- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

i.e. it usually is NOT NC...you only use NC if all the tax-exempt $$ came from NC bonds...and that will happen on a 1099-DIV only if you had a bond fund that invested exclusively in NC bonds.

____-

A simple answer for a mixed Muni bond fund (i.e. not exclusively NC) is to go to the bottom of the list of states and select "Multiple States".

______

But, if you can find enough information from the fund to delineate "exactly" how much came from NC bonds, you are allowed to (but are not required to) break out those NC $$ amounts to possibly get some reduction in NC state taxes.....BUT, again, you have to get the information from the funds, and your supplemental tax data sheets to do that...otherwise you just select "Multiple States" for the entire lot and move on.

______________

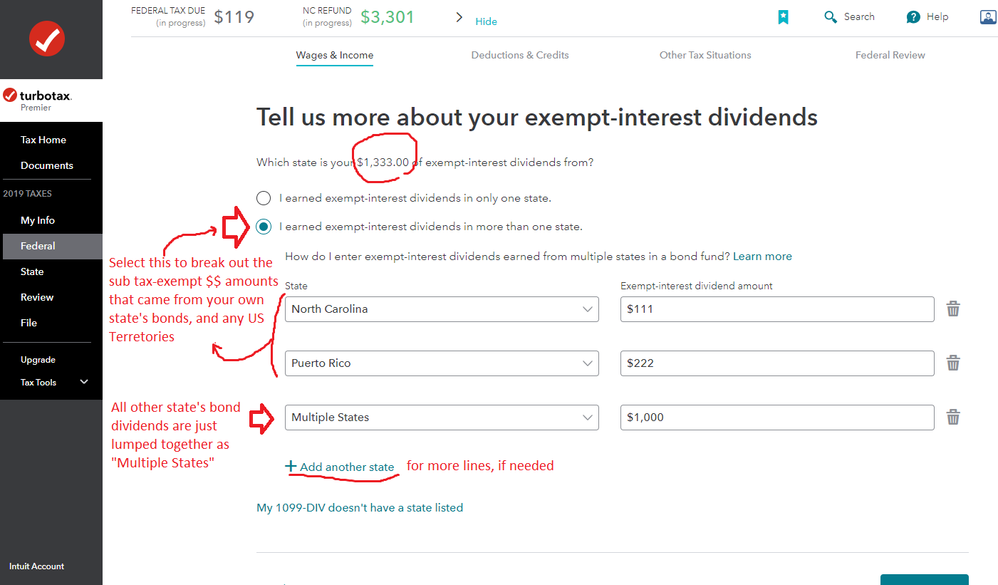

IF you do decide to try breaking out the NC $$ you'd do it as shown below:

(NC also exempts $$ from any US Territories):

___________________