- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You will need to file a Part Year resident return. This will allow you to select the dates you lived in the state so you won't be penalized for the time you did not live in the state.

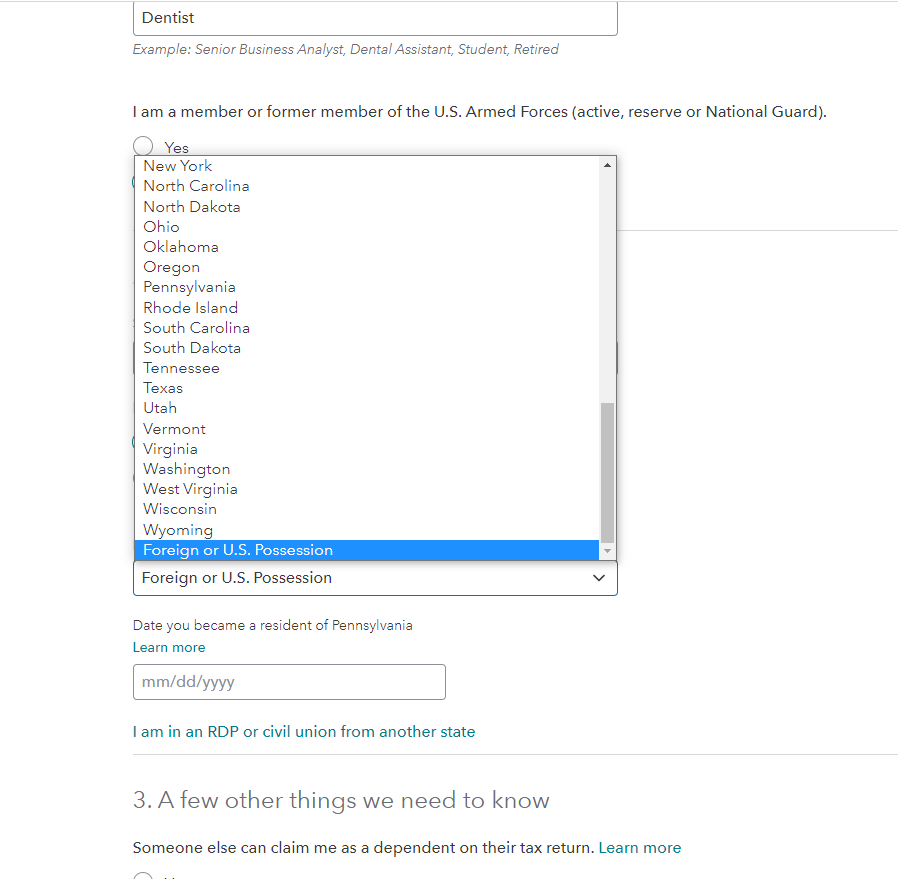

To trigger the state Part-Year form, you just need to go back to the Personal Info section, then say yes to I lived in another state in 2021 and select Foreign or US Possession.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 18, 2022

9:05 AM