- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Need help filing NC tax returns of a non-resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help filing NC tax returns of a non-resident

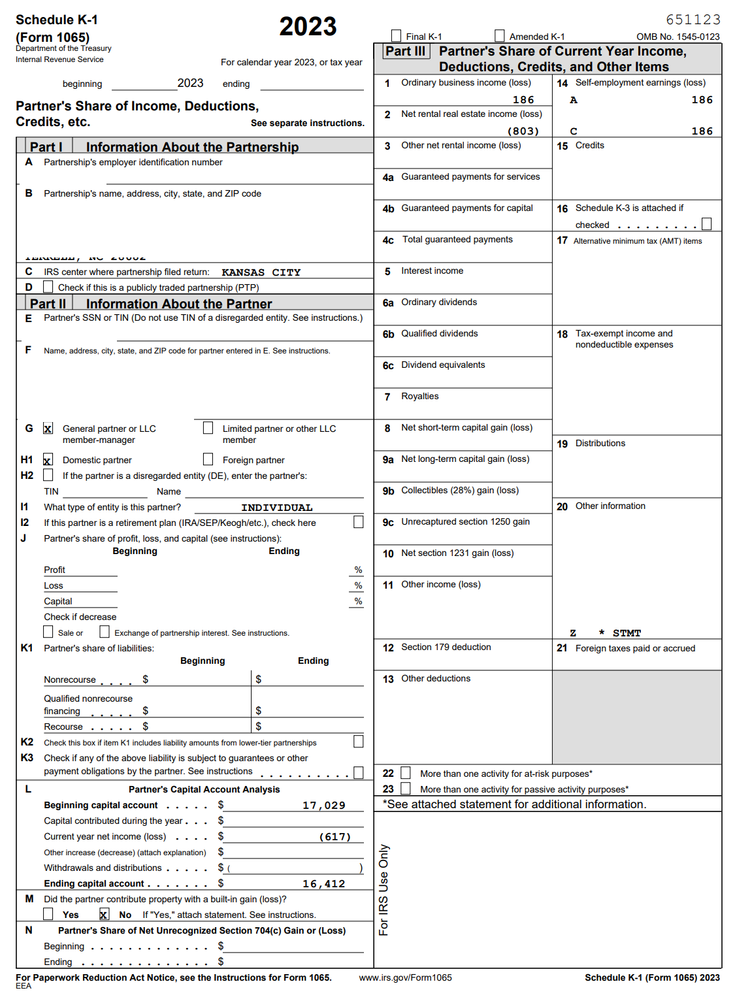

I reside in WA state, but I have a rental property in NC purchased through a LLC a year ago. I'm using Turbox Premier desktop version for filing my federal and NC State taxes and TurboTax showing few years for NC state filing. Appreciate if someone can throw inputs on this error.

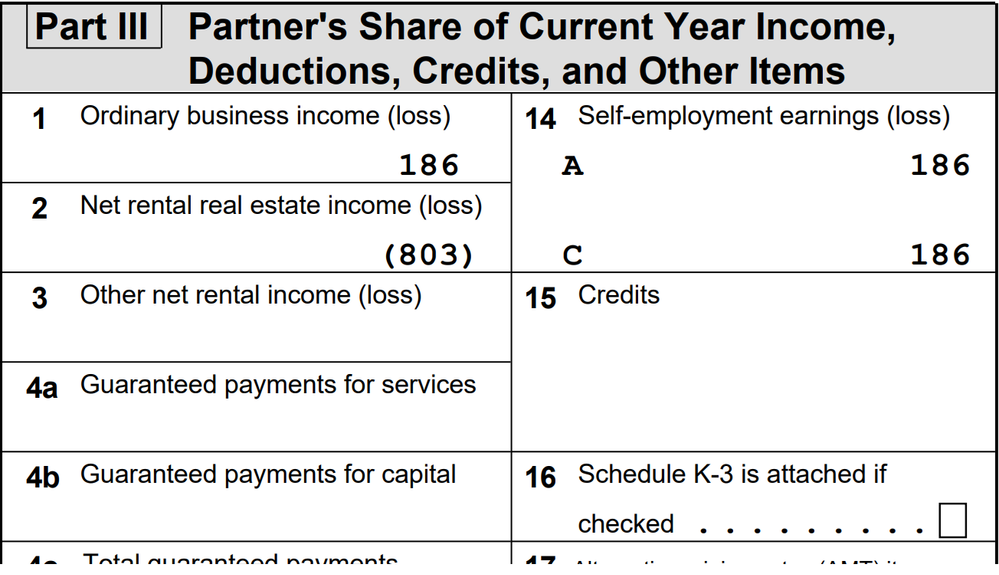

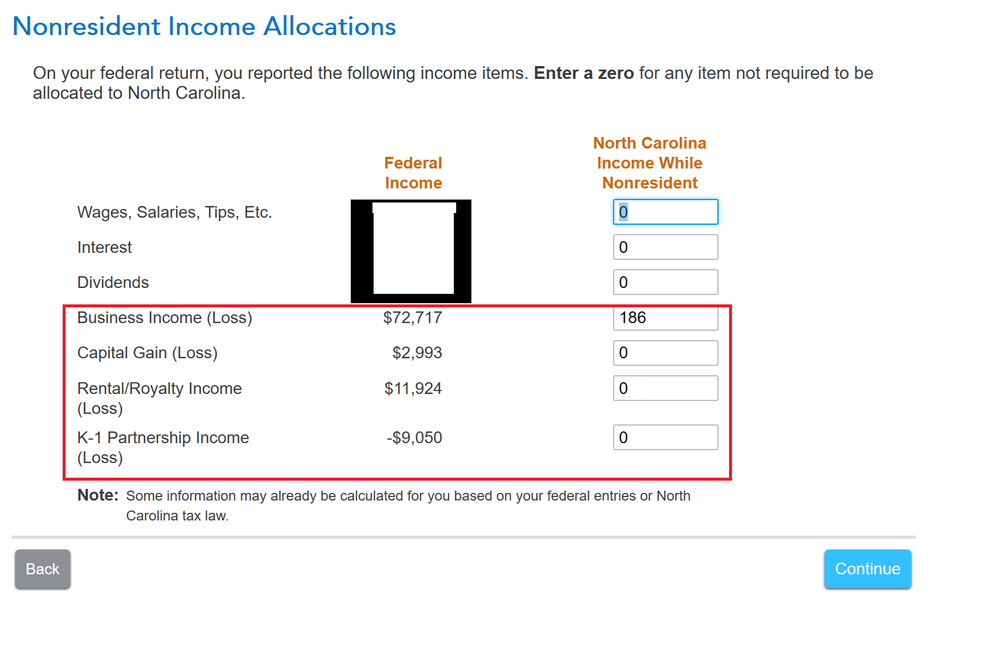

In the state tax section, What would be value for the business Income & Capital gain? Adding my K-1 values portions for reference to get help here. Should I enter Ordinary business Income here? Or the Net income loss here? Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help filing NC tax returns of a non-resident

If the image you posted contains all the entries for Schedule K-1 Boxes 1 through 20, then you have no capital gain/loss. You have Ordinary Income and Net Rental Real Estate Loss.

If the total federal Business Income is generated by a Schedule C business outside NC, you would not enter the K-1 amount in that box for NC. Likewise for the rental income -- if you recognize that the federal total does not include the amount from the K-1.

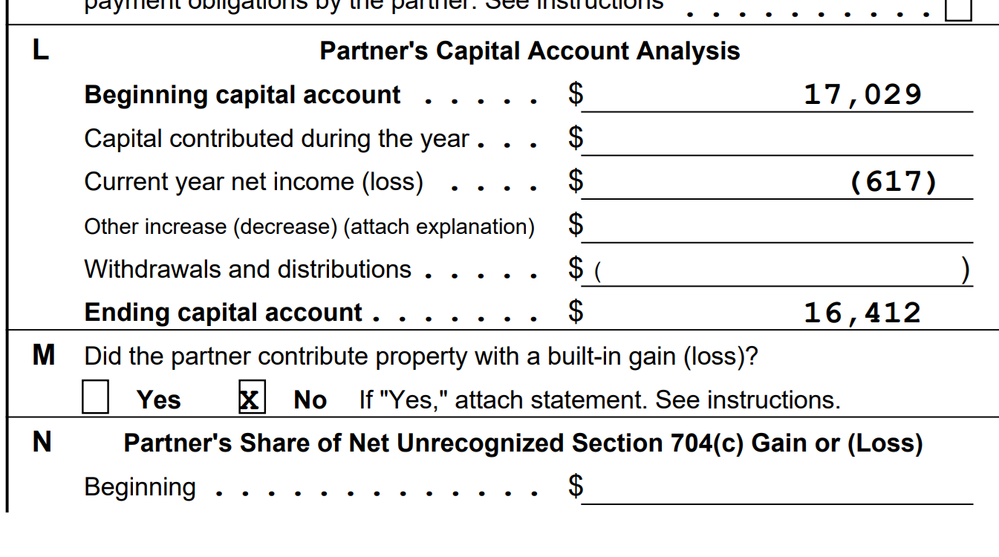

Instead, add Box 1 and Box 2 then enter the result in the K-1 Partnership Income in the NC column. This should be the amount shown in Section L as Current Year Net Income (Loss).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help filing NC tax returns of a non-resident

Thank you very much for your reply. Attaching my complete K-1 that was generated for NC LLC company by removing sensitive personal information.

From what I understand, I need to fill K-1 partnership amount of (617) for NC state tax filing? I submitted my taxes last night with amount 186 under K-1 and remaining all as zeros. That ended up paying $7 taxes to NC.

If this is incorrect, I would like to amend my returns to stay correct. Do I need to report any other values such as capital gain (loss) for NC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help filing NC tax returns of a non-resident

Your k-1 shows the $186 income but it also shows a rental loss. If that is NC rental loss, that would also go on your NC. In the first post, a couple boxes down is rental income/loss. You would not need to report anything else. Honestly, for $7, I wouldn't bother with an amended return - you are welcome to!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jenniferbook902

New Member

franderpolido

New Member

steve-knoll

New Member

pmrbgr5099

New Member

dhelms_1

New Member