- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: partial resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

partial resident

Moved out of the US in April, when filing my state tax. What are procedures so I don't get penalized for not having insurance for the rest of the year?

Please advise on what to do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

partial resident

You will need to file a Part Year resident return. This will allow you to select the dates you lived in the state so you won't be penalized for the time you did not live in the state.

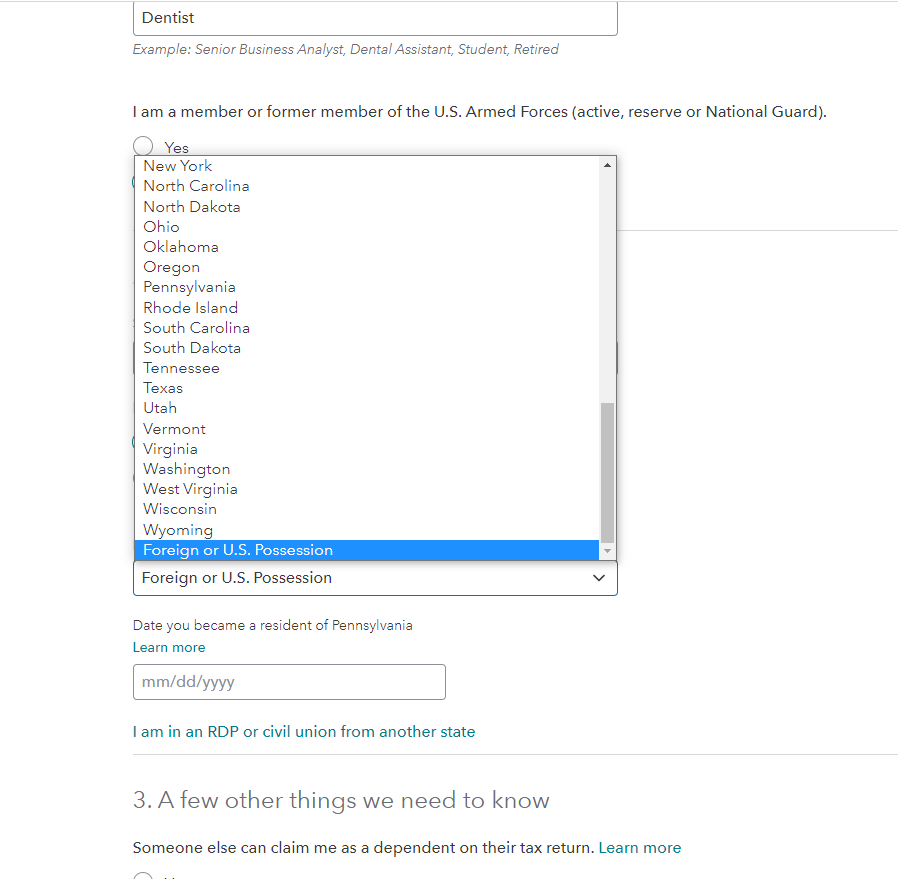

To trigger the state Part-Year form, you just need to go back to the Personal Info section, then say yes to I lived in another state in 2021 and select Foreign or US Possession.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

partial resident

thank you.

Would this be the same thing for the federal part?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

partial resident

I see it's made in the my info section.

thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dominibopula

New Member

test5831

Returning Member

aashish98432

Returning Member

MummyatLilliput

New Member

dennison-jenna

New Member