- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

First the order of preparing the different state returns is important for allocating the income correct. Washington State does not have income tax so you only need to file NJ Part year return and NJ Non-Resident return.

NJ all income is while part year resident and non resident.

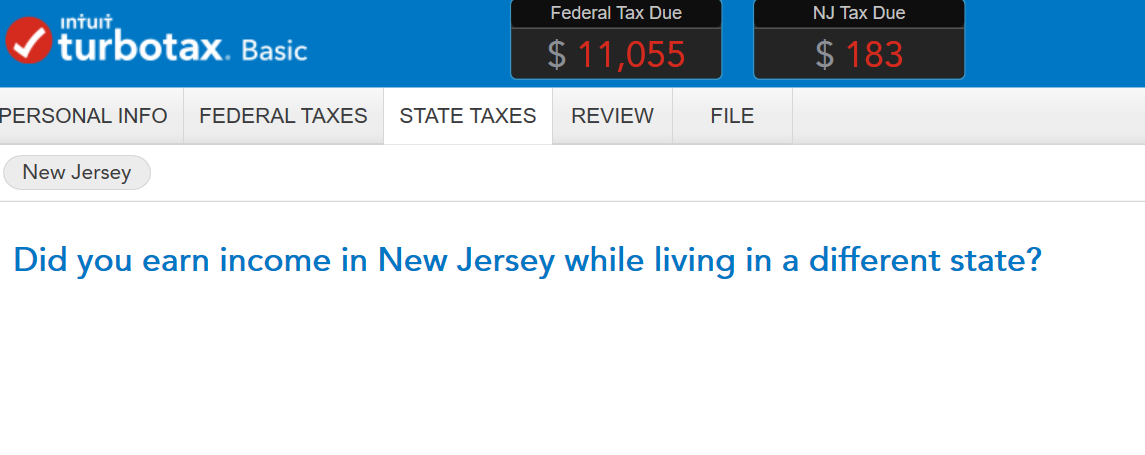

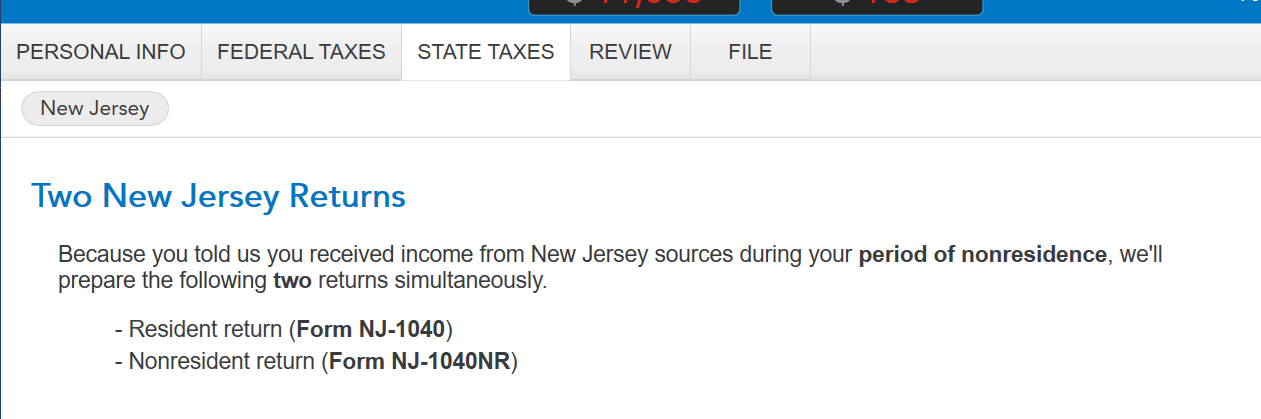

TurboTax will do both returns if you answer the questions accurately. See two screen shots below that will generate the NJ-1040-Nonresident

Answer Yes

Continue to follow the prompts then the Non-resident will generate for you

If you were a resident for part of the year, you were a nonresident for the remainder of that year. File part-year resident and/or nonresident returns as follows:

• You must file both a part-year resident return and a part-year nonresident return if:

- Your gross income from all sources (both in-state and out-of-state) for the entire year was more than the filing threshold amount (see chart on page 3);

- You received income (whether from New Jersey sources or not) during the part of the year you were a resident; and You received any amount of income from New Jersey sources during the part of the year you were a nonresident.

• File a part-year resident return if: You received income during the part of the year you were a resident; and Your income for the entire year is over the filing threshold (see chart).

• File a part-year nonresident return if:

- You received income from New Jersey during the part of the year you were a nonresident; and

- Your income for the entire year is over the filing threshold (see chart).

NJ Part-Year and Non-Resident Returns

**Mark the post that answers your question by clicking on "Mark as Best Answer"