- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

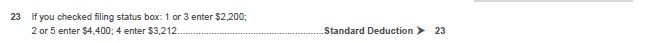

Hawaii form N-11, Line 23, calls for a standard deduction value that is a function of the filing status you selected at the beginning. TurboTax asks for the filing status, we picked MFJ. From this it should put $4,400 in Line 23. It left Line 23 blank in our return/e-filing. In our case, it didn't matter since the next line calls for subtracting either Line 22 (allowable itemized deductions) or Line 23 (standard deduction), whichever applies, from Line 20 (Hawaii AGI), and, in our case, Line 22 applied, and Line 23 didn't.

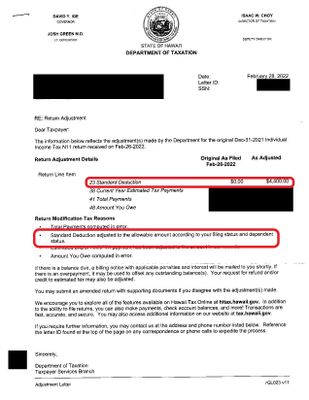

The Hawaii Department of Taxation, however, seems to think Line 23 should be filled out whether it matters or not. They sent us a letter complaining about two errors, the first of which was that Line 23 was $0 as filed (looks blank on what I can see) but was adjusted to $4,400. I'm sure that this is the last Hi DoTax cares about that specific issue, but they cared enough to flag it to us. (The other error was mine but, hopefully, does not require an amended return to fix. It took me a while to figure out that these two issues were entirely unrelated.)

TT never asked me, discretely, what to put in Line 23. But it had all the information it needed to complete the return from how it checked Box 2 based on what I told them about our filing status. And Box 2 is checked.

I spoke to somebody in TurboTax support, and they couldn't have cared less and said that TT doesn't fill out my taxes, I do, so I must not have told them what to put in Line 23. (But nowhere does TT, discretely, ask for what to put in Line 23. It doesn't need to, since Line 23 is entirely derivative from other data I did put in.) The person at TT took the position that I should have printed the return before filing, and spotted this blank, and known HI DoTax wouldn't like it blank, and gone back in and found the question where they asked what to put in Line 23 and entered $4,400.

Am I nuts, or shouldn't somebody, anybody, at TT care about this and address it so that they don't leave Hawaii N-11 Line 23 blank, even if it doesn't matter? If so, how can I reach that person at TT, when the support people take the position that TT doesn't fill out your forms, the user does, so this can't possibly be a TT problem.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

We have not seen reports of this issue. The Hawaii N-11 instructions do not say to include a standard deduction amount if claiming itemized deductions.

The N-11 instructions for Line 24 say that line is "Line 20 minus line 22 or 23, whichever applies," suggesting Line 23 if unnecessary if you are claiming an amount on Line 22.

Otherwise such instructions will generally say something like "enter the larger of line X or line Y," implying there are amounts on both lines.

Instructions for Form N-11 Rev 2020

TurboTax does have a 100% Accurate Calculation Guarantee for both state and federal. If Hawaii penalizes you, can can file an accuracy guarantee claim.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

We have not seen reports of this issue. The Hawaii N-11 instructions do not say to include a standard deduction amount if claiming itemized deductions.

The N-11 instructions for Line 24 say that line is "Line 20 minus line 22 or 23, whichever applies," suggesting Line 23 if unnecessary if you are claiming an amount on Line 22.

Otherwise such instructions will generally say something like "enter the larger of line X or line Y," implying there are amounts on both lines.

Instructions for Form N-11 Rev 2020

TurboTax does have a 100% Accurate Calculation Guarantee for both state and federal. If Hawaii penalizes you, can can file an accuracy guarantee claim.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

Well, now you have seen a report of it. I spoke to Hawaii DoTax about the other problem, my problem, and before I got to my problem, the agent called up and started reading the letter they sent to get up to speed. The *first thing* she said upon reading it is that "We require Line 23 to be filled in even if you are using itemized deductions."

Would you like me to post a (redacted) scan of their "adjustment letter"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

Note that the instructions may "suggest" it's not necessary--and it isn't used to get to the bottom line if using itemized--but the form Line 23 says to "Enter ... $4,400 ...". It doesn't say to "Enter if..."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

Here's their "Adjustment letter". I do not know if they would have sent it if this was the only thing that made their system sad or if I only know about this Line 23 Adjustment because of my other much more significant and self-induced error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT didn't fill in HI N-11 line 23 despite having data to do so; state complained

@dw808 hey there, I just got this too as part of the return reason for my parents. Were you able to get this resolved?

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Landr42

Level 1

shanesnh

Level 3

afernandezcmu

New Member

valleynomad

Returning Member

in Education

sjbak

New Member