- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Remote work live in NJ work for company in NB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

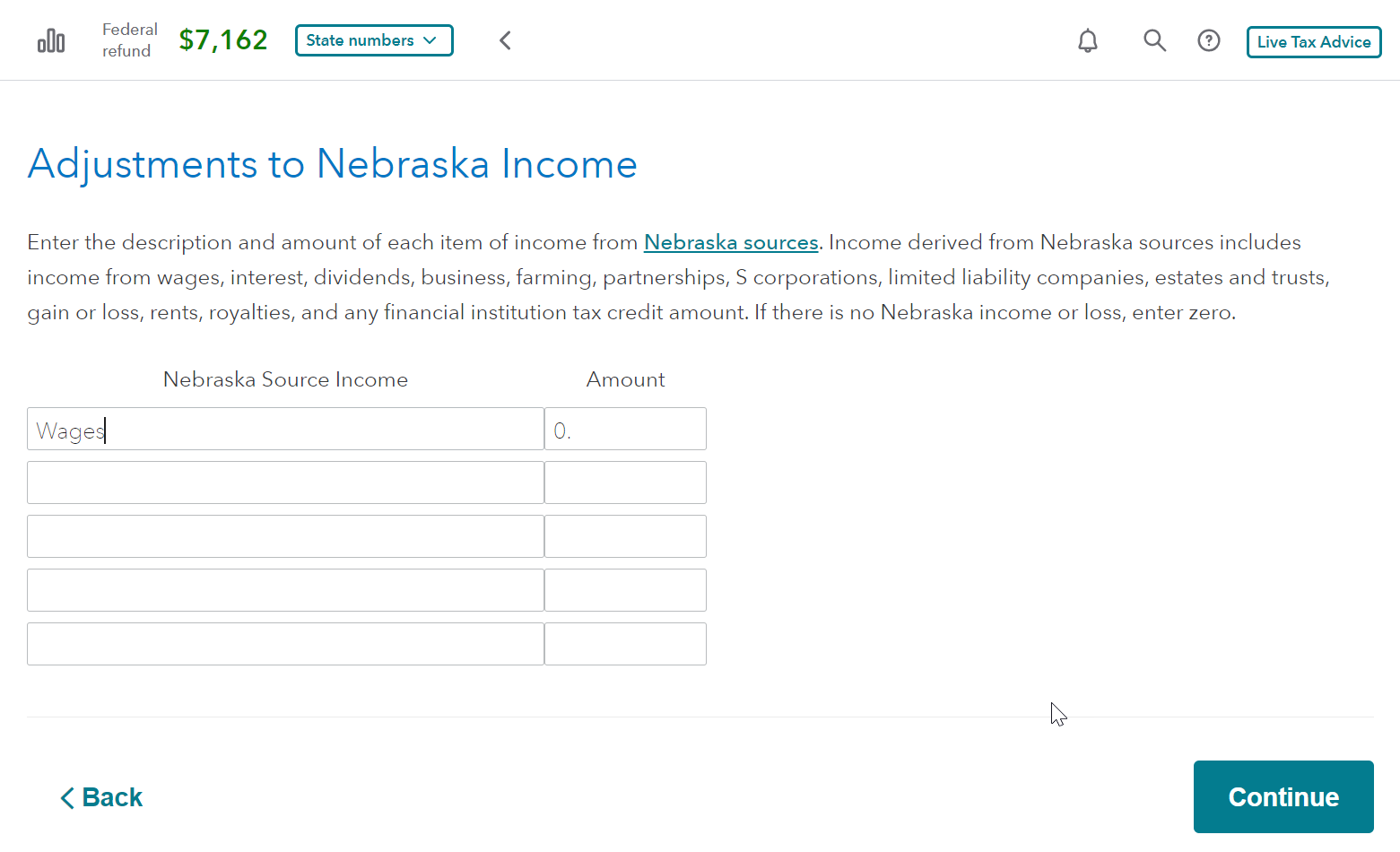

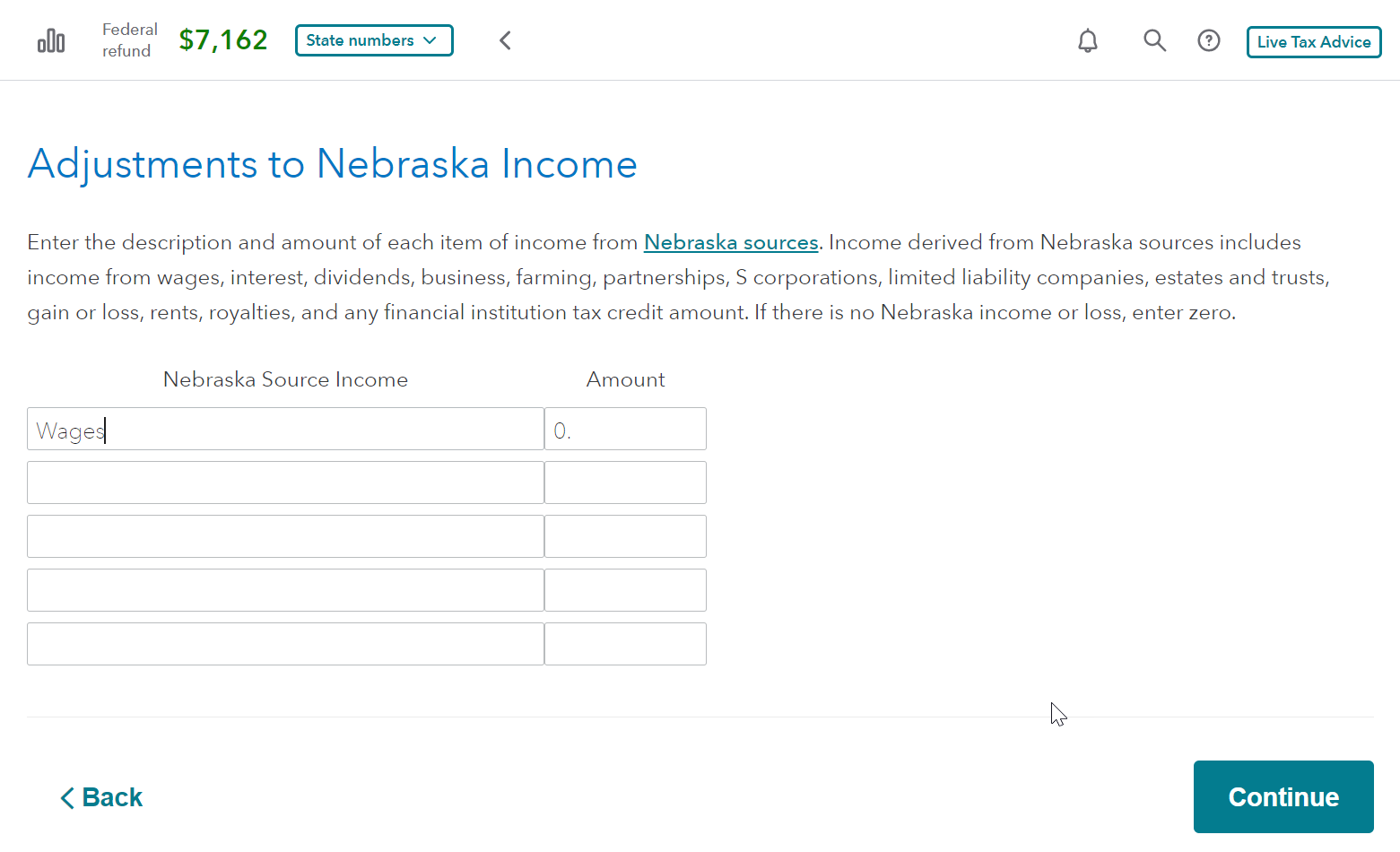

I work remotely from my home in New Jersey, but the company I work for is in Nebraska. I started filling out a non-residental State tax return for Nebraska. The thing I'm confused by is do I need to enter my wages on the Adjustments to Nebraska income screen? If I enter the wages that are listed on my W2 I end up owing NB a significant amount of money.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

Nebraska does not tax remote workers. You should not file a nonresident Nebraska tax return if your employer did not withhold NE income tax.

If your employer did withhold NE income tax, file a nonresident tax return to claim a refund on the entire amount withheld. On the Nebraska return, change your wages to $0 on the screen “Adjustments to Nebraska Income.

Your refund should equal NE withholding.

Consider filing by mail. Attach a statement explaining that your employer withheld NE tax by mistake and that you are filing to claim a return. We suggest using certified mail with proof of delivery.

File Form W-4N to claim an exemption from withholding by writing “Exempt” in Box 3.

“Every payor who is paying for personal services performed or to be performed substantially in Nebraska must deduct and withhold income tax if the payments are to a nonresident individual who is not subject to withholding on the payment under the I.R.C., or to a corporation, partnership, or limited liability company (LLC) described Reg-21-001.04C through 001.04C(5).”

REG-21-001 Requirement to Withhold Nebraska Income Tax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

on my w2 I have state income tax in box 17 but the state says NJ.

so does this mean I don’t need to file a State return for NE?

I already purchased one

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

Yes. You don’t need to file a Nebraska return if you have no Nebraska tax withheld. Your employer correctly withheld New Jersey. All you need to file is a NJ full-year resident return.

Contact TurboTax support to ask for a refund for the Nebraska program.

What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

Nebraska does not tax remote workers. You should not file a nonresident Nebraska tax return if your employer did not withhold NE income tax.

If your employer did withhold NE income tax, file a nonresident tax return to claim a refund on the entire amount withheld. On the Nebraska return, change your wages to $0 on the screen “Adjustments to Nebraska Income.

Your refund should equal NE withholding.

Consider filing by mail. Attach a statement explaining that your employer withheld NE tax by mistake and that you are filing to claim a return. We suggest using certified mail with proof of delivery.

File Form W-4N to claim an exemption from withholding by writing “Exempt” in Box 3.

“Every payor who is paying for personal services performed or to be performed substantially in Nebraska must deduct and withhold income tax if the payments are to a nonresident individual who is not subject to withholding on the payment under the I.R.C., or to a corporation, partnership, or limited liability company (LLC) described Reg-21-001.04C through 001.04C(5).”

REG-21-001 Requirement to Withhold Nebraska Income Tax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

on my w2 I have state income tax in box 17 but the state says NJ.

so does this mean I don’t need to file a State return for NE?

I already purchased one

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote work live in NJ work for company in NB

Yes. You don’t need to file a Nebraska return if you have no Nebraska tax withheld. Your employer correctly withheld New Jersey. All you need to file is a NJ full-year resident return.

Contact TurboTax support to ask for a refund for the Nebraska program.

What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tami_454

New Member

evilnachos123

New Member

Megnrust

New Member

ashley-evans2460

New Member

sabrina-i-mercado

New Member