- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Tax exempt interest (muni bonds) state allocation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt interest (muni bonds) state allocation

I used the TurboTax interview mode and entered my brokerage information via the document ID and account number. When I ran Smart Check, I got errors and need to input " Tax exempt interest state allocation." Apparently, Turbotax did not fill in the individual muni bond information. Is this normal that it will not automatically fill?

Now do I have to list every bond/state or just put in my state of residence and then can lump all the other states together with XX?

thanks in advance for help and clarifications.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt interest (muni bonds) state allocation

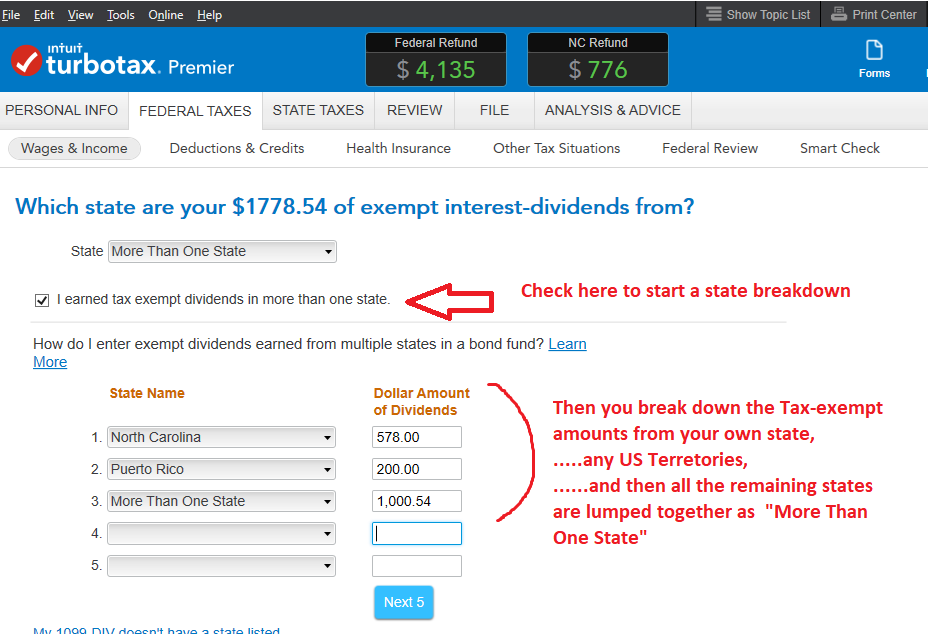

No, The imported files do not actually contain that detailed information....so you need to edit any 1099-INT forms with box 8$ in them, or any 1099-DIV with box 12 $$ on them.

When you edit them, if the $$ amount is small, you are allowed to just go to the bottom of the list of states and choose "More than one State', and that satisfies the situation (the Online software uses the term "Multiple States").

But if the amount is significant, you just break out your own state's $$ amount, and any US Territories (Puerto Rico, Guam, etc) and the remainder of the $$ is just pooled as "More than one State"

(But if you are a resident of CA, MN, those states have severe limitations on whether you are allowed to do the state-specific breakout for 1099-DIV $$ in box 12. IL doesn't allow a state-specific breakout for 1099-DIV forms at all)

See example below for an NC resident:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt interest (muni bonds) state allocation

That display is from the Forms Mode screen, during error check....certainly you might be able to change it properly in that screen, but you really have to know what you are doing (and I've been working with desktop for over 20 years)

TO get to my screen, navigate back to the 1099-INT entry area on the Federal Wages&Income area (it's in the Personal taxes tab if you are using H&B). Then Edit the 1099-INT involved, and go thru the follow-up questions after the main 1099-INT form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt interest (muni bonds) state allocation

No, The imported files do not actually contain that detailed information....so you need to edit any 1099-INT forms with box 8$ in them, or any 1099-DIV with box 12 $$ on them.

When you edit them, if the $$ amount is small, you are allowed to just go to the bottom of the list of states and choose "More than one State', and that satisfies the situation (the Online software uses the term "Multiple States").

But if the amount is significant, you just break out your own state's $$ amount, and any US Territories (Puerto Rico, Guam, etc) and the remainder of the $$ is just pooled as "More than one State"

(But if you are a resident of CA, MN, those states have severe limitations on whether you are allowed to do the state-specific breakout for 1099-DIV $$ in box 12. IL doesn't allow a state-specific breakout for 1099-DIV forms at all)

See example below for an NC resident:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt interest (muni bonds) state allocation

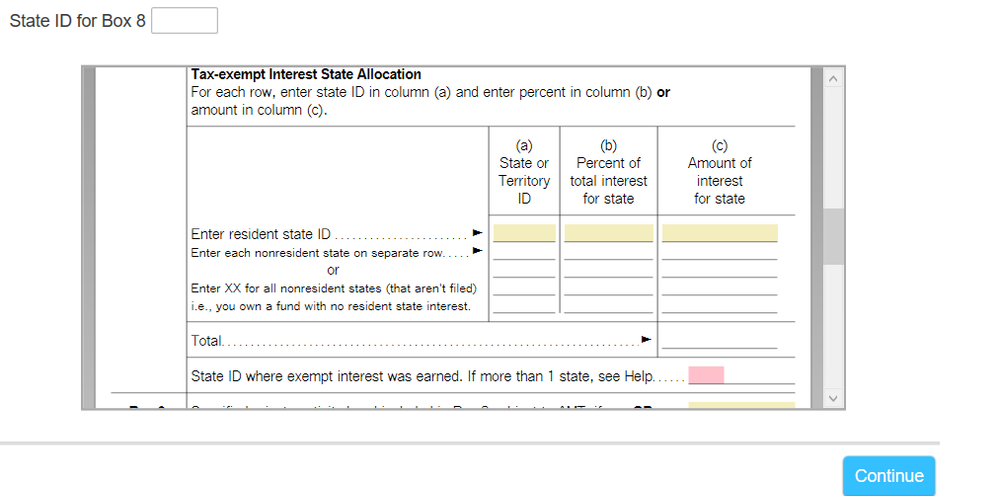

thanks for such a quick reply! The $ amounts are significant. Is there a quick way to get to the screen that you show above? It put me on this screen:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt interest (muni bonds) state allocation

That display is from the Forms Mode screen, during error check....certainly you might be able to change it properly in that screen, but you really have to know what you are doing (and I've been working with desktop for over 20 years)

TO get to my screen, navigate back to the 1099-INT entry area on the Federal Wages&Income area (it's in the Personal taxes tab if you are using H&B). Then Edit the 1099-INT involved, and go thru the follow-up questions after the main 1099-INT form.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DX77

New Member

MK3386

New Member

patamelia

Level 2

JR500

Level 3

akandelman

New Member