- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: New York 529, turbotax blanks "federal"and "new york source portion"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York 529, turbotax blanks "federal"and "new york source portion"

for new york 529 contributions, there are two blanks "federal"and "new york source portion", I contributed 10000, how to fill? thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York 529, turbotax blanks "federal"and "new york source portion"

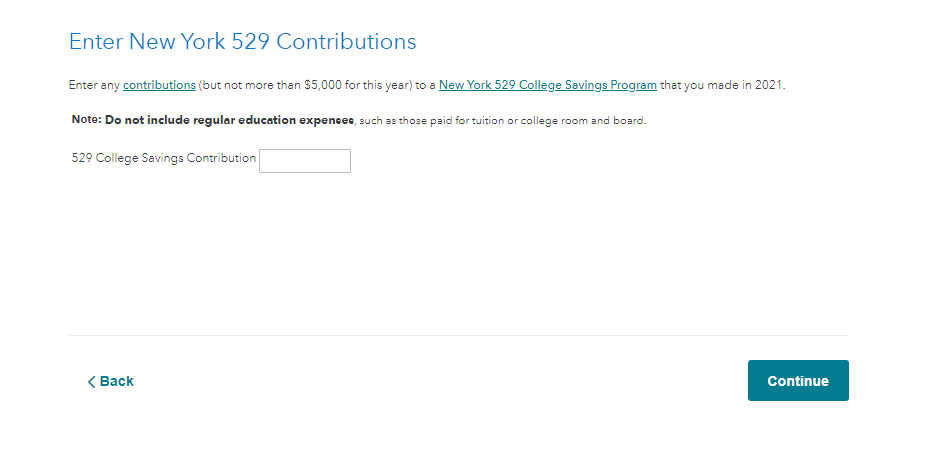

As you are completing your New York State return, you will get to a page titled Changes to Federal Income. Under Education Adjustments, click Start next to New York college savings account activity. On the next page, you can enter the 529 contributions paid. I have attached a screenshot below for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York 529, turbotax blanks "federal"and "new york source portion"

Thanks for your reply!

Maybe I did not describe my issue clearly.

I lived in New York City from Jan-Jun 2021, and worked for a company A in New York. W2 salary from company A is 40,000. and I have a capital gain10,000.

Then I moved to Wisconsin and live from Jul-Dec 2021, and worked for a company B in Wisconsin. W2 salary from company B is 60,000.

I contributed New York 529 in April 2021 (10,000 dollars)

How shall I fill the two blanks below?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York 529, turbotax blanks "federal"and "new york source portion"

You are correct. The fields should read $10,000 for federal and $10,000 for the New York sourced portion. As per the IT-225 instructions, the amount allocated to New York is any such contribution(s) made while a resident of New York State. Since you contributed the amount in April of 2021, while you were a resident of New York, the amount is New York sourced.

@zhoudun73

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarmis

New Member

abuzooz-zee87

New Member

noodles8843

New Member

qmanivan

New Member

4md

New Member