- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Turbo Tax is forcing me to register state taxes as non-resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

I'm originally from Wisconsin and have lived there for most of my life. My drivers license was issued there and my permanent address (parents house) is located there as well. I've lived abroad for the past 5 years, including this past tax year and have never had a problem filing as a Wisconsin resident. But now, turbo tax is forcing me to file as a non-resident even after listing Wisconsin as my state of residence in the personal info tab. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

At the beginning of the Wisconsin interview, did you see a screen with the heading "Did you make money in Wisconsin in 2019, but never live there"?

Yes, I know you apparently didn't make money in Wisconsin in 2019, but go ahead and click "No".

The next screen should ask you what your state of residence was (and for your spouse, too, if one). Indicate Wisconsin.

Then continue and give your county and school information and so on. TurboTax should now be putting your information on Form 1 (resident) and not on Form 1NPR (nonresident and part-year resident).

You can check this in the CD/download software by going into Forms mode and scrolling down to the Wisconsin return to see what the main Wisconsin form is.

In the Online product, you can see only a summary of the state return. Click on Tax Tools on the left, then click on Tools underneath it, then click on View Tax Summary in the center - note, do this why you are in the Wisconsin interview, so TurboTax knows that you want to see the state summary, not the federal return.

If the first line in the summary is "Wages, salaries, tips, etc. (see page 15)", then you have the nonresident/part-year return (which you don't want).

If, however, the first line is "Federal adjusted gross income (see page 12) ." then you are using Form 1, which is the resident return.

Compare the two forms by going to this Wisconsin webpage.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

Hi Bill,

I followed your advice. I made sure to select no on "did you make any money in Wisconsin but didn't live there" and indicated that I was a resident of Wisconsin. Also, the first line of my summary is page 12 "federal adjusted gross income" which means I'm using the correct form.

But I still can't file because every time I do, I'm asked to review a part of my state taxes. And on this page, there is a box checked which says "was a non resident of Wisconsin for all 2019" and it asks me to either put the state or country I was in instead.

The software might be doing this because I initially filled out my info as a non-resident before realizing my mistake. But even after going back and fixing my residency status to Wisconsin resident, it still has me checked as a non-resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

Yes, TurboTax is picking up part of an earlier entry. To save frustration, Delete the Wisconsin state tax return from the summary page and Add it back.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

That worked. Thank you to you both!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

Please explain what you mean by "summary page" ie, please be more specific about where in TT (not TT on line) I can find the page to delete a state return, and then how do I go about adding it back? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

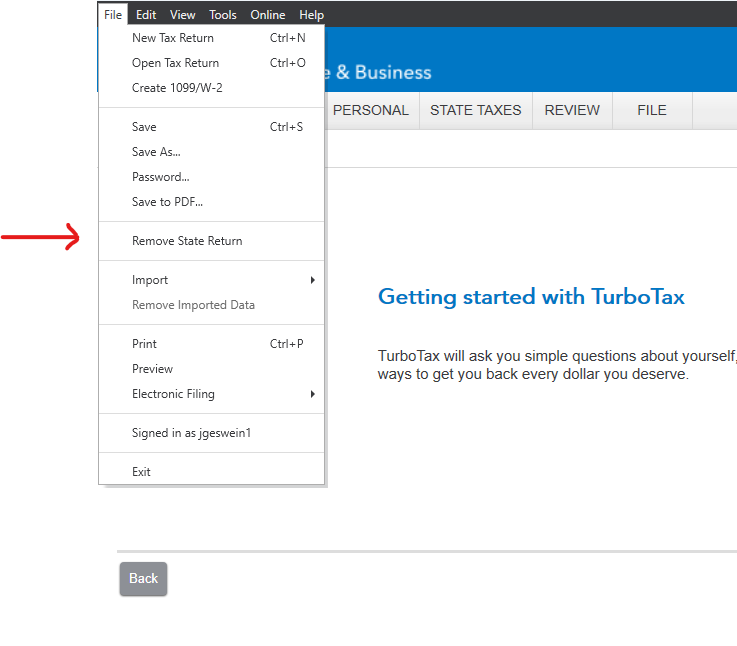

In TurboTax Desktop, remove a state tax return by selecting Remove state return under File in the upper left hand corner of the screen.

Add a state tax return by:

- Selecting State Taxes across the top of the screen.

- Click Continue.

- Click Get another state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

Will removing the state and adding back cause me to lose all of my entries and have to start over on the state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is forcing me to register state taxes as non-resident

You will have to re-enter your answers to some of the more state-specific questions. A lot of your information carries forward from your federal income tax return Information that you input in the beginning, like your W-2,1099's, investment information and personal information. You will not have to reanswer any of those questions.

If you don't see the option to delete your state (you might see "Edit"), you've already paid your TurboTax fees (including the state fee) or registered your free version while the state was on your return. If you've done either of these things, you will not be able to delete your state return.

Click here for "How Do I Delete my State Tax Return?"

Click Here for "How Do I Clear My State Return?"

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

balld386

New Member

sburner

New Member

ronni3sand36

New Member

bofaur

Returning Member

spanglerc

New Member