- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

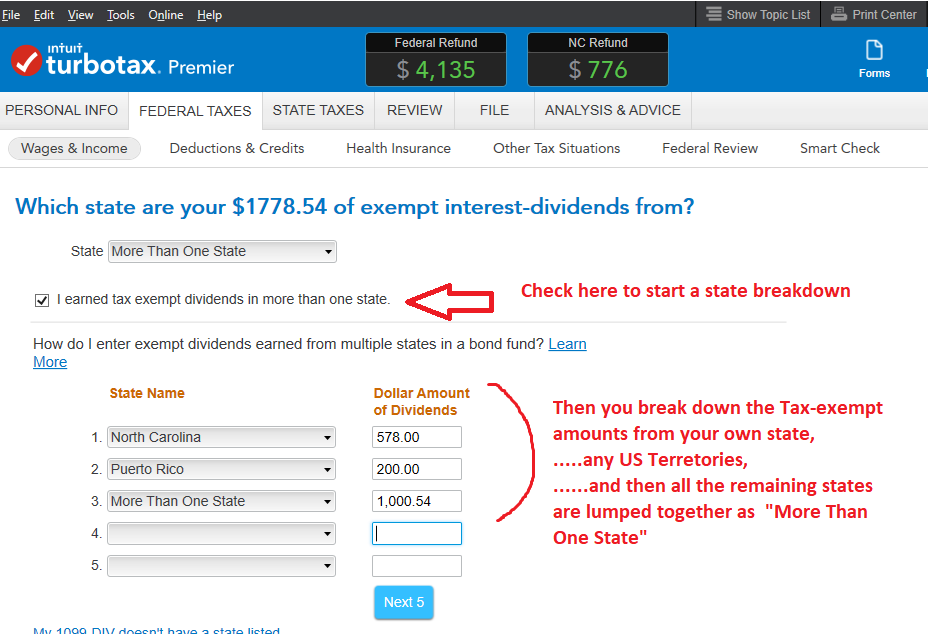

No, The imported files do not actually contain that detailed information....so you need to edit any 1099-INT forms with box 8$ in them, or any 1099-DIV with box 12 $$ on them.

When you edit them, if the $$ amount is small, you are allowed to just go to the bottom of the list of states and choose "More than one State', and that satisfies the situation (the Online software uses the term "Multiple States").

But if the amount is significant, you just break out your own state's $$ amount, and any US Territories (Puerto Rico, Guam, etc) and the remainder of the $$ is just pooled as "More than one State"

(But if you are a resident of CA, MN, those states have severe limitations on whether you are allowed to do the state-specific breakout for 1099-DIV $$ in box 12. IL doesn't allow a state-specific breakout for 1099-DIV forms at all)

See example below for an NC resident: