- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Problem With Box 12 Code S

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

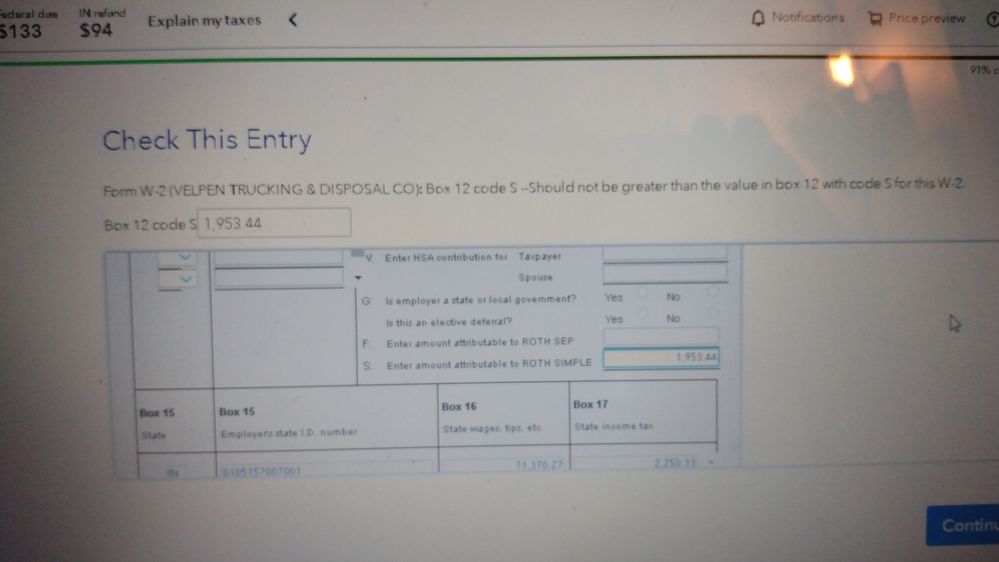

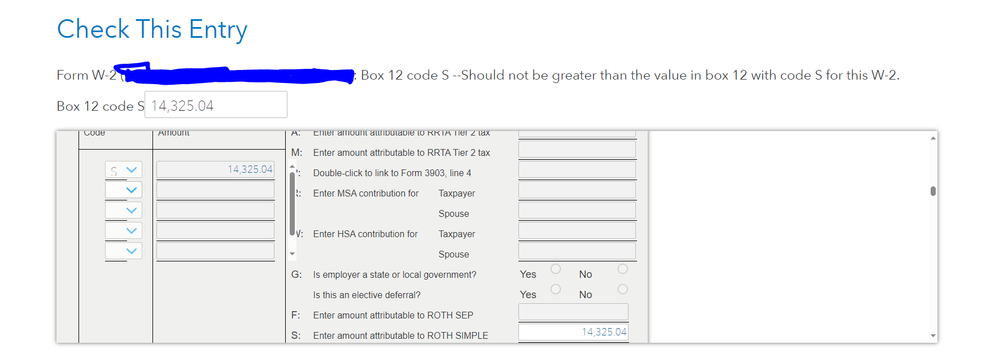

I'm nearly done filing my return, but TT keeps insisting that something is wrong with my W2 entries, specifically Box 12 Code S. I keep getting the message "box 12 code s should not be greater than the value in box 12 with code s for this W2". I have checked and rechecked in the amount I have entered is exactly as it is on the W-2. Please tell me what I'm doing wrong. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

I don't understand the error message, which is something like "a black cat is a cat that's black".

No matter, when I run my test return with similar data, I got in the Review the following:

"Form W-2 (employer name): Box 12 code - We are updating how Traditional SEP and Roth SEP are reported on the tax return based on new guidance from the IRS. Please check back with us after February 7th."

Now, this was triggered by a Notice from the IRS issued on January 8th of this year which updated(changed) a lot of rules on how things like SIMPLE plans were to be reported. As you can imagine, Development teams have been busy making updates and testing them.

I have seen other messages related to this issue, but this is the first time I have seen this particular message. Let me say that I believe that today that there was and update on this issue, and it may have affected something else. I will report this, but quite possibly, it will be fixed by the 7th.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

yes, there is a problem caused by code S. The IRS updated the rules for a Simple plan early in 2024. Turbotax and other return preparers are analyzing the new law to see how it affects returns. There is nothing you can do until they complete this and update the app if needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Please provide specific instructions on what to do. For example:

If you get an error because of Box 12 on your W2 using an S code. because the IRS recently issued changes and we(TT) are updating the program, you cannot file your return today. Please save and close the return and then check back and try to efile your return on February 7. If we are still not able to file your return on that date a new date and instructions will be provided. TT appreciates your understanding our commitment to file your return correctly with the latest changes from the IRS only have we have fully researched those changes and updated our programs.

Please advise,

Verna Murdock

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

I have read here and online that the problem with Box 12 and specifically for SIMPLE IRA will be fixed by Feb. 7. I just checked yet again and still nothing. Your inability to inform your customers of the status of your programming is inexcusable. My taxes have been ready to file for more thank a week and I have to wait on you? I may just spring for another program and ditch TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

I am so fed up with this error. It was supposed to be resolved yesterday but still nothing. Is there any update on when the program will be updated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Try closing TurboTax, clear your Cache and Cookies if you are using TurboTax Online, and reopen TurboTax. You can also try a different browser.

Also, make sure you have ran all updates.

If you are using TurboTax Desktop, check for updates under the Online Tab.

[edited 2.9.24 | 11:39am]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Incorrect. Still not working.

I've cleared cookies and cache, deleted/re-input W-2 still having the same error.

I'm using TurboTax Online Deluxe so I don't think that I can force Updates.

Again, if I change my contribution to xxxx.00 (round down from xxxx.04) it accepts but then the Box 1 number would be off and SHOULD catch that. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

If you are still getting an error, it would be helpful to have a TurboTax ".tax2023" file that is experiencing this issue.You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

Here are the instructions if you are using TurboTax CD/Download:

- Click on Online in the top left menu of TurboTax CD/Download for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number then place in this issue.

- We can then review your exact scenario for a solution.

- Please also tell us any states included in the return.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Thanks.

Token: 1176484

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Token Number - 1176485

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

This is not a recommendation, but users on Reddit have been getting through by removing numbers to the right of the decimal. This concerns me because, if true, the problem is more likely a technical problem and not an IRS one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Right. That was the first thing I tried, rounding down. However if you do that, the calculation of Box1 would not be correct and SHOULD get flagged… I don’t want to submit it to the IRS and risk rejection or audit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Still no update on this.......

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem With Box 12 Code S

Token# 1178422

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michaelbarry06

Returning Member

michaelbarry06

Returning Member

LRS-Utah

New Member

cgershen

New Member

craighorrell

New Member