- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: My Ameriprise Financial 1099-div does not list a state. Do I assume NC since that is the state I live in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Ameriprise Financial 1099-div does not list a state. Do I assume NC since that is the state I live in?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Ameriprise Financial 1099-div does not list a state. Do I assume NC since that is the state I live in?

If the Supplemental Info from your broker does not list the State(s) associated with the tax-exempt dividends you received, yes, you can choose North Carolina, your Resident State.

Basically, this is for state tax, and your home state won't tax dividends earned there.

Here's more info on What State are My Tax Exempt Dividends From?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Ameriprise Financial 1099-div does not list a state. Do I assume NC since that is the state I live in?

You probably have to look though all the backup detail sheets if they sent them with the 1099. The funds should be listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Ameriprise Financial 1099-div does not list a state. Do I assume NC since that is the state I live in?

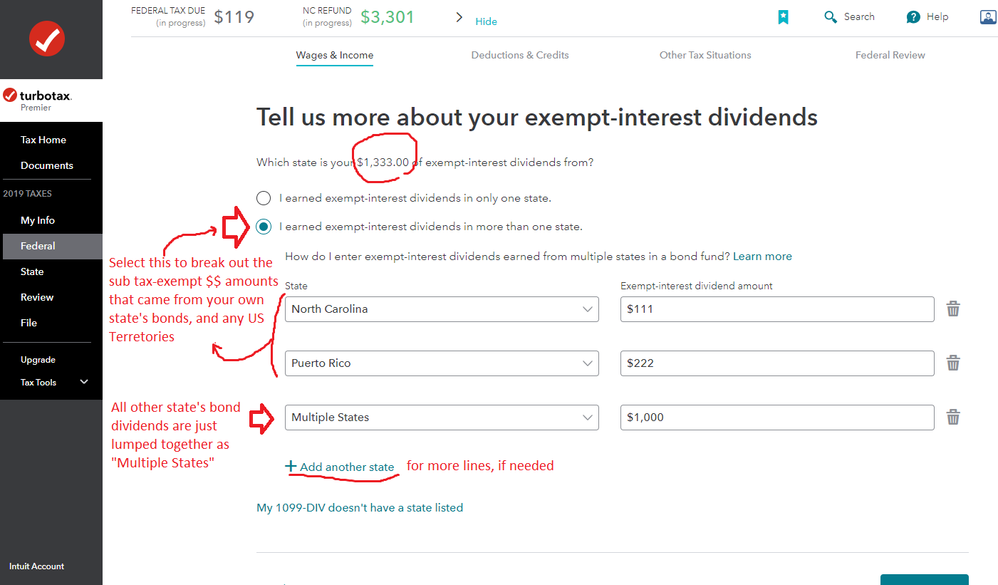

i.e. it usually is NOT NC...you only use NC if all the tax-exempt $$ came from NC bonds...and that will happen on a 1099-DIV only if you had a bond fund that invested exclusively in NC bonds.

____-

A simple answer for a mixed Muni bond fund (i.e. not exclusively NC) is to go to the bottom of the list of states and select "Multiple States".

______

But, if you can find enough information from the fund to delineate "exactly" how much came from NC bonds, you are allowed to (but are not required to) break out those NC $$ amounts to possibly get some reduction in NC state taxes.....BUT, again, you have to get the information from the funds, and your supplemental tax data sheets to do that...otherwise you just select "Multiple States" for the entire lot and move on.

______________

IF you do decide to try breaking out the NC $$ you'd do it as shown below:

(NC also exempts $$ from any US Territories):

___________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bob-swinney

New Member

DM147

Level 1

rfkatie

New Member

Paul2005

New Member

GaryH78049

New Member