- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Worked a Partial Year in NY State and NJ

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked a Partial Year in NY State and NJ

I worked the first half of 2019 in NYC and the second half of the year I worked from home in NJ. I imported/downloaded my W2 from ADP and TurboTax populated all of the related fields for my Federal, NJ State and NY State taxes. My W2 for NJ shows (Line 16) the amount of income I earned for that portion of the year that I worked in NJ. My W2 for NY (Line 16) shows what I earned for the entire year (Line 1) but there is an Earnings Summary in the upper right corner of my W2 (provided by ADP) that breaks down what should be the correct amount for Line 16. How do I adjust the NY State wages to reflect that I only worked there for half the year? Do I just manually change the amount in Line 16 to reflect what ADP calculated as my portion of wages for that period I worked or is there another field that I haven't found where I must enter what portion of the year I worked in NY?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked a Partial Year in NY State and NJ

You should enter your W-2 as it is in TurboTax. When you work through the New York program, you will be asked how much money you earned while working in New York.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked a Partial Year in NY State and NJ

Yes, I see that my NY State tax refund remains the same whether I enter the actual amount in line 16 or use the percentage option. What I don't understand is what the impact is to me NJ State Tax return. If I enter the actual amount on Line 16 in the NY State Tax return I receive a refund from NJ. But if I use the percentage I owe thousands of dollars to NJ. My NJ W-2 shows that I have paid NJ State taxes for the portion of wages earned while I worked in NJ. Using the percentage in the NY State Tax form aren't I being double taxed by NJ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked a Partial Year in NY State and NJ

Are you filing a Non-Resident return for the State of New York?

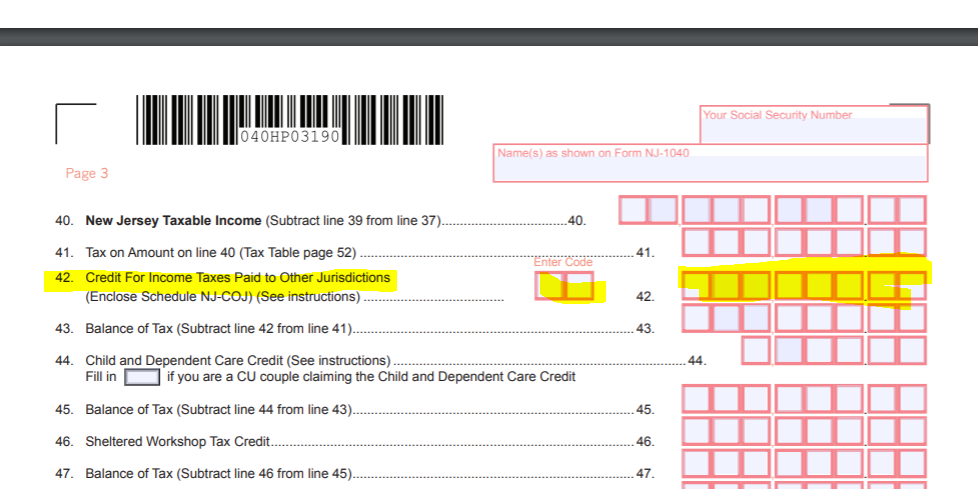

For you State of New Jersey State Tax Return, you are allowed a credit for the taxes that you pay the State of New York, this should reduce your tax burden. Is this showing up on your State of New Jersey Tax Return? Here is a link for the State of New Jersey Income Tax Instructions, see page 32 for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

douglasjia

Level 3

Questioner23

Level 1

lucasmyamurray

New Member

naewhitehead

New Member

phillips_lp

New Member