- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

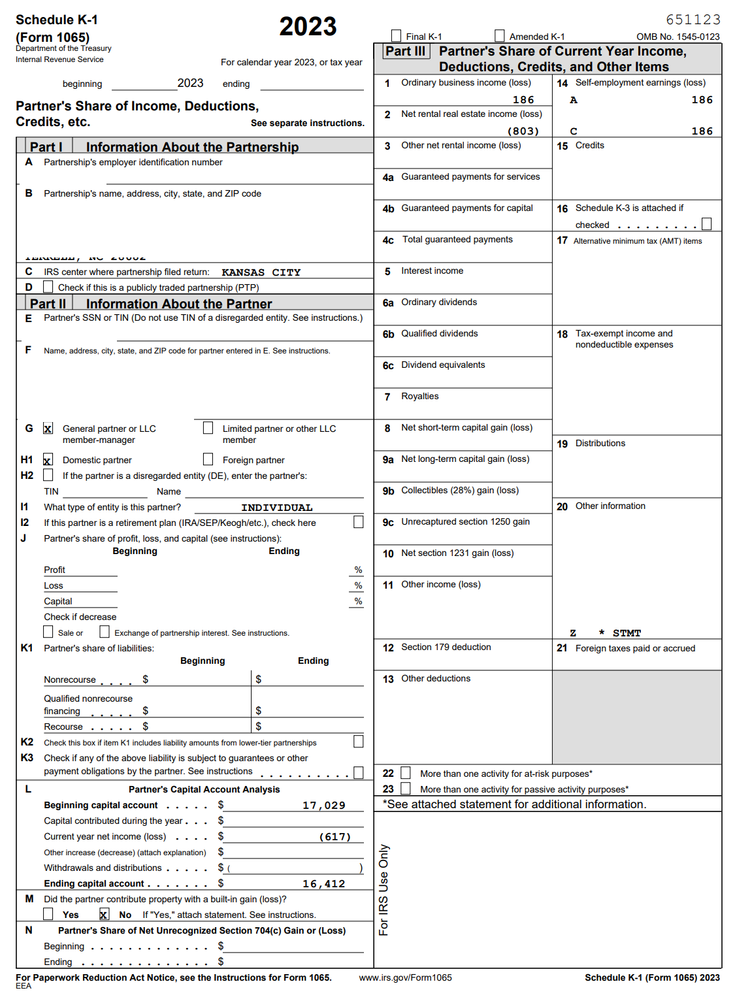

Thank you very much for your reply. Attaching my complete K-1 that was generated for NC LLC company by removing sensitive personal information.

From what I understand, I need to fill K-1 partnership amount of (617) for NC state tax filing? I submitted my taxes last night with amount 186 under K-1 and remaining all as zeros. That ended up paying $7 taxes to NC.

If this is incorrect, I would like to amend my returns to stay correct. Do I need to report any other values such as capital gain (loss) for NC?

April 16, 2024

12:06 PM