- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: State Return Ca

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Return Ca

I have a message that my Federal Tax return was accepted in February. I already have that done. But I cannot find any acceptance by Ca State. I thought I filed at the same time on line. When I call the tax board there is no information on a return for me.

Can I file the Ca return again? I don't see how to file it without filing Federal.

Screen shots would be helpful.

Terry

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Return Ca

If the Franchise Tax Board has no record of your return, you probably never finished filing your state return.

If you used TurboTax Online, you can log into your account to see the status of your returns. It should say accepted for California if you successfully filed. TurboTax should also have sent you an email (and text message, if you opted in), saying your returns were transmitted.

If you used TurboTax CD/Download:

- Open the File menu

- Select Check E-file status

- Or, go to the File tab and select the Check E-file Status header

For a video see: How do I check my e-file status?

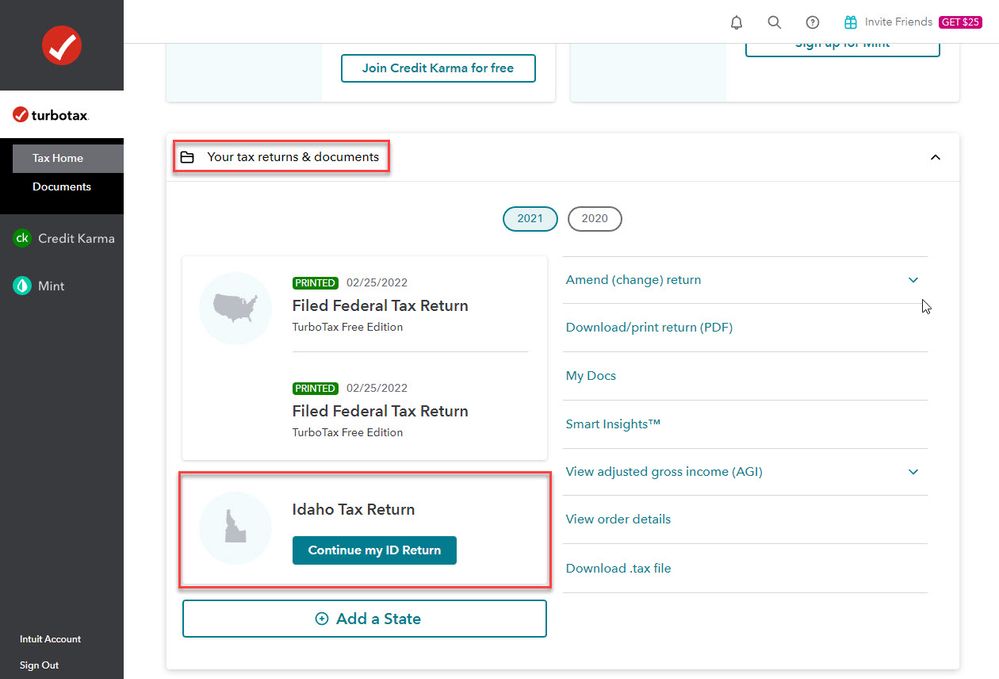

If your federal was accepted, you should be able to e-file state by going back into TurboTax. For TurboTax Online, scroll down to Your tax returns & documents on the landing page and select Continue my CA Return. If you have problems, you can print and mail.

If you are using CD/Desktop, open the programme. Tap the State tab and continue through the filing process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Return Ca

Yes you can try Efiling CA again. It if already was filed it will just reject so no problem.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

connorcnb

New Member

stephaniecol0830

New Member

rouxanton002

New Member

shanter13

New Member

griego-smiley

New Member