- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help filing NC tax returns of a non-resident

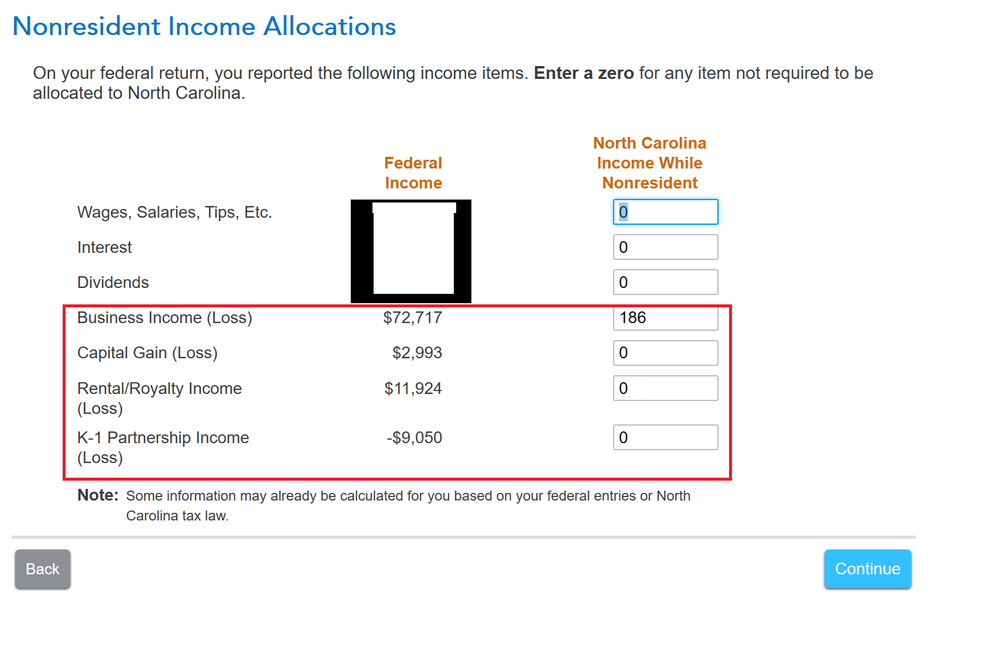

I reside in WA state, but I have a rental property in NC purchased through a LLC a year ago. I'm using Turbox Premier desktop version for filing my federal and NC State taxes and TurboTax showing few years for NC state filing. Appreciate if someone can throw inputs on this error.

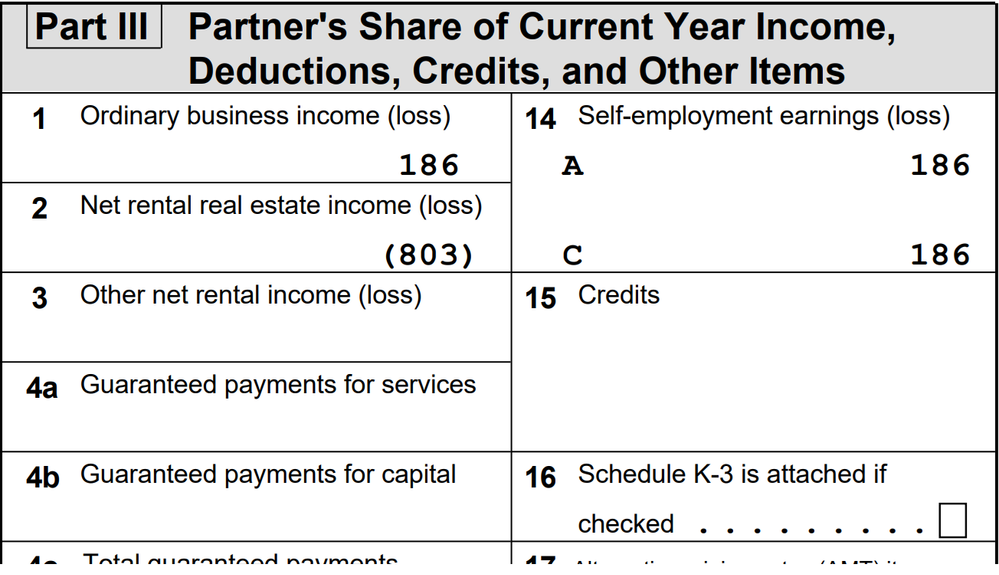

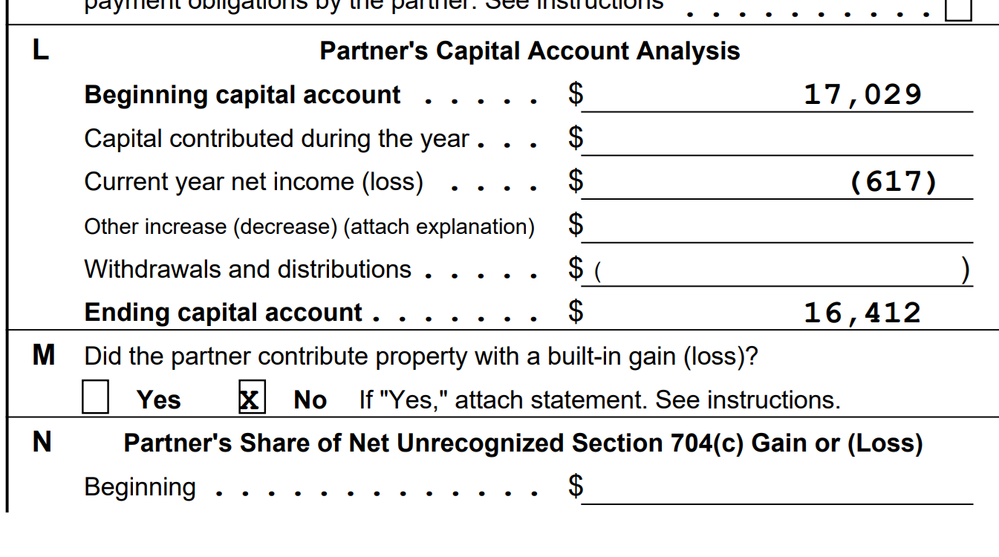

In the state tax section, What would be value for the business Income & Capital gain? Adding my K-1 values portions for reference to get help here. Should I enter Ordinary business Income here? Or the Net income loss here? Please help.

April 15, 2024

11:14 AM