations should be on the dividends NOT the capital gains. Can this glitch in the program be fixed??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

After many hours and much frustration and study, I have found that the way you must enter dividends from US obligations on TTX is to call them interest. I got a supplemental information sheet from my investment company that shows the percent US income in the investment I own. I had to manually calculate the amount that my state does not tax. At some point in the step by step TTX does ask if any of your interest is from US obligations. TTX does not handle dividends from US obligations. You have to treat your US dividends as US interest. That way it will be handled correctly on both your federal and your state income tax. It is my understanding that no states tax this kind of income. This is a problem that should be fixed by the TTX people. It is a bug in the programming. It is very confusing, especially if you are keying everything in on your 1099s as printed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

I am not finding this same selection on Turbotax for Mac, but have always used it for Turbotax for Windows.

Is it now in a different location? It isn't available on the Federal or State.

I have just spent > 1 hour on phone with Turbotax rep who is arguing with me that the selection should be present. Instead she insists it should be on the 1099....uh....clueless.

Please help if you can.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Interest and dividends are entered differently. For dividends:

- Go to federal income

- Edit your 1099-DIV

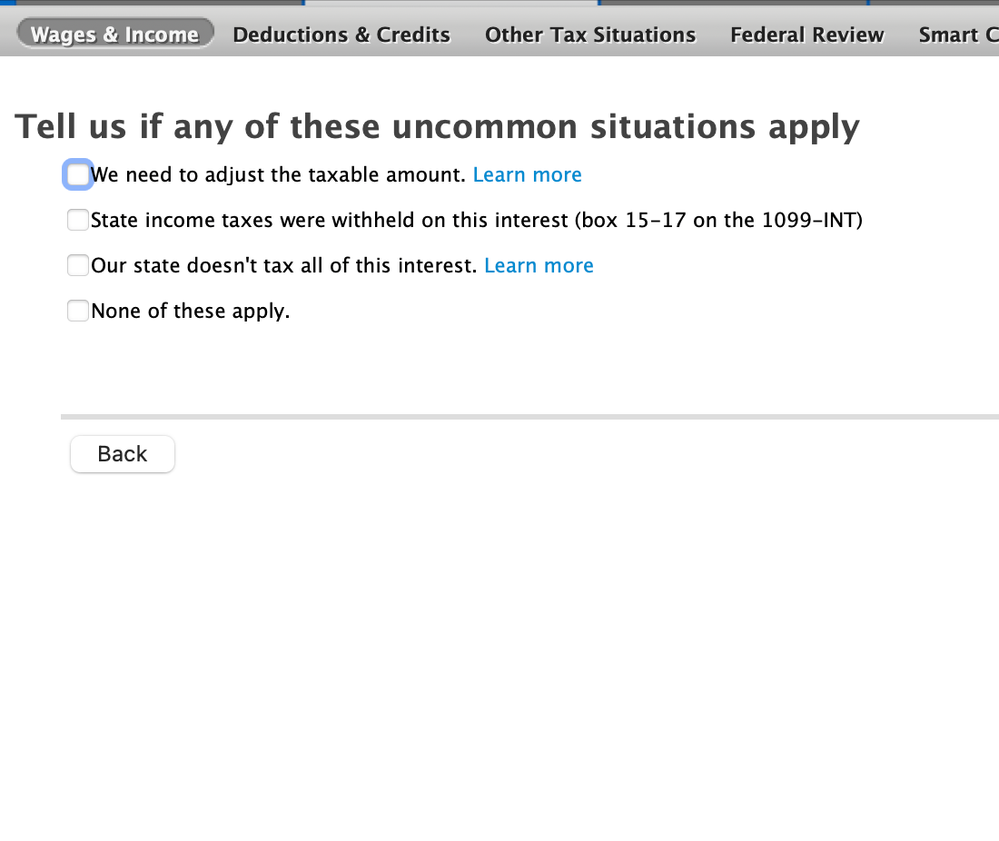

- Go through the whole process. When you come to Uncommon Situations Stop

- Select a portion of these dividends is US Government interest

- Continue

The program should take it through to your state. If you still have trouble, reply with the state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Yes I've seen that screen many times using Windows.

You are showing the Windows screen shot. Problem is only with Mac version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

What happens when you select to adjust the amounts? Is the program not moving forward or carrying? Please give us more information as to the issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

I am on the commensurate screen on MAC as the one you noted for WINDOWS. "Uncommon situations"

On mac, the selection list is different and does not include an option to provide to enter interest from US Obligations.

Nor does the State tax return user interface.

I am now resigned to file out the form manually on Turbotax by locating the NC State tax form.

Sigh....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Oh I see what you are asking. These selections on that next screen are only for Federal taxes, not for US Obligations for State tax.

I also called the Support line. That person tried to argue with me about tax law and also tried to tell me it should be on the 1099. Geez. Need better support reps. 1 hour on phone. Finally hung up.

Whomever coded the Mac version did not use the Windows version as an example.

I will however thank the Community for trying to help. Needs a programmer to fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Similar problem! Two 1099s with money market income, the box 3 is "0" in both for US obligations, BUT the reported % for US obligations between the two is several thousand dollars. TBTX will not ask me the key question, and when I try to enter the deduction on the state form (IN, Schedule 2) it will not let me enter it. The only thing I can think of is to edit the interest report in the Federal Income section and enter the correct amount from each brokerage account attributable to US government obligations. I have decided this is my last year paying for software that forces me to lie on my return to get the right outcome. Interviewing tax preparers in May who use professional software that works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

You need to check your Supplemental Information sheets first. For my Fidelity account, the Govt Money Market I have, reports their dividends (Including US Treas obligations) only in box 1a&1b of a 1099-DIV form, and not on a 1099-INT. Those US Treasury Obligations are handled properly in the software on a follow-up page to the 1099-DIV form, and then those $$ transfer to the state forms to be subtracted automatically. Thus box 3 on a 1099-INT never comes into play.

______________

The issue some folks are having, is for actual, individual US "AGENCY" bonds they hold (like TVA, FHLB and a couple others) that report $$ in box 1 of a 1099-INT. Some states have a section in the state software to take those $$ out, and some don't (like my NC doesn't)...thus...some suggestions to move some $$ from box 1 of a 1099-INT to box 3. (luckily for me , for NC I don't have to do that, since I can enter them in an NC form in the correct area using the Desktop software...but Online users cannot)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Yes, thanks, I abandoned the box 3 strategy shortly after I posted my comment because it only increased total federal income without reducing state taxes. Duh! I had all the necessary information for US obligations, but couldn’t find a way to get it into the form. After rerunning the 1099 dividend section for each brokerage in the federal tax part of TurboTax I located the checkbox for the US government interest, entered the information there and it carried over to the state form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Us government obligations

Agreed, this is cumbersome to manually calculate. You take the investment center's tax form for Percentage of Income (or ordinary dividends / interest) times your matching individual account holding. Then enter separately on your state return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SuzMarie

Level 2

Newh0617

New Member

user17722139154

New Member

fdragan

Level 1

lgwalker59

New Member