- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- State filing - Residency Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

I have SSN. My wife got ITIN just now. We filed jointly for 2019.

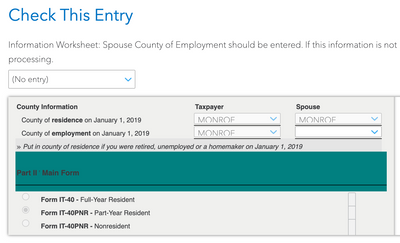

Now we started filing Indiana state return. It asks: "Your Indiana residency status". I lived in Indiana for the whole 2019 year but my wife arrived in USA for the first time in July 2019.

QUESTIONS:

1. Should I select "part-year resident"? Because I lived full year and my wife lived only 6 months in Indiana.

2. What about "County of Residence" on 1/1/2019? I know mine is MONROE county. But my wife wasn't even in USA on 1/1/2019. Should I select "No Entry" for her? When I do this, it says that my return can be delayed if I select "No Entry" for the county of residence and employment.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

Form IT-40PNR for Part-Year and Full-Year

Nonresidents

Use Form IT-40PNR if you (and/or your spouse, if married filing

jointly):

• Were Indiana residents for less than a full-year or not at all, or

• Are filing jointly and one was a full-year Indiana resident and the

other was not a full-year Indiana resident

residency status - non-resident

use 00 for her county

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

- Don't you think it should be part-year resident? I am not sure why you are suggesting "non-resident". I lived in Indiana for whole 2019 year and my wife lived starting 06/2019.

- Turbotax isn't allowing me to enter 00 for county for my wife. Also, I selected "No Entry" for resident county, it automatically changed it to MONROE. Screenshot attached.

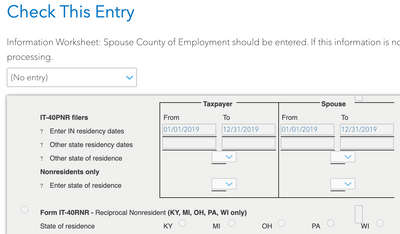

- Turbotax automatically changed the dates my wife lived in Indiana from "6/26/2019-12/31/2019" to "1/1/2019 - 12/31/2019".

Please help. @Anonymous

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

Please let me know as mentioned in my previous post.

Summary of questions asked in the previous post:

[1] Shouldn't it be part-year resident?

[2] Turbotax isn't allowing me to put 00 for my wife's residence county and employment county.

[3] Turbotax automatically changes the dates my wife lived in Indiana from "6/26/2019-12/31/2019" to "1/1/2019 - 12/31/2019".

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tstaley922

New Member

monica3000intx

New Member

Cryptonic_Sonic

New Member

user17694626826

New Member

Rtucker0925

New Member