- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- turbotax reject e-file my California tax return(include LLC).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

turbotax reject e-file my California tax return(include LLC). The reason is my return includes an LLC. But Ca.gov website says Form 568 can be e-filed. How can I e-file my CA return using turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

There may be information on Form 568 that is causing the rejection, as these forms can be e-filed. Are you provided with an exact cause for the rejection? Please reply to this thread for further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

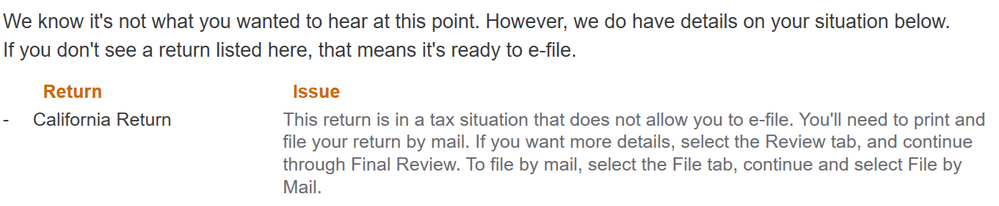

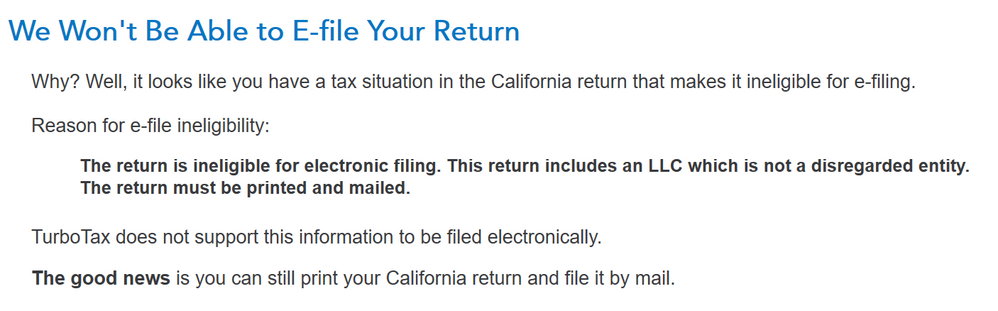

The following screenshot is all the message I received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

TurboTax Home & Business can prepare California Form 568 only for a Single-Member LLC that is a disregarded entity. If you have tried to file Form 568 for an LLC owned by more than one person or failed to indicate it is a disregarded entity, the e-file will be rejected.

You can verify this using Forms Mode.

- Open your return and click the Forms icon in the TurboTax header.

- Scroll down to the California forms and click on Form 568 under Sch C Wks to open the form in the large window.

- Scroll down to Line U(1) and verify if the Yes box is checked. If not, you cannot e-file the form.

- Scroll down to the bottom of the form.

- If the box is checked, you must print and mail Form 568.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

On Line U(1) "No" box is checked. My LLC is single member and considered a disregared entity.

I have already mailed my California tax return and From568 (LLC) with the TurboTax instructions I used on April 7 because I could not get any answer. I was supposed to check Yes on Line U(1) of From568, but I mistakenly checked No and submitted it. Does this need to be amend filed? If so, please let me know when and how to file.

I have e-filed with the IRS, do I need to amend this as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

No, your answer to that question was correct. Since you've already mailed your return, you should wait to see if the State has any questions about Form 568 (they should not). It's possible another box for "disregarded entity" wasn't checked or didn't transmit properly when you tried to e-file.

There's no need to amend your federal or state returns as long as you receive no correspondence regarding a correction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

Thank you for great help.

I will see if I receive no correspondence regarding a correction. I hope IRS or the state not cotact me about the isuee as you said.

Regarding e-filing of the turbotax. According to your explanation, my case is supposed to be e-filing capable, but for some reason in the software the part in question was not reflected correctly in the document, thus preventing e-filing. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turbotax reject e-file my California tax return(include LLC).

Mailing your CA 568 will not impact or interfere with the IRS accepting your Federal return.

Here is a link to the contact information for the California FTB. You can contact them in many ways to confirm your return was processed or set up an online account with their tax portal: CA Franchise Tax Board.

If you are expecting a refund from the IRS, you can track your refund status with the link below:

You need your filing status, your Social Security number, and the exact amount (line 35a of your 2022 Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkbrad

New Member

Idealsol

New Member

roybnikkih

New Member

gerald_hwang

New Member

ahkhan99

New Member