- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Nebraska does not tax remote workers. You should not file a nonresident Nebraska tax return if your employer did not withhold NE income tax.

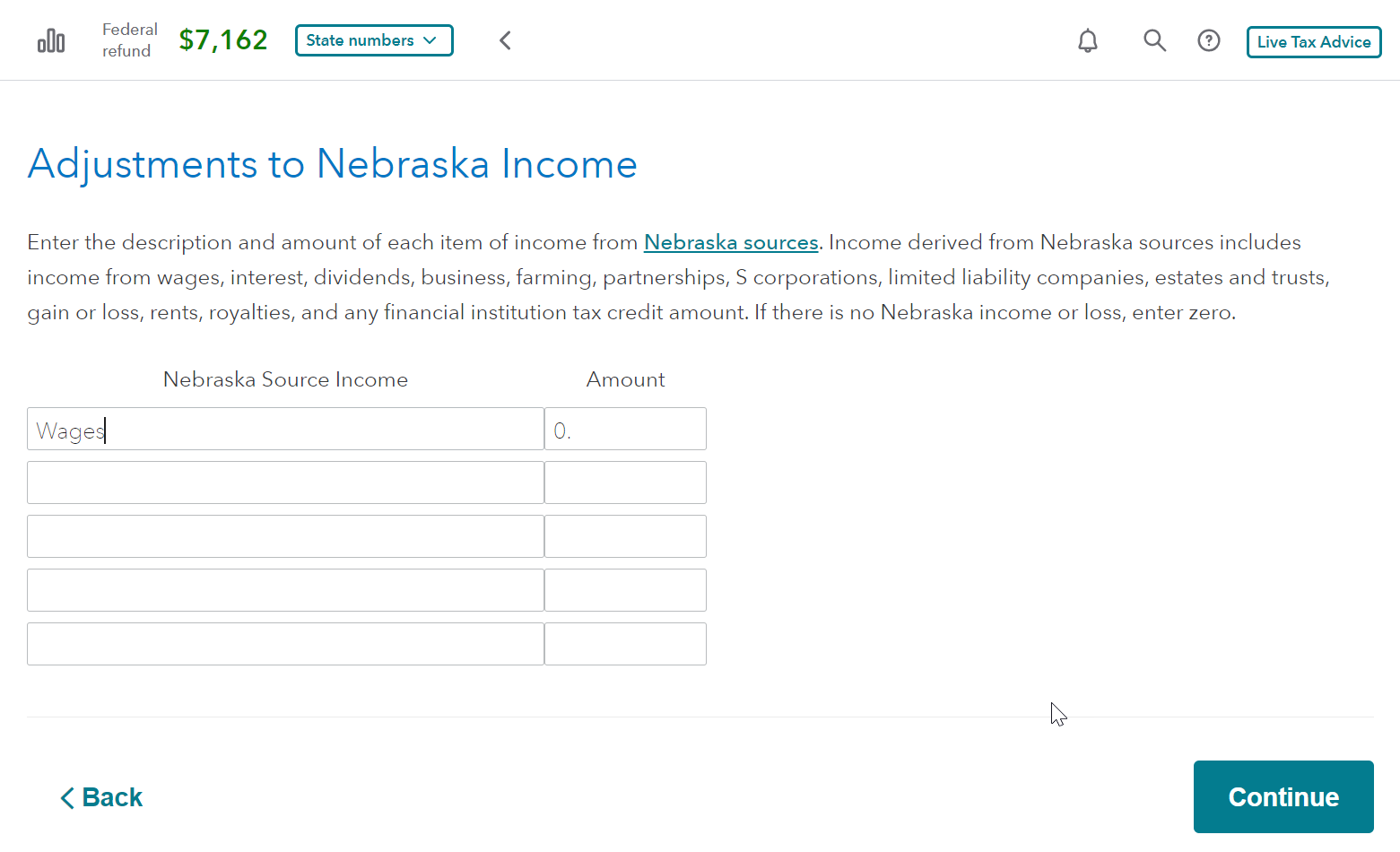

If your employer did withhold NE income tax, file a nonresident tax return to claim a refund on the entire amount withheld. On the Nebraska return, change your wages to $0 on the screen “Adjustments to Nebraska Income.

Your refund should equal NE withholding.

Consider filing by mail. Attach a statement explaining that your employer withheld NE tax by mistake and that you are filing to claim a return. We suggest using certified mail with proof of delivery.

File Form W-4N to claim an exemption from withholding by writing “Exempt” in Box 3.

“Every payor who is paying for personal services performed or to be performed substantially in Nebraska must deduct and withhold income tax if the payments are to a nonresident individual who is not subject to withholding on the payment under the I.R.C., or to a corporation, partnership, or limited liability company (LLC) described Reg-21-001.04C through 001.04C(5).”

REG-21-001 Requirement to Withhold Nebraska Income Tax

**Mark the post that answers your question by clicking on "Mark as Best Answer"