- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: NJ Part year resident and part year non-resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ Part year resident and part year non-resident

Hi, i & spouse (MFJ) were residents of NJ from Jan to Mar 31st. We moved to WA in April, with wife moving to WA employer immediately. I worked for NJ employer from Apr 1 to June 30th. And then moved to WA employer.

It looks like i have to file NJ part year resident and non-resident. And that this has to be a paper filing for NJ, which i can print out from TT. Please confirm the above.

Now when i use TT for calculating NJ part year resident, it is using the apportioned income for months of Jan to March to estimate the liability accurately. But, when i calculate non-resident income for NJ, TT is using the incorrect amount of total income of W2. And it is not giving me the flexibility to correct it.

More details : This is the screen in adjustments of NJ state return, where the question is "Tell us your income while living in NJ. Total income on W-2 is xxxx." (This amount is incorrect.) . Then it calculates the total income while living outside NJ. This amount is again incorrect, with no flexibility to change. Please clarify.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ Part year resident and part year non-resident

To phrase differently, how is the NJ non resident all income everywhere calculated?

Is it all income (all states) from April onwards? Or only all income for months April & May? Or something different?

I am not able to reconcile TT all income with my W2s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ Part year resident and part year non-resident

First the order of preparing the different state returns is important for allocating the income correct. Washington State does not have income tax so you only need to file NJ Part year return and NJ Non-Resident return.

NJ all income is while part year resident and non resident.

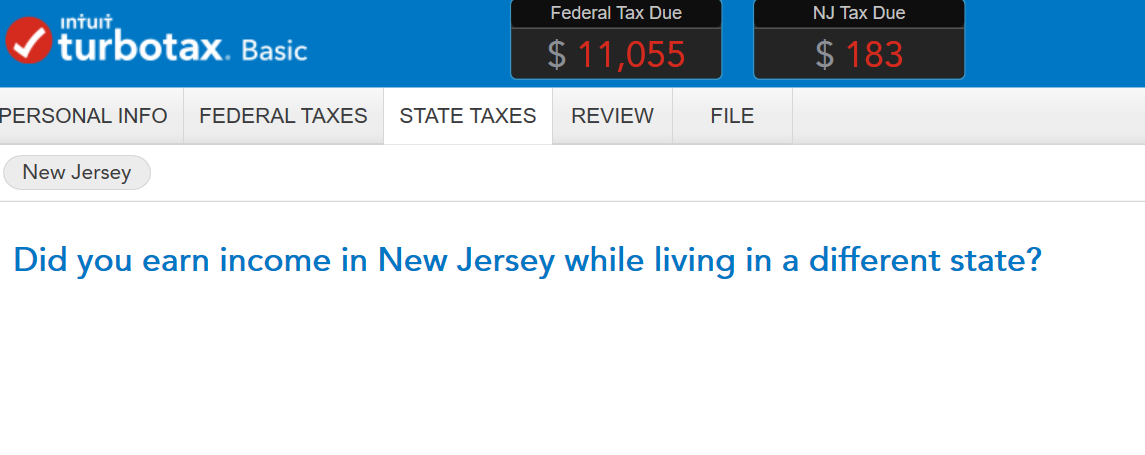

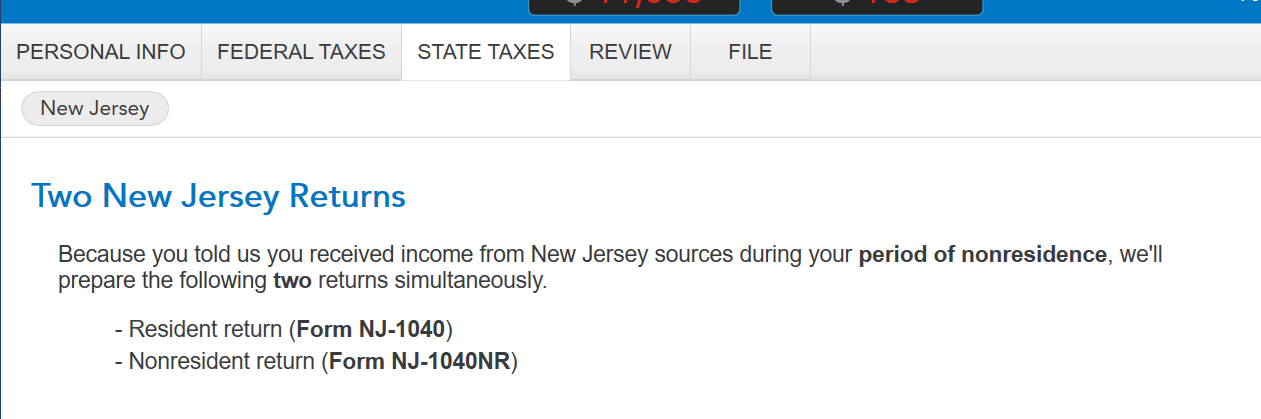

TurboTax will do both returns if you answer the questions accurately. See two screen shots below that will generate the NJ-1040-Nonresident

Answer Yes

Continue to follow the prompts then the Non-resident will generate for you

If you were a resident for part of the year, you were a nonresident for the remainder of that year. File part-year resident and/or nonresident returns as follows:

• You must file both a part-year resident return and a part-year nonresident return if:

- Your gross income from all sources (both in-state and out-of-state) for the entire year was more than the filing threshold amount (see chart on page 3);

- You received income (whether from New Jersey sources or not) during the part of the year you were a resident; and You received any amount of income from New Jersey sources during the part of the year you were a nonresident.

• File a part-year resident return if: You received income during the part of the year you were a resident; and Your income for the entire year is over the filing threshold (see chart).

• File a part-year nonresident return if:

- You received income from New Jersey during the part of the year you were a nonresident; and

- Your income for the entire year is over the filing threshold (see chart).

NJ Part-Year and Non-Resident Returns

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Propeller2127

New Member

Kh52

Level 2

flyday2022

Level 2

balld386

New Member

Liangtwn

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill